The EIA released its Annual Energy Outlook

Here's 15 forecasts that went right and wrong over the past decade - a thread #oott #oil #natgas #renewables

Oil Demand: In 2011, oil demand was forecast to be 19.1 Mbbls/d by 2022 (actual: 17.7 Mbbls/d)

Here's 15 forecasts that went right and wrong over the past decade - a thread #oott #oil #natgas #renewables

Oil Demand: In 2011, oil demand was forecast to be 19.1 Mbbls/d by 2022 (actual: 17.7 Mbbls/d)

Part of the energy revisions reflect changes to U.S. population growth (which has been revised down 6% since the 2018 - the first year with forecasts out to 2050). By 2050, U.S. population is expected now at 370 mln vs. 395 mln people previously.

U.S. Crude Supply: In 2011, oil production was forecast to be 3.8 Mbbls/d by 2022 (actual: 9.6 Mbbls/d).

2050 production forecast has been revised 5% higher y/y to 11.2 Mbbls/d. But overall, for the next ~30 years, the EIA expects production to remain mostly flat #permian #bakken

2050 production forecast has been revised 5% higher y/y to 11.2 Mbbls/d. But overall, for the next ~30 years, the EIA expects production to remain mostly flat #permian #bakken

WTI Spot Price: In 2011, oil prices were forecast to be $112/bbl by 2022 (actual: $95/bbl). By 2050, oil price expectations have been revised higher by +12% to $98/bbl (vs. last year’s forecast) #WTI #brent #opec

Natural Gas (NYMEX) Prices: In 2011, natural gas prices were forecast to be $5.40/mcf by 2022 (actual: $6.50/mcf). For 2050, natgas prices have been revised higher by +5% y/y but still lower than many prior year forecasts – despite the volatility we saw in 2022

In 2011, electricity was forecast to be $8.85/kWh by 2022 (actual: $12.25/kWh). Compared to last year’s outlook, 2050 price forecast has been revised +8% to $11.00/kWh #energy #EnergyBills

In 2011, share of electric vehicle sales were expected to be 26% by 2022 (actual: 15%)

By 2050, share of EV sales have been revised up by 20% y/y (i.e., EV’s are now expected to be 30% of all new vehicle sales (vs. 25% last year) #energytransition

By 2050, share of EV sales have been revised up by 20% y/y (i.e., EV’s are now expected to be 30% of all new vehicle sales (vs. 25% last year) #energytransition

In 2011, natural gas supply was forecast to be 64 bcf/d by 2022 (actual: 100 bcf/d).

The 2050 natural gas supply forecast has been revised -1% y/y (to 115 bcf/d). The trend has been moving lower over the last few years and down from a high forecast done in 2020 at 123 bcf/d

The 2050 natural gas supply forecast has been revised -1% y/y (to 115 bcf/d). The trend has been moving lower over the last few years and down from a high forecast done in 2020 at 123 bcf/d

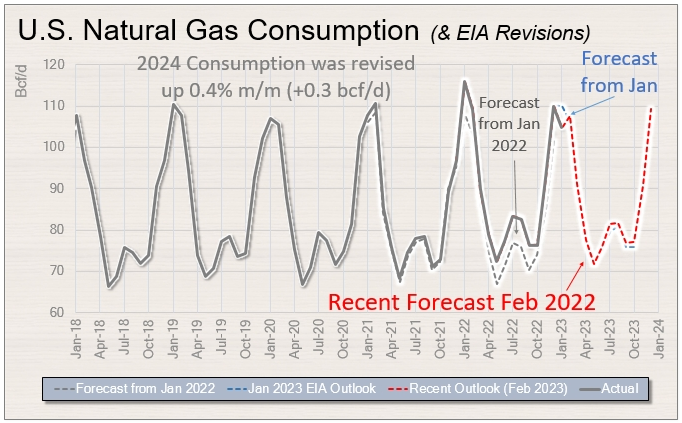

In 2011, natural gas demand was forecast to be 68 bcf/d by 2022 (actual: 88 bcf/d).

For 2050, natural gas demand has been revised lower by 12% y/y to 82 bcf/d. This is a considerable drop from prior years with more renewable energy expected

For 2050, natural gas demand has been revised lower by 12% y/y to 82 bcf/d. This is a considerable drop from prior years with more renewable energy expected

In 2011, the U.S. expected to be exporting ~5 bcf/d of gas by 2022 (actual: 18.9 bcf/d).

For 2050, net exports have been revised up +47% y/y (to be 37 bcf/d).

For 2050, net exports have been revised up +47% y/y (to be 37 bcf/d).

In 2011, solar/ wind was expected to supply 2.4% of energy by 2022 (actual: 5.6%).

By 2050, solar/wind mix has now been revised +146% since 2018 (from 9.5% energy share to 23.3% with the most recent forecast). #solarenergy #renewables #WindEnergy

By 2050, solar/wind mix has now been revised +146% since 2018 (from 9.5% energy share to 23.3% with the most recent forecast). #solarenergy #renewables #WindEnergy

Net Summer Capacity for both solar and wind energy was revised up meaningfully y/y #energy

Once again however, planned coal and nuclear plant retirements keep getting pushed out as demand for energy continues

In 2011, household energy use was expected at 25 Mwh by 2022 (actual 27 MwH).

By 2050, individual household energy use has been revised -3% y/y to 22.5 Mwh. Expected efficiencies are offset by more households with Air conditioning, deep freezers and clothes dryers, etc

By 2050, individual household energy use has been revised -3% y/y to 22.5 Mwh. Expected efficiencies are offset by more households with Air conditioning, deep freezers and clothes dryers, etc

In 2011, CO2 emissions/capita were expected to be 16.8 MMmt (actual: 14.6 MMmt).

CO2/capita has now been revised down-20% (since 2018 forecasts) and is expected to be 10.6 MMmtCO2/capita by 2050

Follow @JeremyMcCreaCFA @RaymondJamesCDN

CO2/capita has now been revised down-20% (since 2018 forecasts) and is expected to be 10.6 MMmtCO2/capita by 2050

Follow @JeremyMcCreaCFA @RaymondJamesCDN

• • •

Missing some Tweet in this thread? You can try to

force a refresh