1/6 Did you know that the first block of the #Bitcoin #blockchain, known as the Genesis Block, was mined on January 3rd, 2009 by the mysterious creator of Bitcoin, Satoshi Nakamoto?🤔

Find out more about The Genesis Block in @esatoshiclub's thread 👇

Find out more about The Genesis Block in @esatoshiclub's thread 👇

2/6 The Genesis Block is unique in a number of ways. For one, the 50 #BTC reward for mining the block was sent to an address that it can never be recovered from.

Since its creation, many people have sent $BTC to the account, pushing its total balance to 68.56 #BTC, worth $1.1M

Since its creation, many people have sent $BTC to the account, pushing its total balance to 68.56 #BTC, worth $1.1M

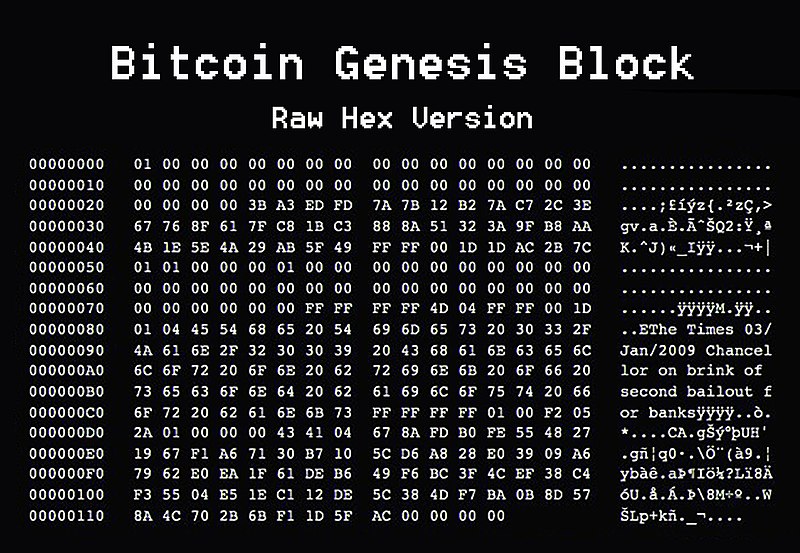

3/6 #Satoshi also included a message within the block, which was a headline from a British newspaper, The Times. The headline read: "The Times 03/Jan/2009 Chancellor on brink of second bailout for banks."

4/6 Some speculate that the inclusion of this headline was a message from #Satoshi about the role of banks and governments in financial systems. Others believe it was simply a way for Satoshi to prove that the code was not written prior to January 3rd.

5/6 It's worth noting that the second block of the #blockchain was mined on January 9th, a full six days after the first block. This is unusual, as #Bitcoin blocks are supposed to take about 10 minutes to #mine. It's not clear why there was such a delay in mining the second block

6/6 The Genesis Block remains an important and interesting part of the Bitcoin blockchain. It is a reminder of the inception of this revolutionary technology and the possibilities it holds for the future of financial systems and transactions.

• • •

Missing some Tweet in this thread? You can try to

force a refresh