If you've heard about a global #Nuclear #energy resurgence⤴️⚛️👂🐦 driving demand for #Uranium that's in a deep supply deficit⤵️⛏️ and wonder how U can invest💵🤔 in this tiny #mining #stocks sector famous for spectacular gains🎆💰😃 here's a🧵 on the various ways U can play.🤠👇

To build your own #Uranium #mining #stocks portfolio📂 of #U3O8 equities traded in #Canada, #USA, #Australia & #UK🛒 U could choose from the holdings of 100% pure-play '@Sprott Uranium Miners ETF' $URNM 🇺🇸🇦🇺🇬🇧🛒⚛️⛏️🤠🐂 #Nuclear #investing #NetZero #ESG🏄♂️ sprottetfs.com/urnm-sprott-ur…

Lowest risk #Uranium #investing option🦺 is a Fund that stacks raw #Nuclear fuel #U3O8🏦⚛️ providing direct 1-to-1 exposure to U3O8 Spot price.📈👯 In North America that's @Sprott Physical Uranium Trust (TSX: $U.UN $U.U OTC: $SRUUF)🇺🇸🇨🇦 & in #UK Yellow Cake plc (AIM: $YCA)🇬🇧🛒⛏️

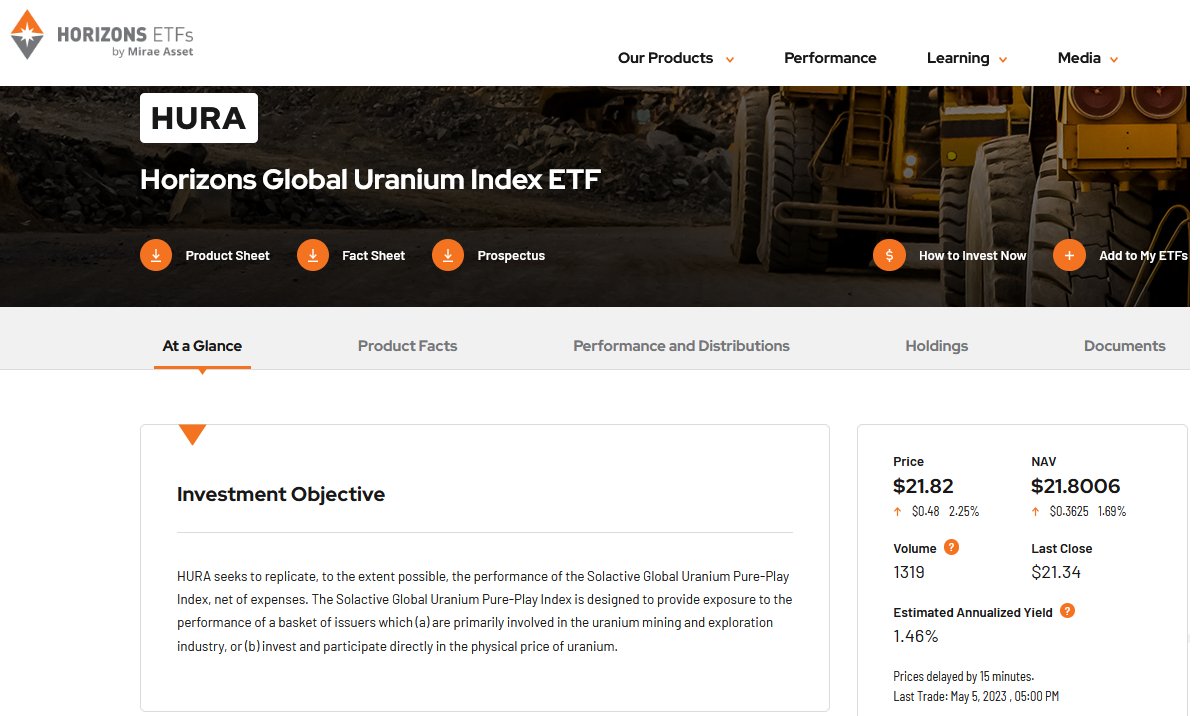

If U prefer ETF baskets of #stocks for 1-trade in & out U sector exposure:🧺 on NYSE🇺🇸 LSE🇬🇧 ASX🇦🇺 is 100% pure-play @Sprott Uranium Miners ETF $URNM; 100% pure-play Horizons Global #Uranium Index ETF $HURA on TSX 🇨🇦; Global X Uranium(70%)/#Nuclear ETF $URA 🇺🇸 $URNU 🇬🇧 $ATOM 🇦🇺🤠

