First, the captain-obvious no-duh punchline:

look where few others are looking,

avoid competition,

be roughly right (not precisely wrong) where superior precision analysis is unnecessary...

Sturgeons Law + Bayes Law.

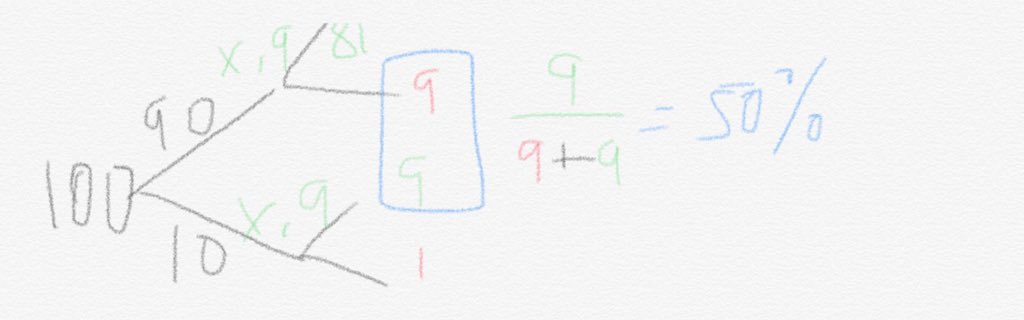

I’ll show you that you can hire an analyst with 90% accuracy (!) and you will still have ONLY 50/50 odds of selecting a good investment—IF you look where others are

