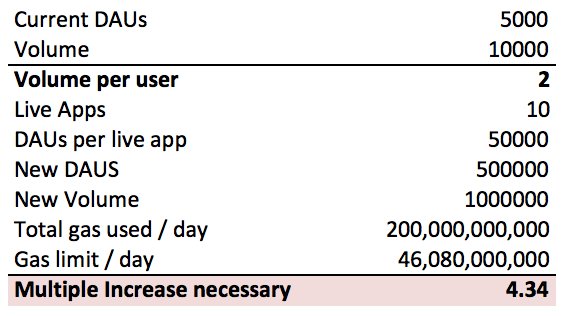

As shown in the thread below, block size is effectively full — and there are only 4 apps with greater than 500 DAUs

(1) Continue to keep block size capped, raising fees, or (2) increase block size raising the burden further on a full node.

@StopAndDecrypt's recent articles details this well

(1) current demand is very elastic b/c there aren’t any mission critical applications

(2) competitors, like EOS, are emerging with dramatically lower, even 0, fees

B/c of this, fees peaking is going to be a leading indicator of price reversing as people move to other chains or stop usage altogether

They have to raise this cap to ensure the narrative doesnt break

The problem is as people realize that ETH isn't architecturally decentralized any longer, the decentralized narrative and their value prop will also start to die...

I dont think this can last, but it can definitely take ETH market share

1. dApps launch, fees rise, block size is raised further and nodes continue to centralize

2. dApps launch, fees rise, block size isn't raised (or not fast enough) and apps go elsewhere

3. dApps never launch on ETH

If EOS can have 21 validators, why not have 2? Why even have a blockchain?!