Part 1

Part 2

Part 3

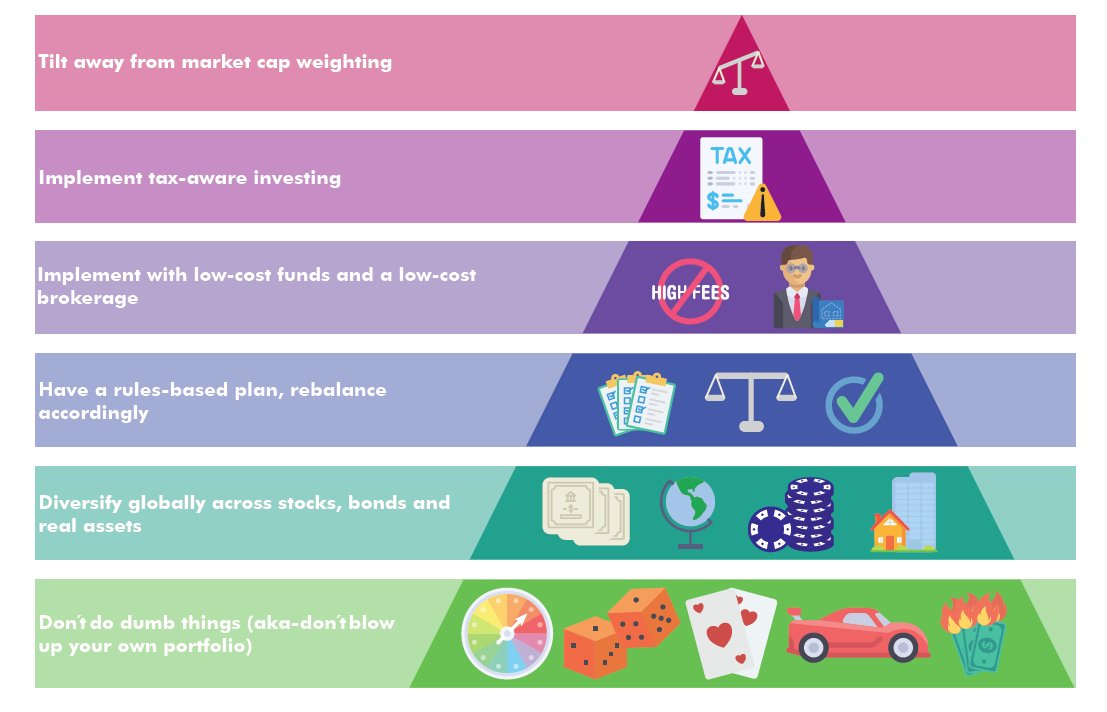

Start with the global market portfolio as a base case allocation, it's diversified and you can implement it for ~free.

That's roughly half in stocks and half in bonds. And of that, it's half US and half foreign...

"I'm about 50 percent stocks and 50 percent bonds and I spend half my time worrying about why I have so much in stocks and the other half worrying about why I have so little in stocks."

This may be uncomfortable for some as the US is one of the most expensive stock markets.

Just don's use expensive funds!

mebfaber.com/2017/04/27/pay…

Most of these shops all have a similar allocation (not necessarily a bad thing)

mebfaber.com/2015/04/24/sch…

I invest all of my public assets in a similar way:

mebfaber.com/2018/10/01/why…

Not quite.

Weight management, where the formula is basically:

Weight change: Calories consumed - calories burned.

Now before you keto crazies (@MikePhilbrick99) or others pull your hair out, I realize it's simplified.

cambriainvestments.com/wp-content/upl…

The same is true in investing. The process is dead simple. It's the emotions that get in the way.

