1) As promised, here's a thread showing how #Uranium requirements for just one typical 1000MW #Nuclear reactor in the West have increased by over 9% since #Russia invaded #Ukraine🪖 pushing up mined #U3O8 feed by nearly 20% in new enrichment contracts.🧾⛏️ Old 2021 model.👇🧵...2

2) For illustrative purposes I'll use Spot #Uranium & #Nuclear fuel cycle prices published by @Numerco a year ago on 16 December 2021 before #Russia's invasion🪖 when optimal tails assay was 0.146%:

#U3O8 $43.26/lb

Conversion $16.01/kgU

UF6 $129.04/kgU

SWU $56.13

👇🧵.../3

#U3O8 $43.26/lb

Conversion $16.01/kgU

UF6 $129.04/kgU

SWU $56.13

👇🧵.../3

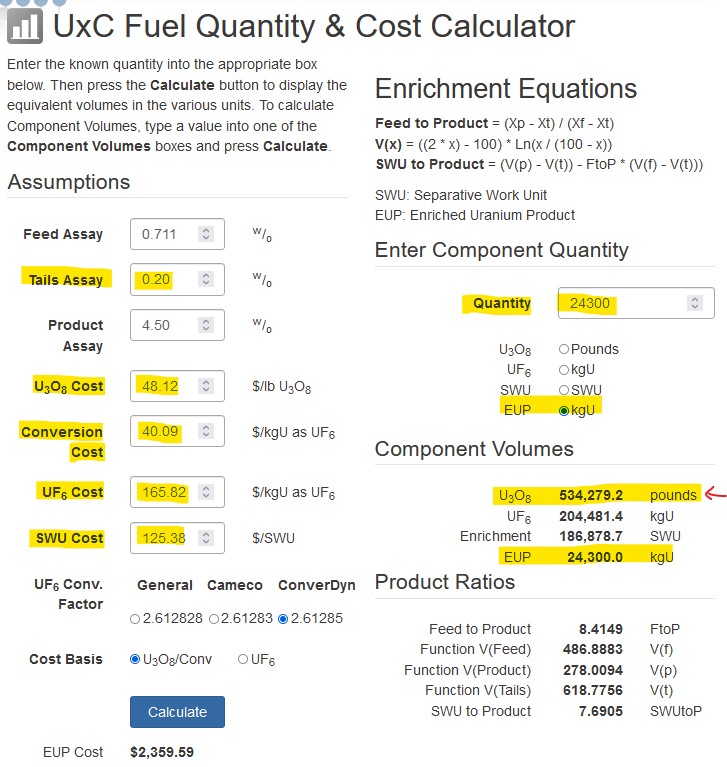

3) Plugging that data into UxC's #Nuclear Fuel Quantity & Cost Calculator🧮 to determine mined #U3O8 required for a typical 1000MW reactor using WNA's published average of 24,300 kgU of 4.5% Enriched #Uranium Product (EUP) yields 489,284 lbs #U3O8 per 1000MW (1 Gigawatt)👇🧵../4

