#Global #ETF Weekly (thread): 15 Jan 2021

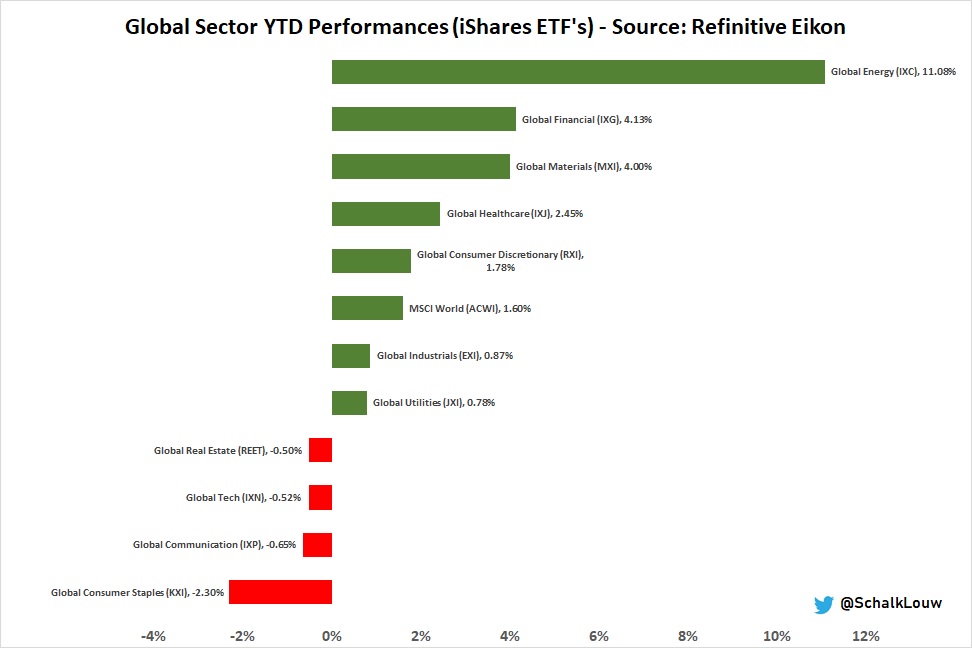

- 2020 worst perf #sector making comeback in 2021 $IXC

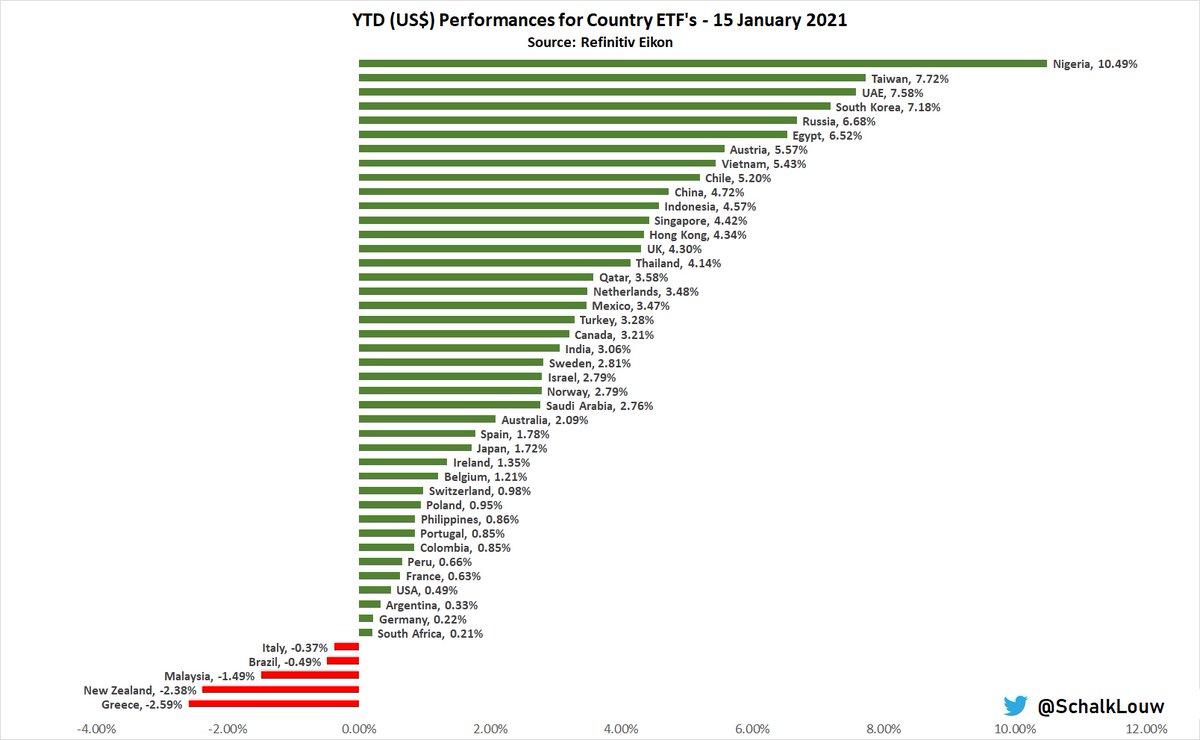

- This is helping #oil producing countries with #Nigeria, #UAE & #Russia in top5 #Country ETF YTD performers in USD $NGE $UAE $ERUS

- Few countries moving in red this week

- 2020 worst perf #sector making comeback in 2021 $IXC

- This is helping #oil producing countries with #Nigeria, #UAE & #Russia in top5 #Country ETF YTD performers in USD $NGE $UAE $ERUS

- Few countries moving in red this week