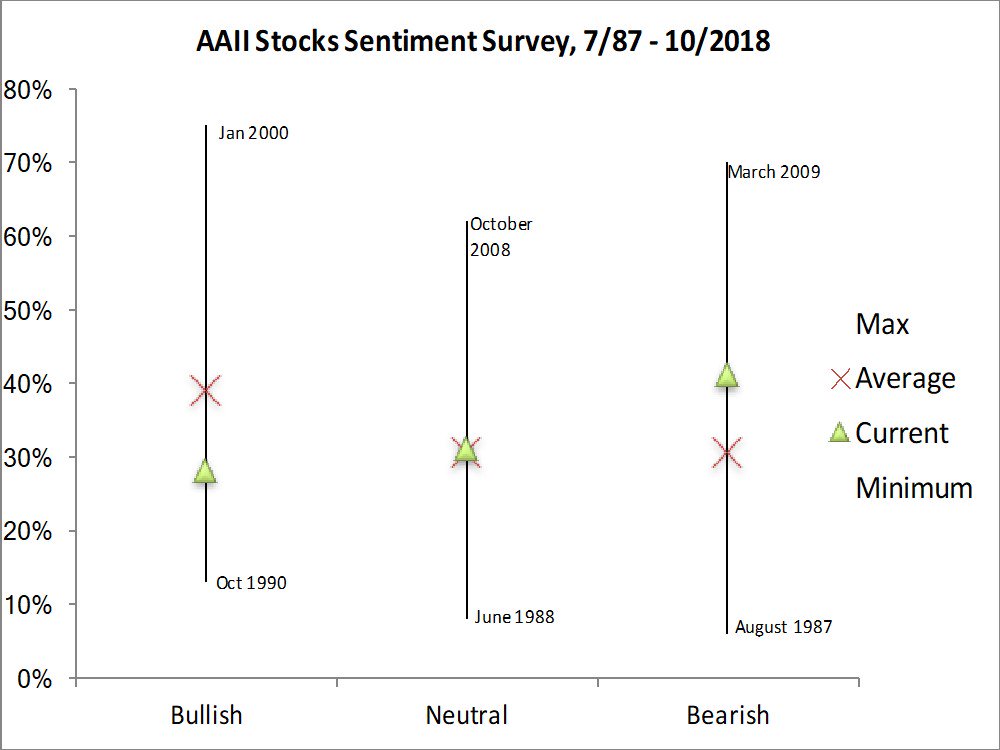

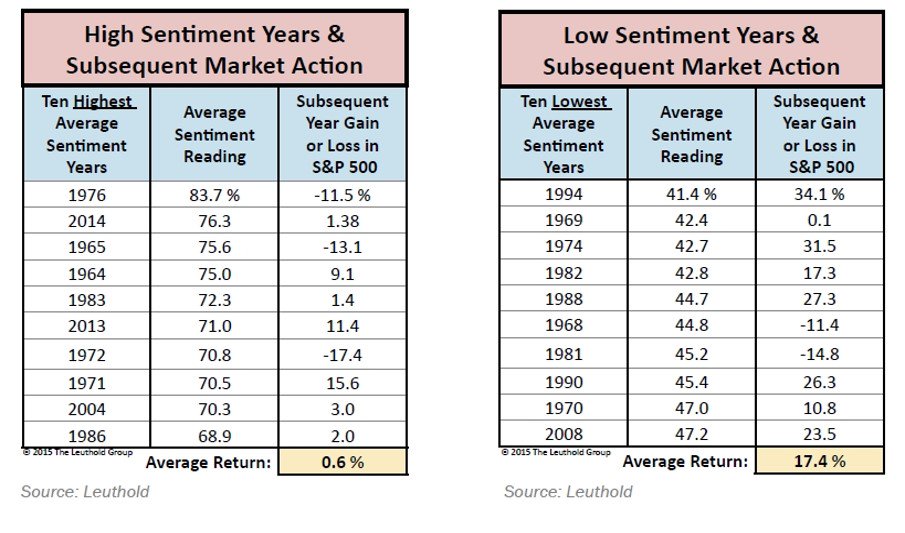

What happens when everyone agrees, in fear or in euphoria?

As you can see now people are a little bit bearish, not surprising after a nasty October!

When were people most BEARISH? March 2000.

Literally you could not make up a worse time for either!!

Most BULLISH when you should be BEARISH, most BEARISH when you should be BULLISH.

Not surprisingly, bad sentiment leads to good returns and vice versa.

The second highest bullish reading ever...

Please, they're just as bad, but just use fancier words like "rigorous" while expecting the same 10% returns, they just make believe it's all magically coming from private equity.

I would love to see the names of who filled out that survey so they could all be fired!

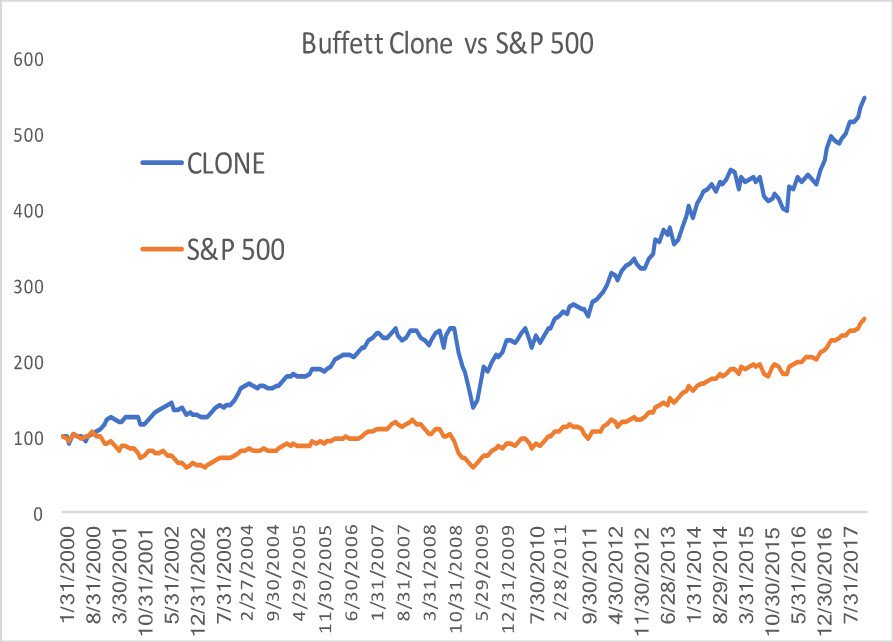

We examined investing in lots of famous fund managers through government filings. Quick summary: it works great.

That would beat 99% of all mutual funds over the period

Because during that period he had a stretch where he underperformed 8 out of 10 years.

He would have been fired many times over by those consultants after two bad years. Forget 10!

Half the time you will look stupid and about 25% of the time you'll look incredibly stupid. That's hard for many especially when their neighbor is getting rich...

"I've heard Warren say a half a dozen times, 'It's not greed that drives the world, but envy,'" Munger says.

So how to combat this? Simple - have a plan.

- Owns an investment salad

- Has a binary view on investing

- Harbors a secret desire to complicate the process

These above problems persist and are exacerbated since you do not have a written investing plan.

Most investors have unrealistic expectations. Solution? Lower expectations, spend less and save more. If you exceed those expectations, that's gravy...

"AND JOY IS, AFTER ALL, THE END OF LIFE. WE DO NOT LIVE TO EAT AND MAKE MONEY. WE EAT AND MAKE MONEY TO BE ABLE TO LIVE. THAT IS WHAT LIFE MEANS AND WHAT LIFE IS FOR." Mallory