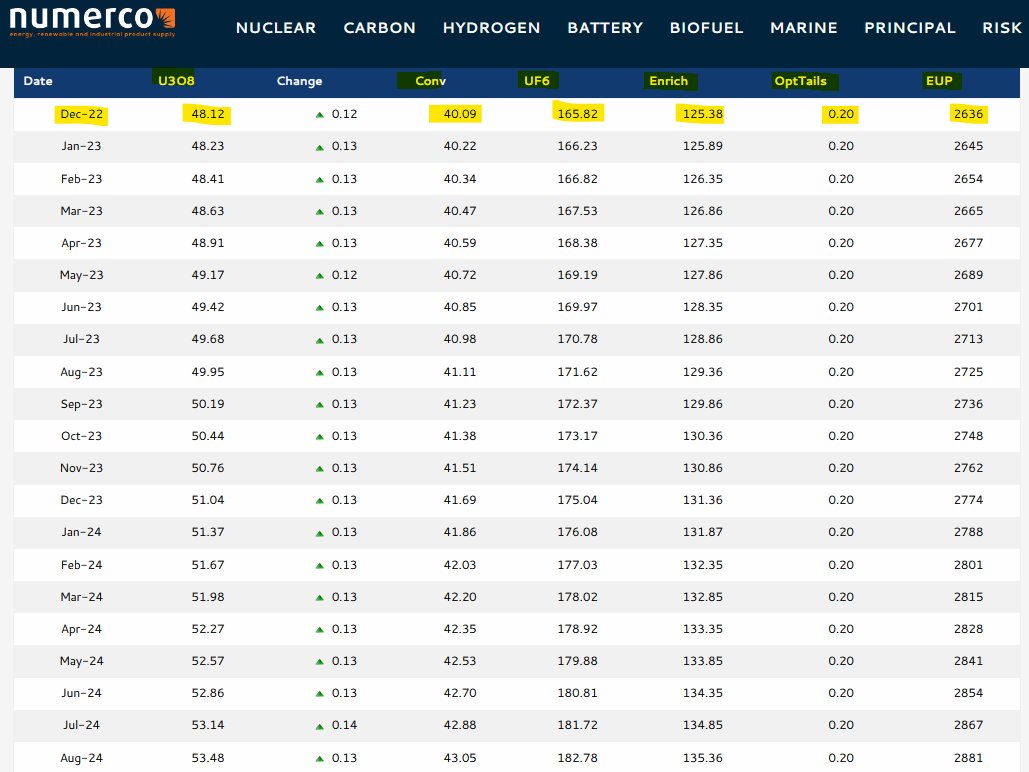

4) Fast forward a year to @Numerco's #Uranium & #Nuclear fuel cycle prices as of 9 December 2022 with optimal tails assay now at 0.20%⬆️ as western enrichers transition to overfeeding.🍼

#U3O8 $48.12 +11%

Conversion $40.09 +150%🚀

UF6 $165.82 +29%

SWU $125.38 +123%🚀

👇🧵.../5

#U3O8 $48.12 +11%

Conversion $40.09 +150%🚀

UF6 $165.82 +29%

SWU $125.38 +123%🚀

👇🧵.../5

5) Plugging today's data into UxC's #Nuclear Fuel Quantity & Cost Calculator🧮 to determine #U3O8 required for the same typical 1000MW reactor yields 534,279 lbs #U3O8 per 1000MW, an increase of 45,000 lbs (+9.2%) per Gigawatt in 1 year since #Russia invaded #Ukraine⬆️

👇🧵.../6

👇🧵.../6

6) But, UxC now quotes an even higher tails assay of 0.25%⬆️ for new enrichment contracts with western enrichers transitioning to overfeeding🍼 which requires even more western mined #Uranium feed of 585,341 lbs #U3O8, a 96,000 lbs (+19.6%) YoY increase per Gigawatt.🎇⏫👇🧵 ...7

