In Part I we talked about how US stocks and bonds are primed for low future returns.

Investors should take their medicine, lower expectations, save more, and spend less.

Investors shouldn't obsess over the exact asset mix, but rather focus on cost aware implementation for low fees and taxes.

But first, get out a pen or pencil. Ready?

Write down the % of your stock portfolio you have in US stocks (or local country if abroad)...

Got it?

I wrote a book on stock market valuations (free here: cambriainvestments.com/investing-insi…), and I used to give speeches and ask people the same question.

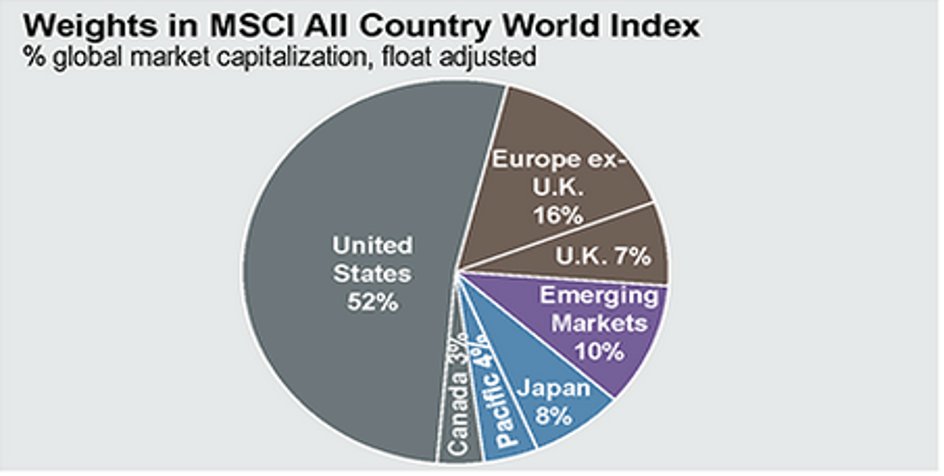

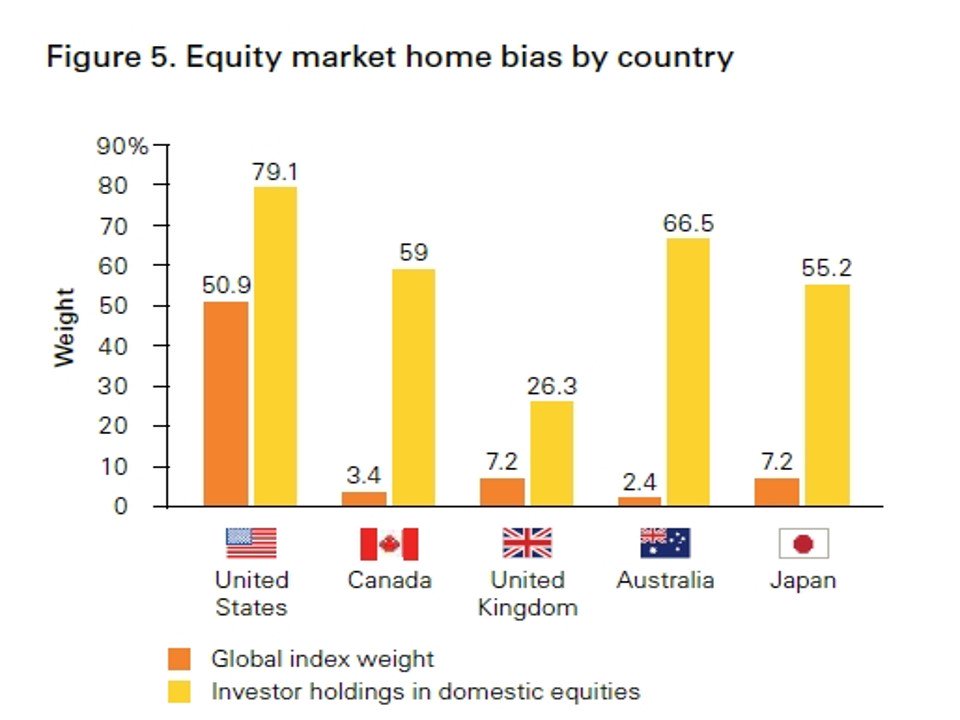

We'd collect the responses live, and the answer was always the same: 80%.