Sturgeons Law playfully tells us 90% of stuff is crap

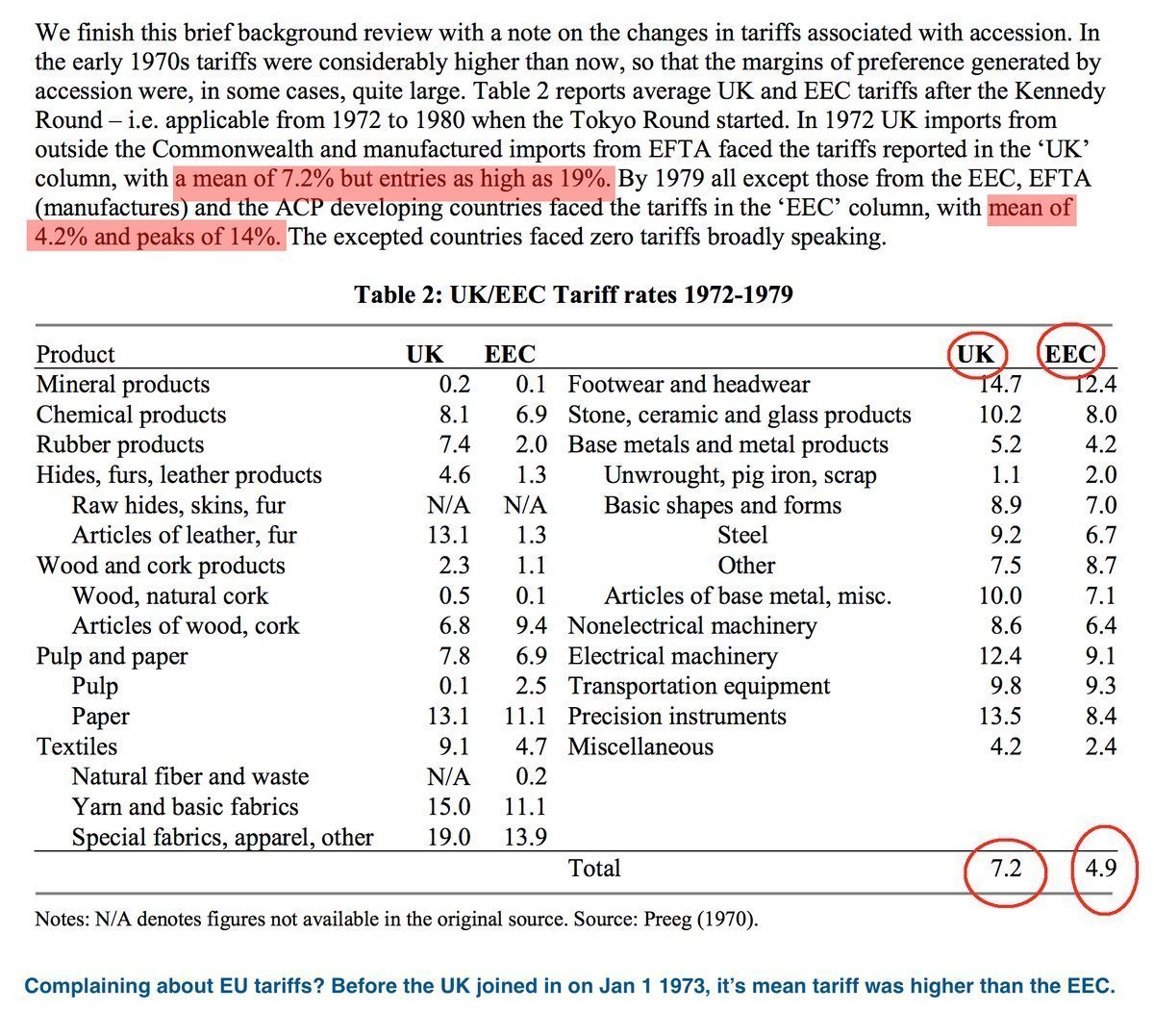

Assume

90 companies are crap

10 good

Now Bayes:

-Your analyst has 90% accuracy rate discerning between crap & good

-What are odds the good co they recommended is *actually* good?

Of 10 good they correctly said 9 good (.9*10) but mistook 1 as bad

They present to you 18 good co’s

But only 9 are actually good

9/18 =50%

Your 90% accurate analyst?

No better than a coin toss!

OR

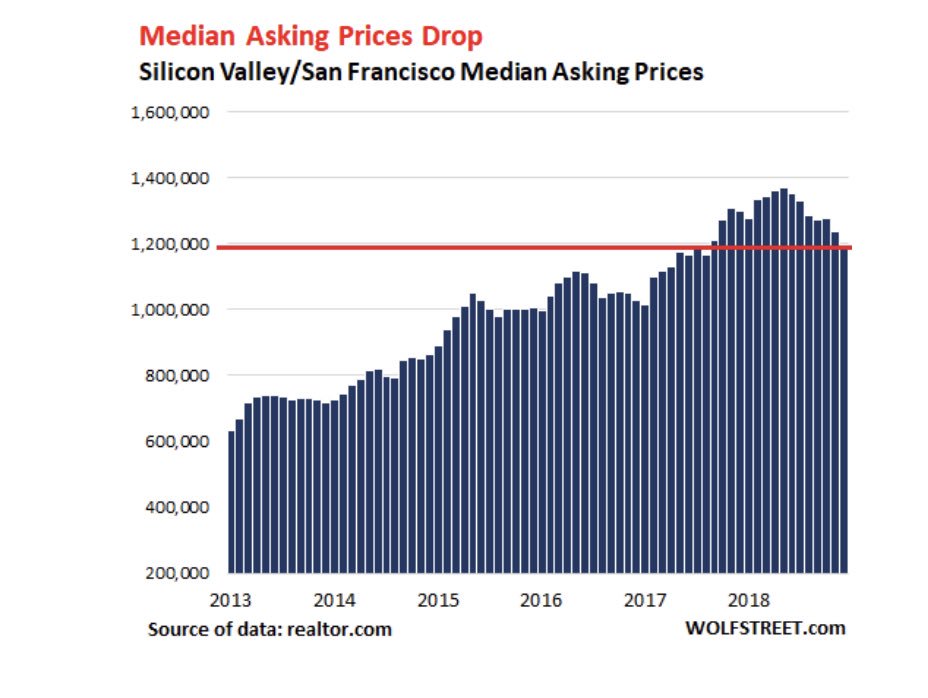

Go where barriers are higher, there are fewer crappy co’s because there are fewer co’s—so its maybe half-Sturgeon and instead of 10% being good, 45% are good...

It’s why I’m psychotically focused on structural competitive advantage—

Less than 5 Co’s in

-nuclear waste tech

-metal 3D printing

-robotic surgery

-satellite antennas

QED