2/8

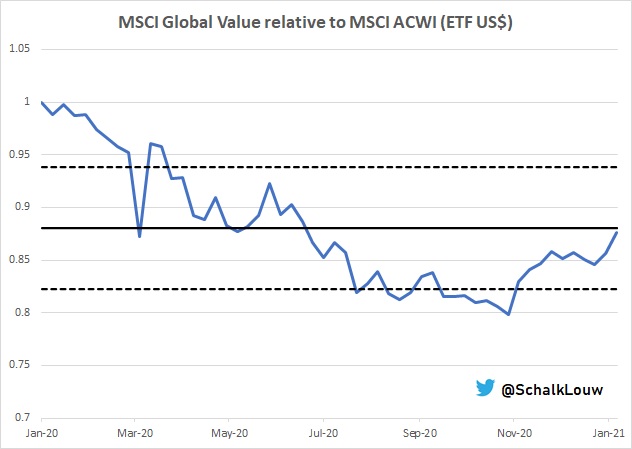

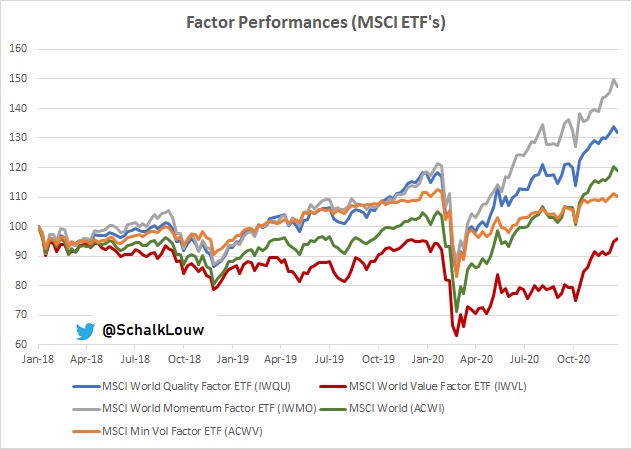

#Global #Value #stocks still making short-term recovery, with $IWVL #ETF still looking very strong relatively over the short-term. Over 3yr period it is however still lagging quite substantially.

This should be interesting for this months #OrbisvsSP500 unofficial challenge

#Global #Value #stocks still making short-term recovery, with $IWVL #ETF still looking very strong relatively over the short-term. Over 3yr period it is however still lagging quite substantially.