New @Sprott Junior #Uranium Miners ETF $URNJ on Nasdaq🇺🇸 holds a basket of mid, small & micro cap #Uranium #mining #stocks traded in #Canada, US, #Australia, Hong Kong & London⚛️⛏️ that is likely to outperform $URNM & $URA in a 'rip your face off' U bull market cycle🫠🛸🌜🤠🐂

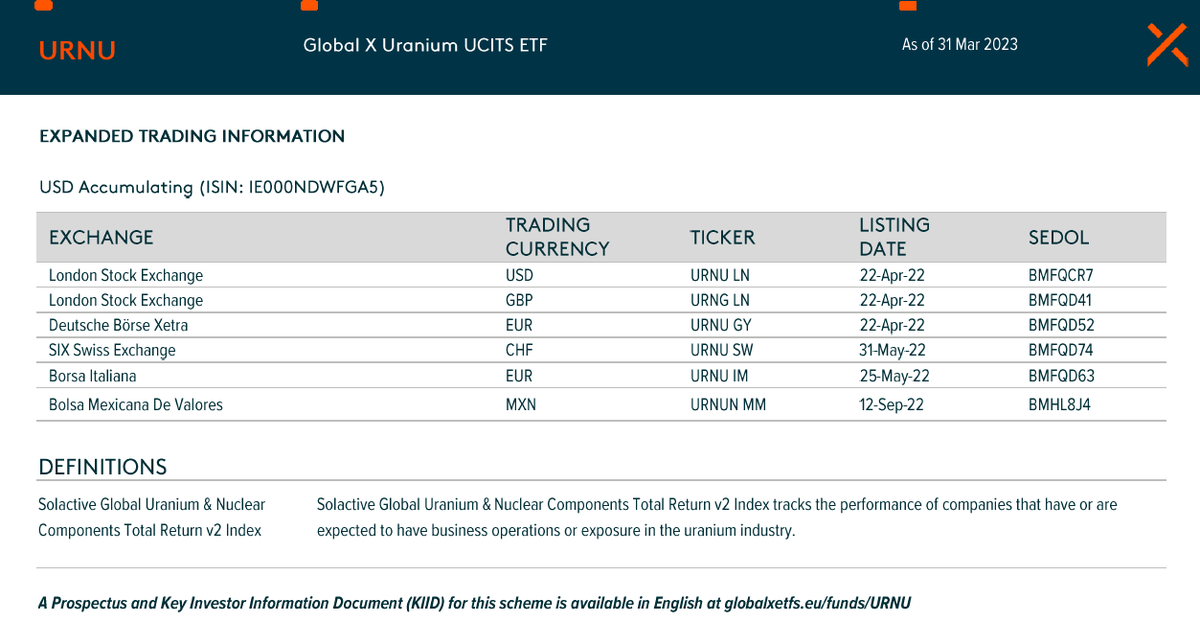

Investors in #Europe🇪🇺 & #UK can now choose from several new #Uranium ETF tickers: @hanetf's 100% Pure-Play @Sprott #Uranium Miners UCITS ETF $URNM (USD) $URNP (GBP)🇬🇧 $U3O8 (Euros)🇩🇪🇮🇹 and Global X Uranium/#Nuclear UCITS ETF $URNU (USD) $URNG (GBP)🇬🇧 $URNU (Euros & CHF)🇩🇪🏰🤠🐂

