Fresh October home builder survey results. Top themes: 1) Builders are finally lifting sales caps (though not all). 2) Lack of lots & land development delays will hold back growth in 2022. 3) Most builders expect prices to keep rising. Market commentary to follow…

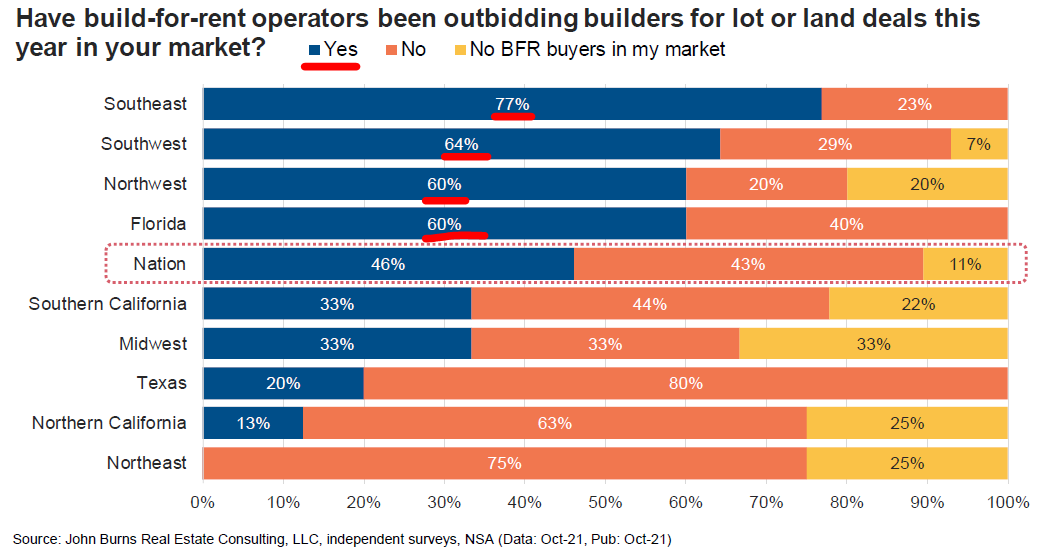

#ColoradoSprings builder: “One cautious trend to watch is single-family rental businesses paying more for land than builders. This will suck up trade capacity & supply at a time we can't afford it.”

#Denver builder: “Traffic & sales definitely slowing down, but also following a more seasonal pattern as compared to 2020. Resale inventory is still historically low. Rents are skyrocketing again.”

#Austin builder: “Price of homes is unaffordable for almost all of the population who lives here. The influx of people with equity from the coasts continues to drive the market. The lack of labor & materials means the demand can't be met.”

#Dallas builder: “Due to a large number of sales in 2021, we’ll have declines in 2022. This is due to land availability. Huge number of communities coming online in 2023. Supply chain issues are getting worse & have spread to land development.”

#Houston builder: “Prices aren’t coming down in our market anytime in the foreseeable future, due to lag in supply caused by shortages in labor, materials, etc.”

#SanAntonio builder: “Labor shortages & material increases continue to stress home delivery. Market is still strong, but slowing a bit. Getting lots on the ground & material supplies are some of the challenges, as well as extreme materials theft.”

#Orlando builder: “No resistance to continued price increases due to lack of available building lots in our submarket.”

#Tampa builder: “At maximum capacity & with the tight labor supply, we do not see an opportunity to expand our production over the next 12 months.”

#Naples builder: “We’ve been temporarily sold out. New sales will begin again mid-November.”

#Chicago builder: “Just starting to get back at acquiring lots & starting to build.”

#Cleveland builder: “In 2022 there will likely be a 10% to 12% increase in prices over 2021.”

#Oakland builder: “Market continues to stay very strong in California. We are temporarily sold out at all of our communities.”

#Reno builder: “Demand is still strong but not as strong as it has been. Prices are already up 20%+ since June 2020. Another 20% would take us to possible bubble territory. Appreciation is moderating so I don't think that will happen.”

#WashingtonDC builder: “Demand is waning due to price increases. We are no longer operating with sales caps in communities.”

#Harrisburg builder: “Market was very slow in August & September but really turned around in October.”

#Seattle builder: “Sales & closings in 2022 will be negatively impacted by limited supply of lots being delivered to the market in early 2022 with recovery in late 2022. No demand impacts are forecasted to impact sales or closings in 2022.”

#RiversideSanBernardino builder: “People aren't selling their resale home because they have nowhere to go except out of state. The worst of COVID is past us but still people are afraid of selling because they can't move up & there are no reasonable rentals available.”

#SanDiego builder: “I see price increases in 2022, 2023, & 2024 before I see a flattening in prices. We are far too supply restricted.”

#Birmingham builder: “Increased sales & production due to new communities coming online.”

#Charleston builder: “YOY projections are flat because of limited lots. Land entitlement process is lengthy. Our lot supply doesn't increase our volume until 2023-2024.”

#Greenville builder: “Demand remains strong. Very little resale inventory & finished inventory sells quickly. It is very challenging getting supplies on a timely basis. This is impacting build times. Land development timelines continue to lag.”

#Wilmington builder: “We’ve taken our spec houses off the market. Once they reach cabinets, we’ll place them back on the market. Home prices will continue to rise slightly over the next 18 to 24 months.”

#Charlotte builder: “Sales are likely to go up as a result of new availability of homes to sell. Same goes for closings.”

#Atlanta builder: “We pulled so many extra sales & starts into 2021 that we're going to be severely short on vacant developed lots in the first half of 2022, hence the huge projected slowdowns in sales & starts in 2022.” THE END @conorsen

• • •

Missing some Tweet in this thread? You can try to

force a refresh