This should be interesting for this months #OrbisvsSP500 unofficial challenge

3/8

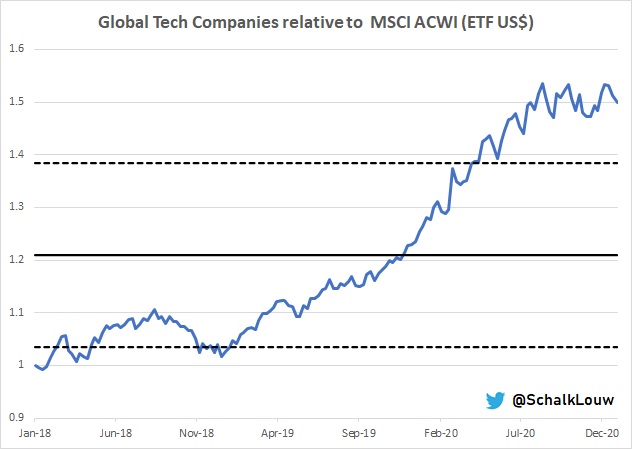

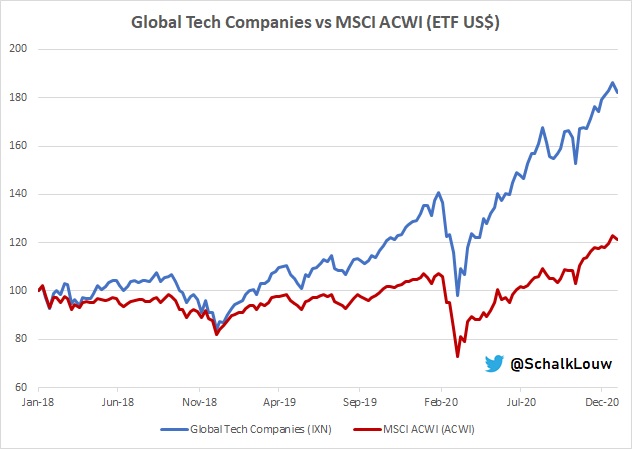

This one is worrying, but then again, it's been for some time. #Global #Tech #stocks relative to #MSCI All Country World Index is definitely creating some concern. Be very careful.

$IXN vs $ACWI

This one is worrying, but then again, it's been for some time. #Global #Tech #stocks relative to #MSCI All Country World Index is definitely creating some concern. Be very careful.

$IXN vs $ACWI

4/8

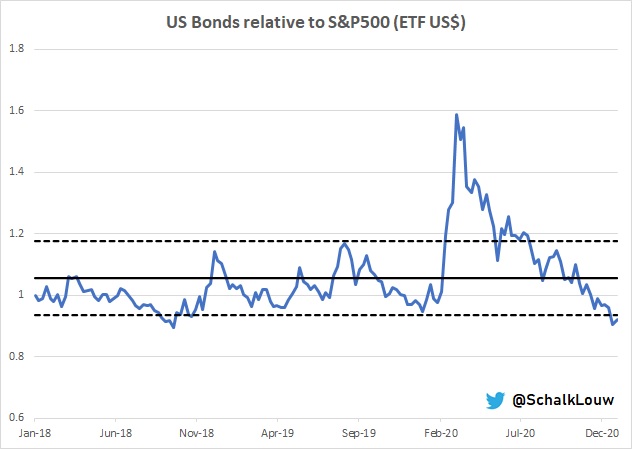

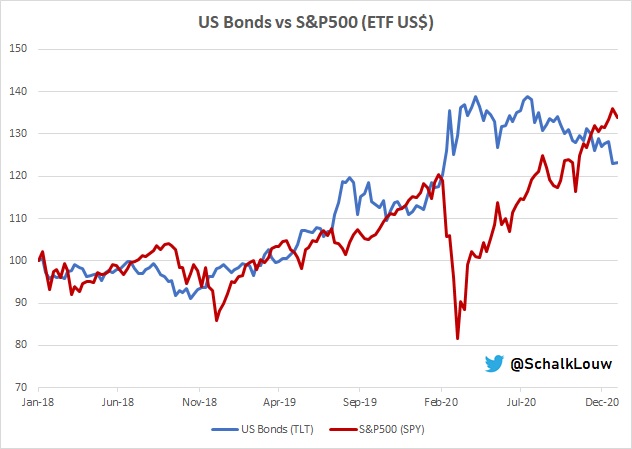

Know this one might create some controversy, therefore disclaimer 1st. I'm also not positive on #US #Bonds over longer-term. But be careful over short-term as $TLT #ETF relative to $SPY indicate oversold (bonds) &/or overbought (equities) & could see profit taking. #stimulus

Know this one might create some controversy, therefore disclaimer 1st. I'm also not positive on #US #Bonds over longer-term. But be careful over short-term as $TLT #ETF relative to $SPY indicate oversold (bonds) &/or overbought (equities) & could see profit taking. #stimulus

