Consider e.g. the value to Formula 1 of a clearly questionable UK tax ruling: itv.com/news/2016-11-2…

For example, the Procter & Gamble deal in the Netherlands "allowed the company to shift $676m untaxed to Cayman, signed off by a single tax inspector"

dutchnews.nl/news/archives/…

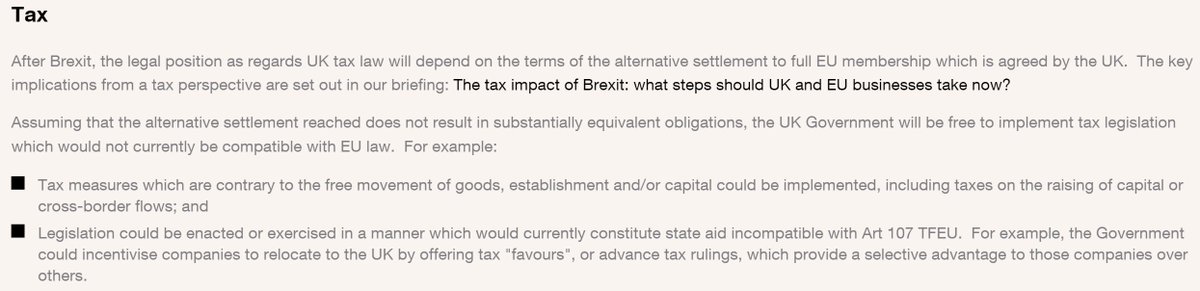

Here's Clifford Chance: …cialmarketstoolkit.cliffordchance.com/en/topic-guide…

But secret advanced tax rulings would still incentivise systemic abuse and corruption. Give us transparency please. /