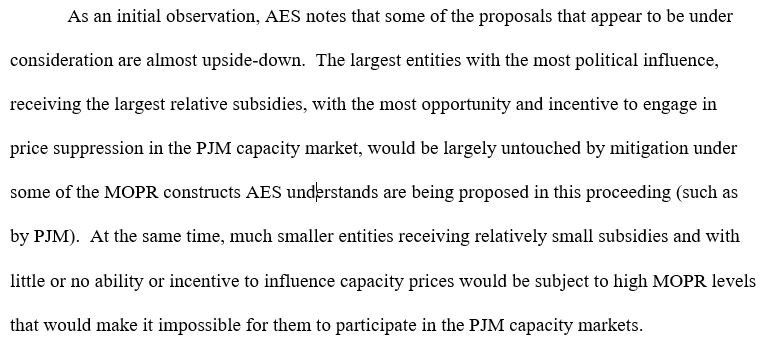

creates significant and unproductive tensions with state policy initiatives"

elibrary.ferc.gov/idmws/file_lis…

bids at zero as when the subsidized unit is removed from the auction via FRR-RS. The very result FERC seeks to avoid (price suppression from subsidization)

remains"

Citation to 19th Century Law Alert!

Calpine dangles the possibility that generators will ask FERC for stranded cost recovery if it doesn't ensure a competitive market by MOPRing everyone. Footnotes Smyth v. Ames! elibrary.ferc.gov/idmws/file_lis…

I can't log in so I can't file...

among suppliers to serve the available load..."

markets may induce a certain degree of capacity market fatigue and prompt questions about whether there is some better approach."