5/8

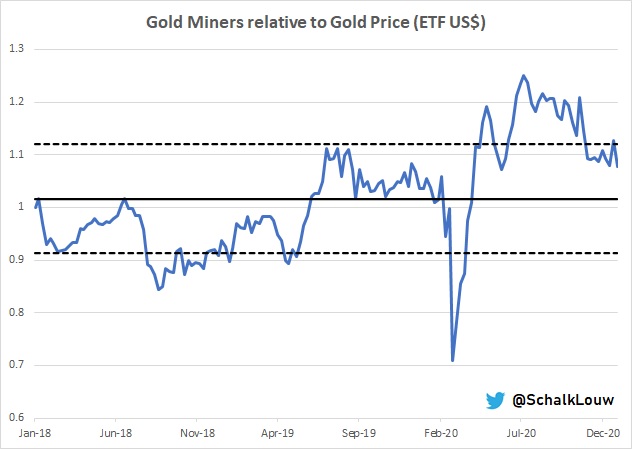

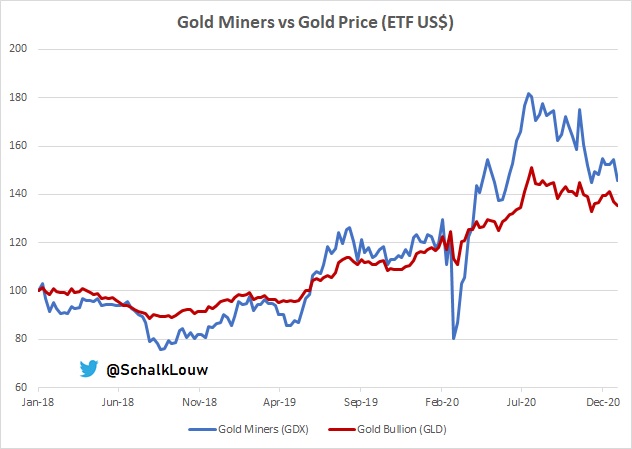

This 👆🏼 could be positive for #Gold. Comparing $GLD (gold price) #ETF with $GDX (#Goldminers), one can see that miners getting close to gold ($/oz). Relative not cheap yet & can still see further weakness. Will do separate tech tweet on GDX later. In short wait for $32.20.

This 👆🏼 could be positive for #Gold. Comparing $GLD (gold price) #ETF with $GDX (#Goldminers), one can see that miners getting close to gold ($/oz). Relative not cheap yet & can still see further weakness. Will do separate tech tweet on GDX later. In short wait for $32.20.

6/8

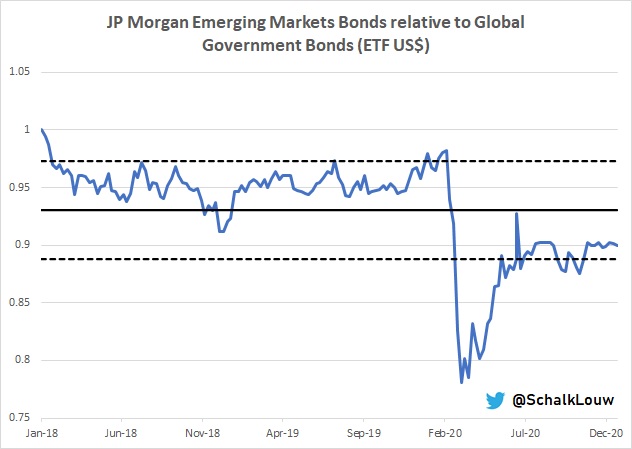

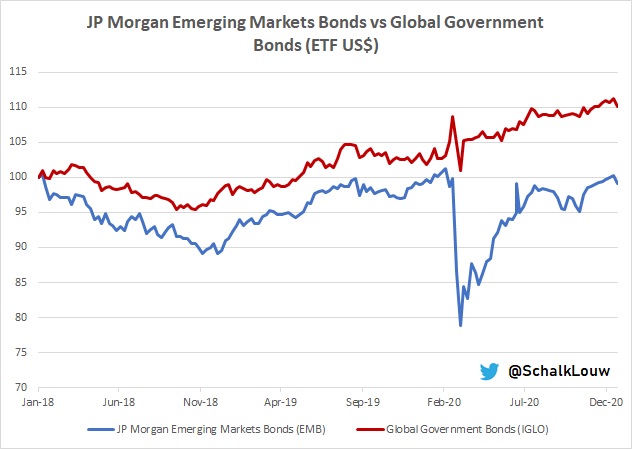

Back to #Bonds. #EmergingMarkets Government Bonds still lagging #Global Government Bonds. Yield seekers might use possible 'risk-on' environment to start buying EM bonds.