If you're just beginning to invest in #Uranium #mining #stocks👶 then a great starter🥣 is #investing in a 100% Pure-Play Uranium ETF: $URNM 🇺🇸🇬🇧🇦🇺 or Horizons Global Uranium Index ETF $HURA 🇨🇦 giving U broad #U3O8 sector exposure⛏️😃 while U do your research📚🧐👇#Nuclear⚛️🤠🐂

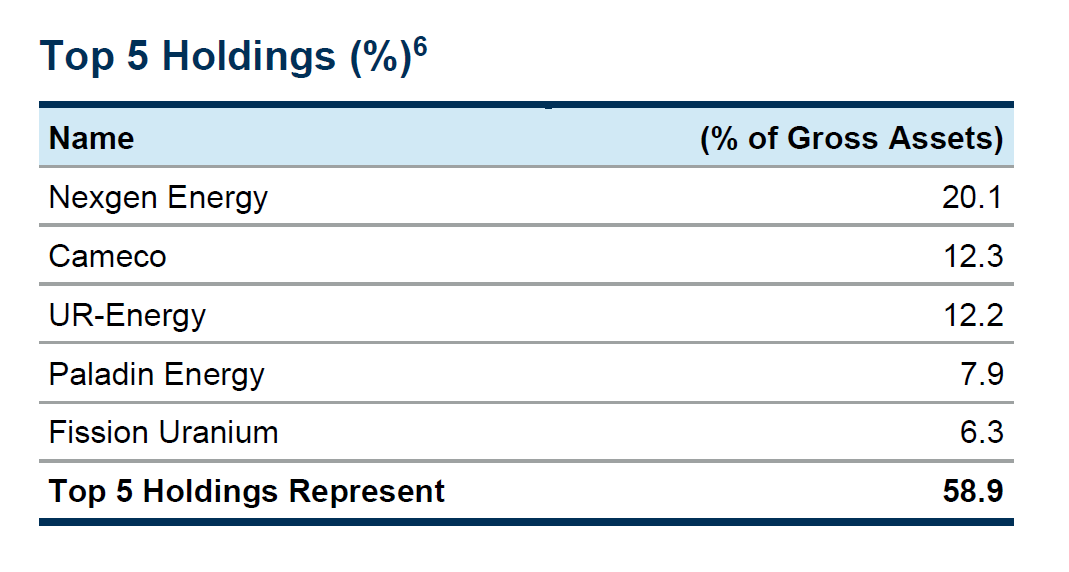

The only publicly-traded actively-managed #Uranium #mining #stocks fund is #UK's NCIM Geiger Counter Ltd $GCL in London🇬🇧 with Top 5 Holdings reported as NexGen $NXE Cameco $CCJ Ur-Energy $URG Paladin $PDN & Fission Uranium $FCU 📂 #investing #ESG🤠🐂 ncim.co.uk/wp/geiger-coun…

I've been researching📚🧐 and accumulating🛒 a large #Uranium #mining #stocks portfolio📂 for many years👴 positioning for a new U bull market.🤠🐂 If you're looking for ideas💡 on #Canada/US companies for your own due diligence🕵️♂️ then U might find some candidates here:👇☘️🌈💰🦄

I'm no authority on #Uranium #mining #stocks traded in #Australia🇦🇺 but last year @StockheadAU published a comprehensive Guide to #ASX-traded U stocks.👇 Check with @stokdog & @patrickadownes who have a lot more info on new U names trading on ASX.🦘⛏️🤠🐂stockhead.com.au/primers/uraniu…

With a #CarbonFree #Nuclear Renaissance boosting #Uranium price & demand🌄⚛️🏗️⏫ just as #U3O8 is in a supply deficit⛏️⏬ while West pivots away from #Russia 🇷🇺⛔️🪖 4 May Bloomberg Consensus Estimates & Targets🎯 can point U to deeply oversold U #mining #stocks🔥🛒💎 🤠🐂🌊🏄♀️☘️

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter