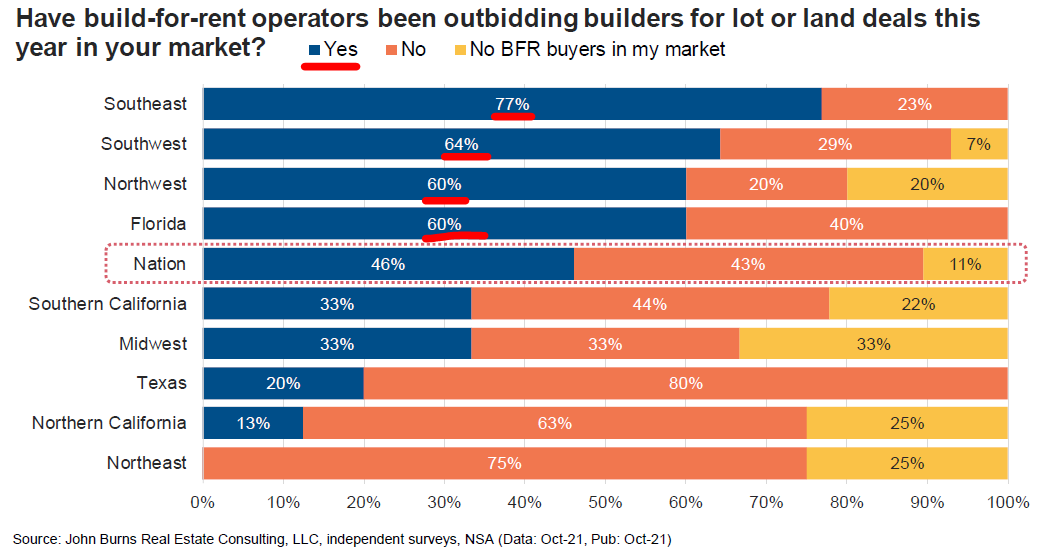

Some interesting comments from today's Fed Beige Book on both housing (investors, lot shortages, market normalizing) & labor market tightness (namely continued wage spike).

#Atlanta Fed housing commentary on investors

#Atlanta Fed commentary on tight job market

#Dallas Fed commentary on housing market normalizing & lot development delays/shortages

#Dallas Fed commentary on labor market & wages

#SanFrancisco Fed commentary on housing

#SanFrancisco Fed commentary on tight job market and double-digit pay rate spike

#StLouis Fed commentary on tight job market & wage spike

#Minneapolis Fed commentary on tight job market. "No longer willing to deal with rude customers..."

#Boston Fed commentary on housing

#Philadelphia Fed commentary on tight job market. "...job candidates would arrive for interviews with several offers in hand."

#Philadelphia Fed commentary on housing. "...increase in home prices enabling graceful exit from debt vs. GFC..."

#NewYork Fed commentary on wage spike

#Chicago Fed commentary on tight job market

• • •

Missing some Tweet in this thread? You can try to

force a refresh