$EMB vs $IGLO

Back to #Bonds. #EmergingMarkets Government Bonds still lagging #Global Government Bonds. Yield seekers might use possible 'risk-on' environment to start buying EM bonds.

$EMB vs $IGLO

7/8

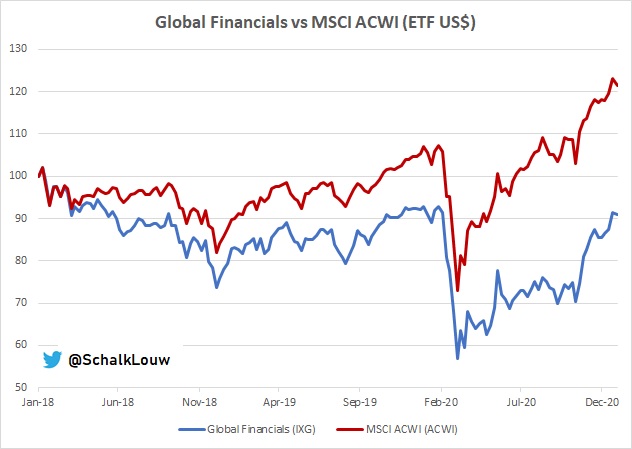

#Global #Financials #ETF, very similar to #Value ETF, are making quite the comeback relative to #MSCI All Country World Index. Still however have a MASSIVE gap to fill, which could take some time. IMHO, it's still an opportunity.

$IXG vs $ACWI

#Global #Financials #ETF, very similar to #Value ETF, are making quite the comeback relative to #MSCI All Country World Index. Still however have a MASSIVE gap to fill, which could take some time. IMHO, it's still an opportunity.

$IXG vs $ACWI

8/8

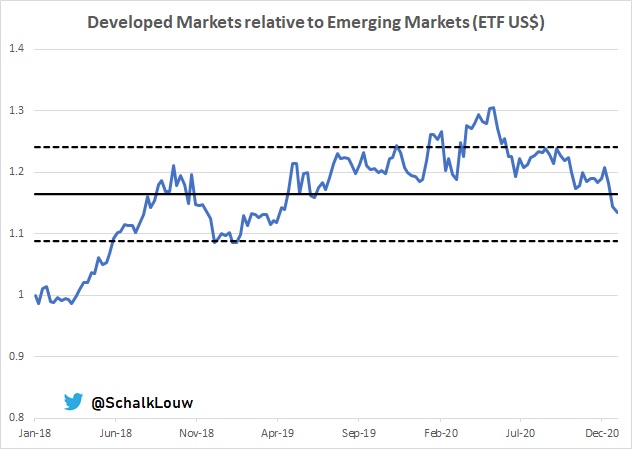

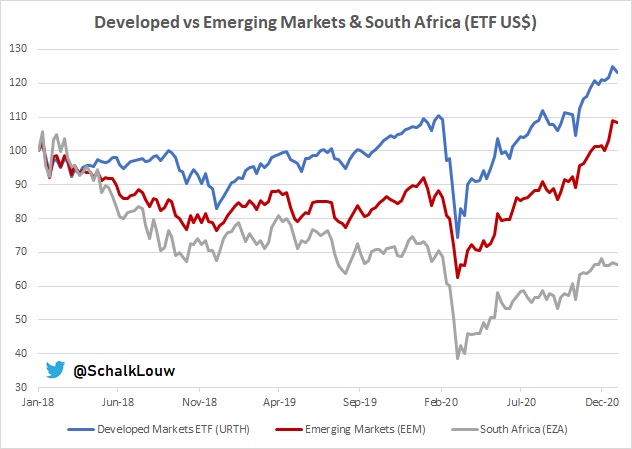

And then finally, #EmergingMarkets #ETF still storming ahead against #DevelopedMarkets ETF, still not relatively "overbought" yet, but getting close.

#SouthAfrica however still lagging in 2021, with $EZA YTD performance in USD of +0.2% vs DM's $URTH +1% & EM's +5.2%.

And then finally, #EmergingMarkets #ETF still storming ahead against #DevelopedMarkets ETF, still not relatively "overbought" yet, but getting close.

#SouthAfrica however still lagging in 2021, with $EZA YTD performance in USD of +0.2% vs DM's $URTH +1% & EM's +5.2%.

Unroll @threadreaderapp

• • •

Missing some Tweet in this thread? You can try to

force a refresh