Our Green jobs report combines BLS employment data with @HIPinvestor company ratings to determine how green or how extractive an industry is

Jobs in greener industries have remained the most resilient since the onset of the #COVID19 #pandemic

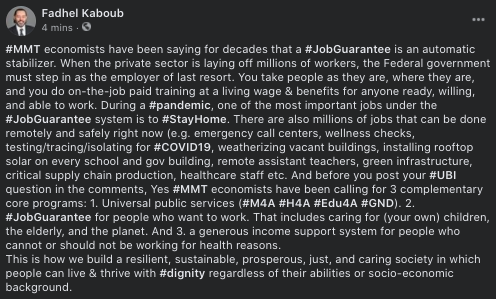

The jobs recovery is already slowing down, which means we need a bolder approach to economic relief and stimulus in order to avoid a post-2008 slow and painful recovery

High-contact sectors have suffered the most during the #COVID19crisis, but even in those industries, Greener industries have been more resilient to job losses

For more on the #GreenJobs report, see our recent op-ed @SustainBrands co-authored by @stf18 @HIPinvestor @fadhelkaboub and Amir Khaleghi

sustainablebrands.com/read/defining-…

sustainablebrands.com/read/defining-…

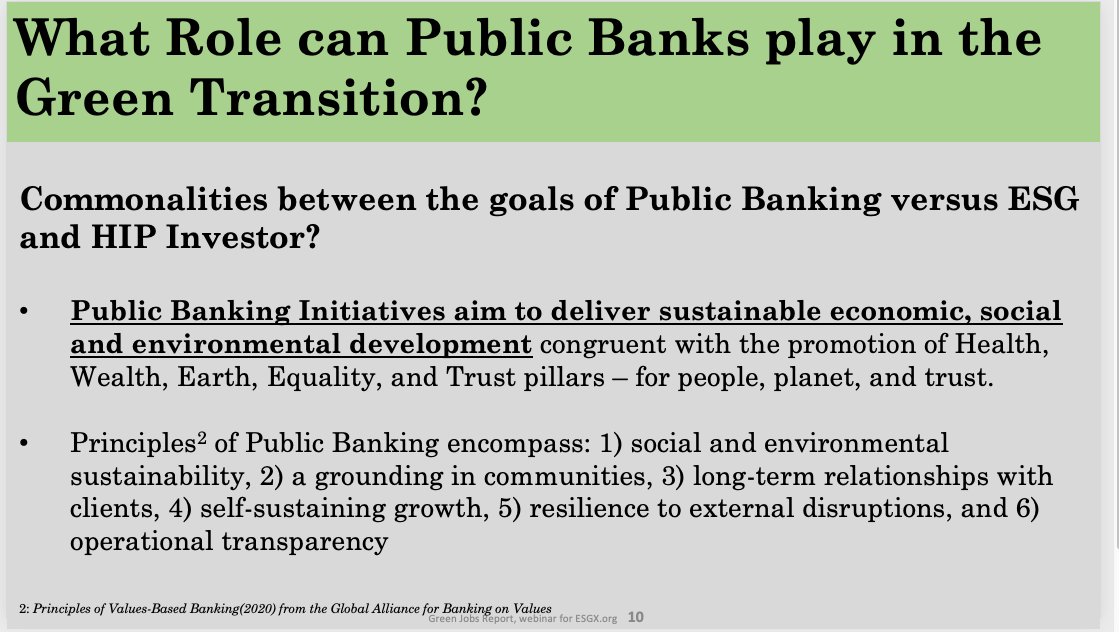

Can public banking be one of the mechanisms to help accelerate the green transition and offer an alternative to private banking?

@sylviachiesq discusses California's experience and her work with @calpba ... Congratulations to CA for passing its Public Banking bill #AB857: californiapublicbankingalliance.org/ab-857-califor…

@RaulACarrillo discusses his Public Banking work at the national level with the Public Banking bill that he helped draft along with @rohangrey in collaboration with the offices of U.S Representatives @RepRashida & @RepAOC

tlaib.house.gov/tlaib-aoc-publ…

tlaib.house.gov/tlaib-aoc-publ…

For more on the Public Banking bill, take a listen to this podcast interview with @rohangrey via @CheeseMacro hosted by @sdgrumbine

realprogressives.org/podcast_episod…

realprogressives.org/podcast_episod…

@RaulACarrillo: the federal bill for public banks would provide a wide variety of public banking options for states and cities to choose from, with capitalization coming from the Federal Reserve Bank as opposed to state and local government tax dollars.

@stf18: there are millions of unbanked and underbanked people in the country that would be better served by public banks. @RaulACarrillo wrote about Postal Banking also as a way to provide basic financial services to all members of society: global-isp.org/policy-note-10…

@RaulACarrillo: public banks can bake environmental responsibility and social impact into their charter. It's not about where the depositors' money will be placed. It's about what the public bank was chartered to do in the first place.

@RaulACarrillo: Public banks will do what they are chartered to do. Design is important. Holding public banks accountable for what they are doing with public money. This is not a given. We have to ensure that environmental and social standards are baked into their mission.

@RaulACarrillo the entire banking system is backstopped by the Fed. Banks are chartered, licensed, regulated, by the Federal government. The Fed is legally the lender of last resort for the private banking system. Banks are legally established by the Gov. And so will public banks

@RaulACarrillo We need to apply a different metric for public banks (triple bottom line). We have to have a responsibility mindset rather than an austerity mindset. Public banks have to support states that must comply with balanced budget amendments.

Learn more about @RaulACarrillo and the LPE Law and Political Economy Project at Yale University:

lpeproject.org

Learn more about @sylviachiesq and the California Public Banking Alliance @calpba

californiapublicbankingalliance.org

lpeproject.org

Learn more about @sylviachiesq and the California Public Banking Alliance @calpba

californiapublicbankingalliance.org

@RaulACarrillo there are activist teams working on public banking in a number of cities and states around the country, including WV, FL, IL, NY, NJ and beyond

Thank you for joining us today! Stay tuned for our next monthly #GreenJobs report. Follow us @ESGX_Live @HIPinvestor @GISP_Tweets @stf18 @RaulACarrillo @Nigel_Lake @FadhelKaboub @sylviachiesq @APEN4EJ @thepublicmoney @calpba

Stay safe everyone!

Stay safe everyone!

• • •

Missing some Tweet in this thread? You can try to

force a refresh