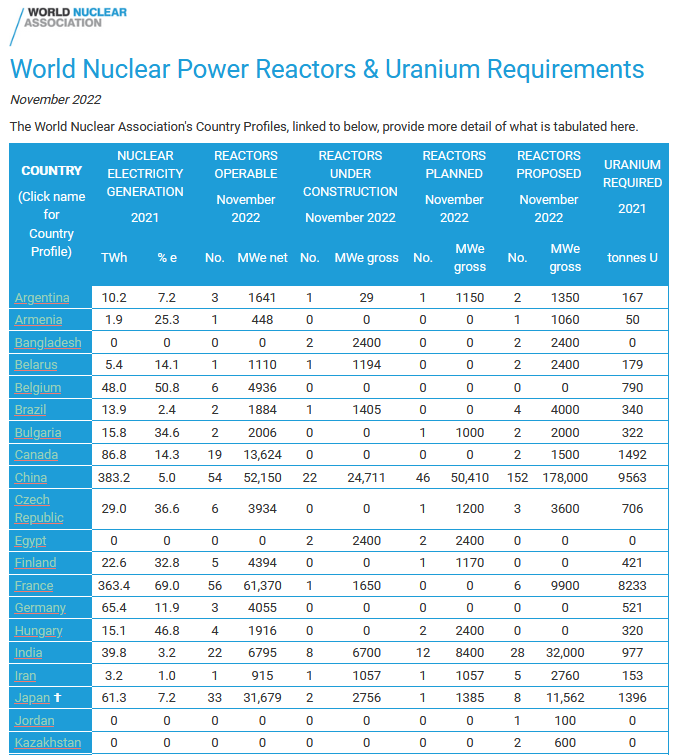

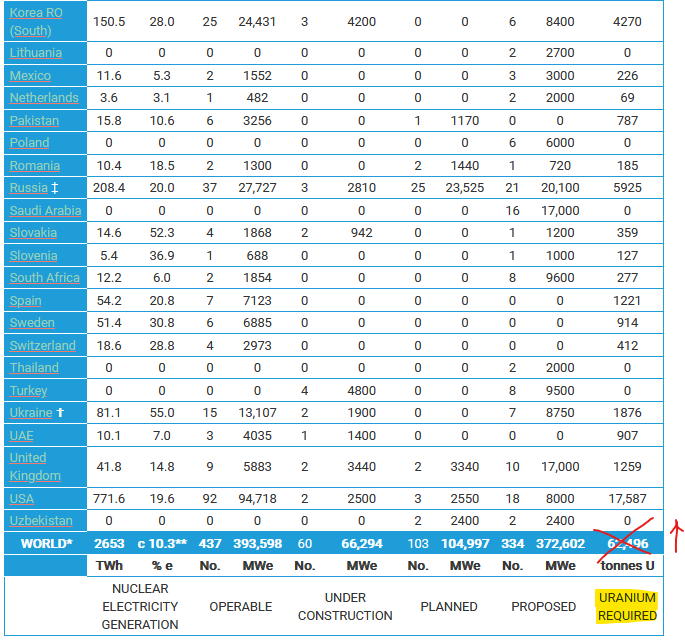

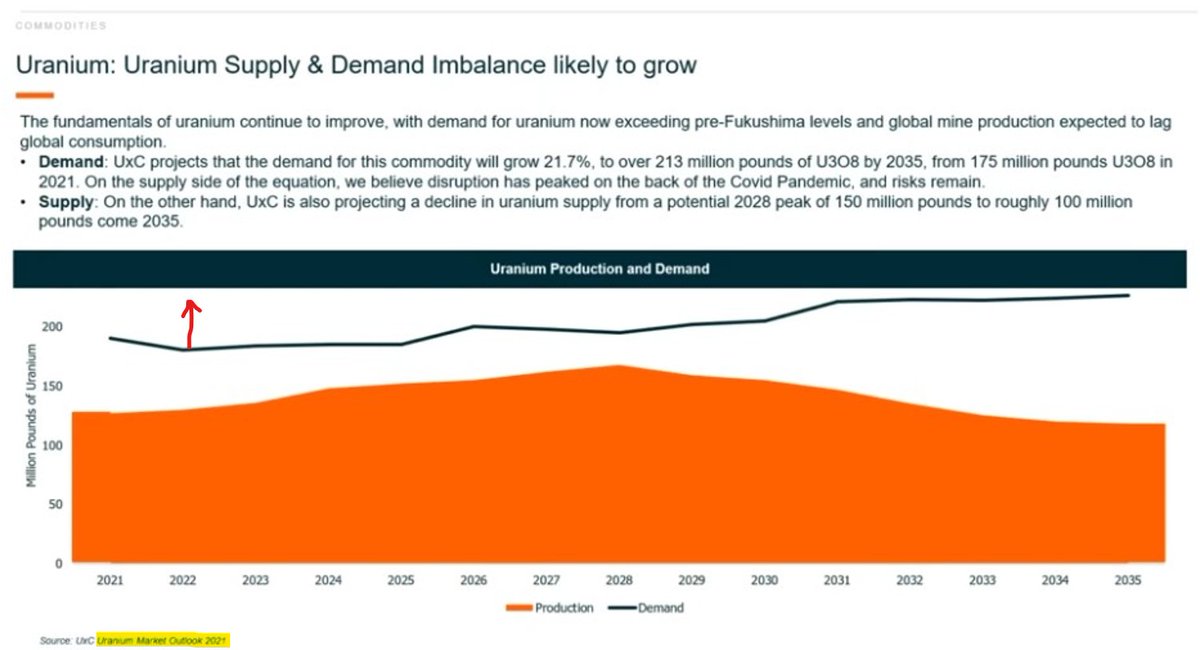

7) With about 60% of 394GW global #Nuclear fleet (excluding 60 new builds) pivoting to use only western enriched #Uranium, with +96,000lbs #U3O8/GW increase for new enrichment contracts, western mined U demand rises by (0.6 x 394)*96,000=+22.7 Million lbs per year onward!↗️🧵../8

8) Of course, true demand depends on what term #Uranium, Conversion, UF6, SWU prices are negotiated in new contracts with enrichers & converters, timing/length of new enrichment orders, etc., but I hope U see why old 2021 models do not yet reflect real U demand from 2022 on.✖️🤠

• • •

Missing some Tweet in this thread? You can try to

force a refresh