For an #economy to flourish, and create #prosperity for the majority of participants, there must be a strong and vibrant #middleclass. Today's #blog digs into the disappearance of the economic engine.

realinvestmentadvice.com/there-really-i…

realinvestmentadvice.com/there-really-i…

The shrinking of the middle class is accompanied by an increase in the share of adults in the upper-income tier from 14% in 1971 to 21% in 2021. At the same time, there was an increase in the share who are in the lower-income tier, from 25% to 29%.

realinvestmentadvice.com/there-really-i…

realinvestmentadvice.com/there-really-i…

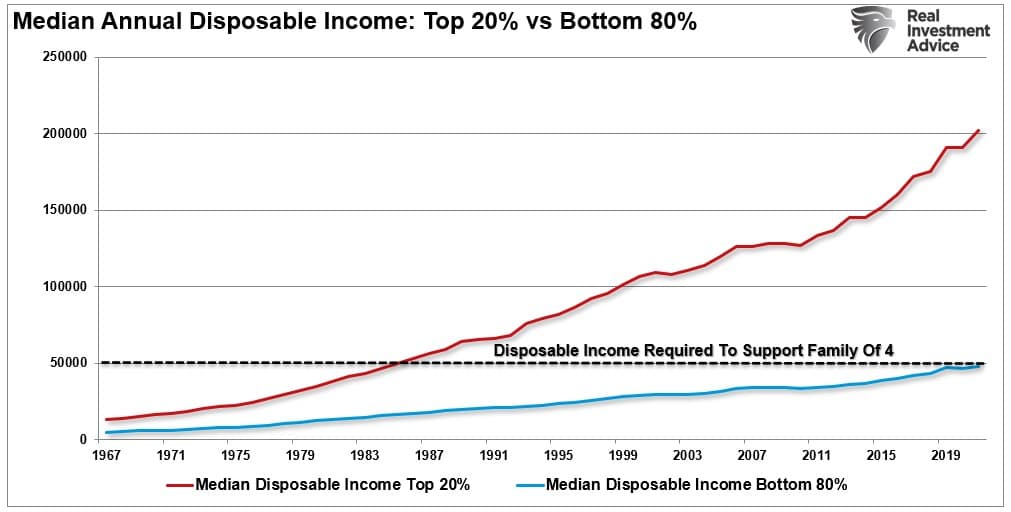

Most importantly, and what is often not included in the analysis, is the standard of living gets “paid for” on an “after-tax” basis. When we include taxation, it becomes clear that roughly 80% of America is failing to support the “middle-class” lifestyle.

realinvestmentadvice.com/there-really-i…

realinvestmentadvice.com/there-really-i…

“When broken down by generation, younger adults, or Gen Zers, are more likely to experience ‘#recession fatigue’ than millennials, Gen Xers, and baby boomers. "

realinvestmentadvice.com/there-really-i…

realinvestmentadvice.com/there-really-i…

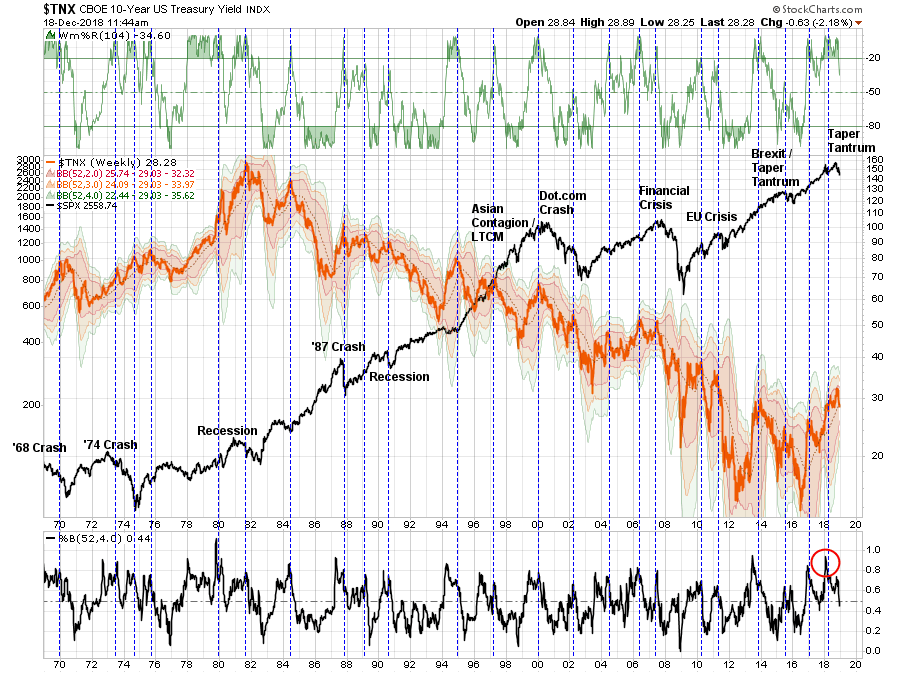

Between 1959 and 1990, individuals could sustain their inflation-adjusted standard of living with only #incomes and #savings. Since 2008, it requires an increasing level of debt to “fill the gap” to afford and the cost of the current living standard.

realinvestmentadvice.com/there-really-i…

realinvestmentadvice.com/there-really-i…

The share of annual incomes between the bottom 80% and the top 5% is evidence of that wealth transfer from the middle class.

realinvestmentadvice.com/there-really-i…

realinvestmentadvice.com/there-really-i…

• • •

Missing some Tweet in this thread? You can try to

force a refresh