So, yesterday we talked about the challenges of investor expectations (too high, 10%) vs. likely future US stock and bond returns (too low, 3%).

Today, I offer a potential solution - a time travelling investment genie.

More on that later...

You'll recognize a few names including @elerianm, @RayDalio / @TonyRobbins, David Swensen, etc.

You can download the full data set and charts in our Global Asset Allocation book here for free..

cambriainvestments.com/investing-insi…

These gurus have MASSIVELY different allocations.

One says put half in real assets while another says none. Some have 55% in bonds, others just 10%. The stock allocation ranges from 25% to 90%!

This should have an enormous impact on returns, right?

If you just survived that was a compliment.

Also note that if you chased the BEST performing allocation in the 1970s, that was then the worst going forward...

She's going to let you go back in time to 1972, and pick out the single best performing asset allocation strategy.

Amazing right?

You have to implement the portfolio with a mutual fund with the average fees of today of 1.25%.

(She's sweet though so no loads, 12b-1 fees, and you even get to put it in a non-taxable account.)

Look how it turned out for Biff!

But what really matters? Something no one thinks about.

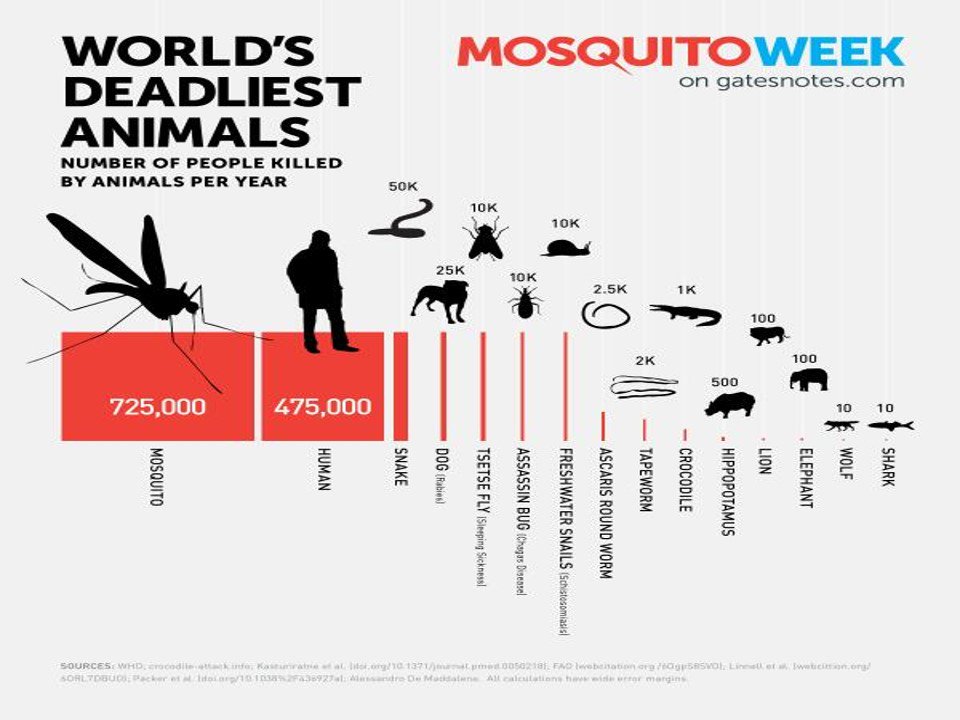

What are most people afraid of? Sharks, lions, wolves...but they kill very few people.

What does kill people? #1 is mosquitoes, #2 other HUMANS, #3 snakes (fair they're awful), #4 man's best friend

The point being, what you spend your time worrying about likely doesn't matter. And what you spend your time NOT worrying about matters a lot.

There's about 5 asset allocation ETFs that manage a few billion that charge <0.3%...Cool.

etf.com/etfanalytics/e…

barrons.com/articles/etfs-…

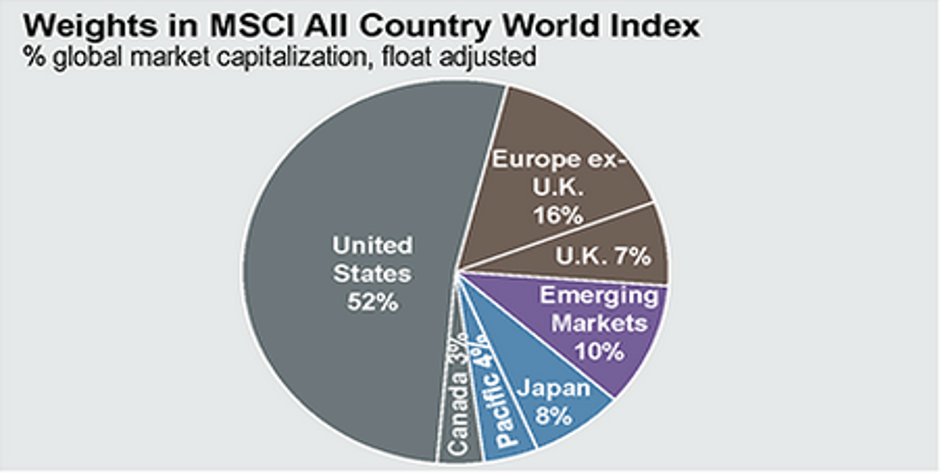

US assets offer little future expected returns, so expand your asset allocation, and pay as little as possible for implementation.

Part 3/4 tomorrow looks at how we can improve upon this base case free asset allocation to hopefully garner higher returns...