#RussiaUkraineConflict - we are getting a lot of inquiries about Russia and critical minerals, esp for #ElectricVehicles & #batteries

A few @benchmarkmin facts:

#Nickel is on red alert.

Norilsk is the world’s largest class 1 nickel producer accounting for 20% of global supply

A few @benchmarkmin facts:

#Nickel is on red alert.

Norilsk is the world’s largest class 1 nickel producer accounting for 20% of global supply

Norilsk overall accounts for 7% of all in nickel supply. But EV makers, auto OEMs and battery cell producers will terrified of losing 20% of a market with prices already at decade long highs.

China will not place real any sanctions on Russia and as a result ensure all #nickel continues to flow into its mainland and into Chinese made battery cells and EVs

Follow @GregMiller_BMI @CDMRawles for more

Follow @GregMiller_BMI @CDMRawles for more

#Cobalt - Russia is a key exporter but not a big miner / primary producer accounting for only 2% of the global market… and with that the 6th largest producer.

…

…

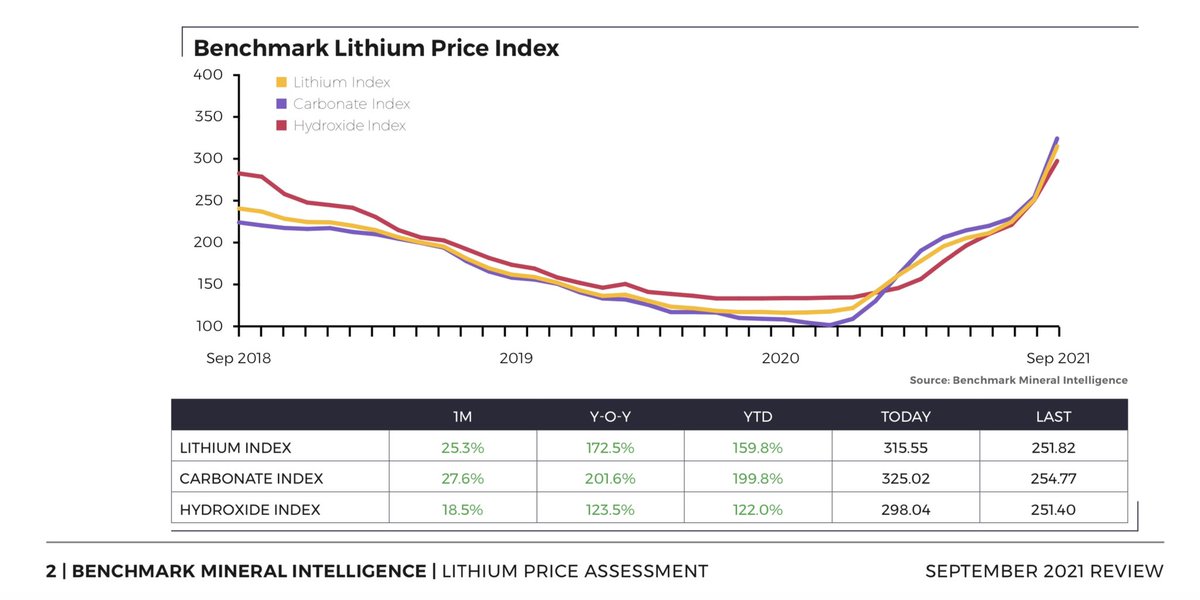

#Lithium - Russia does not have any active lithium mines but one chemical tolling plant

Majority of the country vastly under explored

Majority of the country vastly under explored

#Graphite

One #graphite mine in south Ukraine between Kiev and Crimea. Not enough to disrupt the global supply and demand balance.

One #graphite mine in south Ukraine between Kiev and Crimea. Not enough to disrupt the global supply and demand balance.

#Manganese

#Russia is a big consumer of manganese used in steel smelting and relies on imports for its needs.

It does have huge reserves of #manganese - especially Usinskoe - but has not yet commercialised.

#Russia is a big consumer of manganese used in steel smelting and relies on imports for its needs.

It does have huge reserves of #manganese - especially Usinskoe - but has not yet commercialised.

Lithium ion #Batteries , #cathode, #anode

#Russia and #Ukraine both have zero capacity and capability to to produce #EV battery cells or the corresponding cathodes and anodes.

#Russia and #Ukraine both have zero capacity and capability to to produce #EV battery cells or the corresponding cathodes and anodes.

• • •

Missing some Tweet in this thread? You can try to

force a refresh