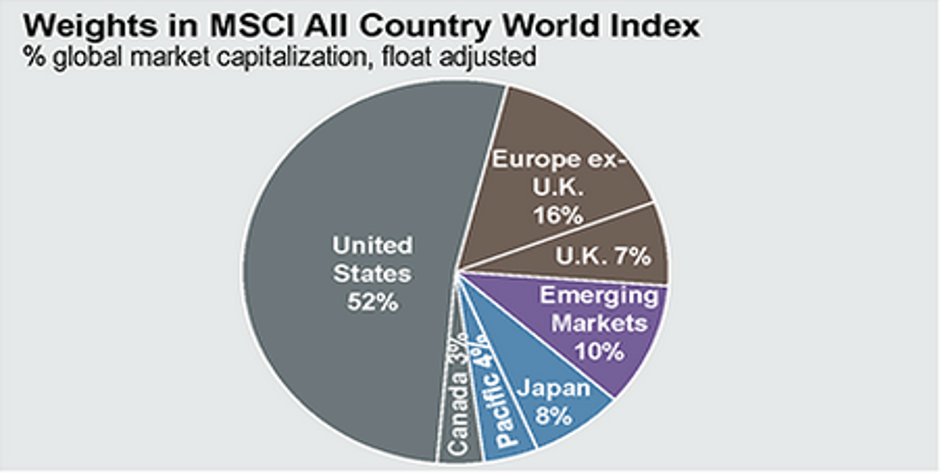

This happens all around the world and is even more egregious elsewhere since most countries have a much smaller % of total market cap.

Chart from @Vanguard_Group

They feel a false sense of comfort with "what they know". It's what they grew up with and see every day.

(And probably the same reason I'm a @broncos fan)

Let me explain why this is a really dumb idea.

If you're investing 80% that means you are making a massive active bet that that US stock market will outperform the rest of the world.

(Pat yourself on the back if you've been lucky and done this the past 10 years)

Bad idea - let me explain.

But why is market cap weighting sub-optimal?

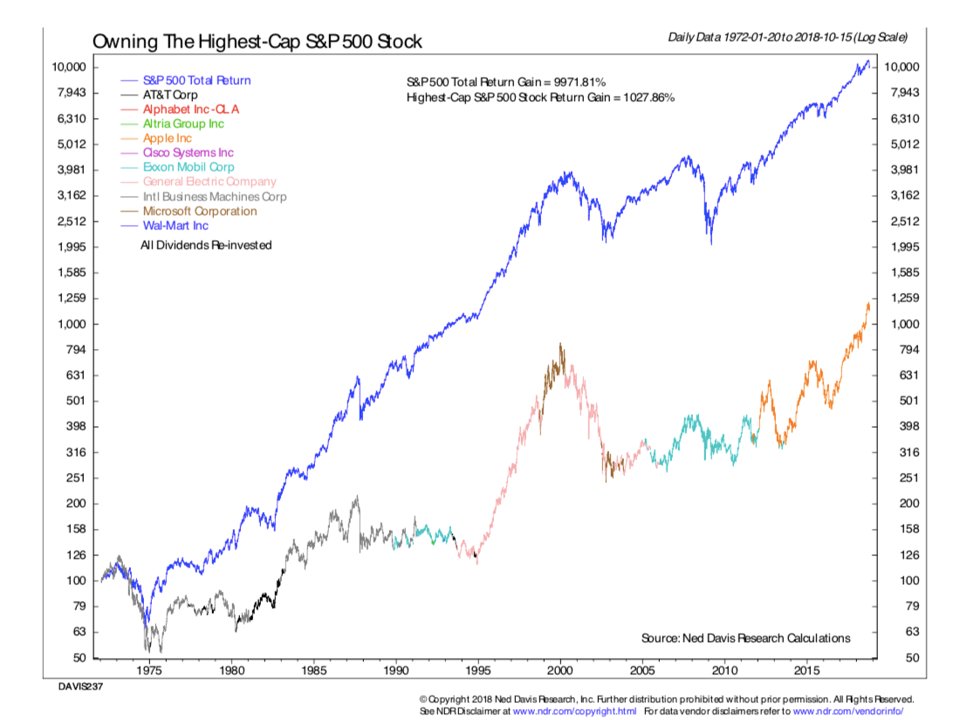

Here's a chart from @NDR_Research that compares the S&P 500 to investing in the largest stock in the market at the time.

And it's a HORRIBLE idea. It underperforms the S&P500 by a mile...now why?

nbc.com/saturday-night…

By the time @apple becomes a $1 trillion company, don't you think there's a bunch of other companies that would like to make phones and billions of $ per year?

This surprises many people but the market index is just price. That's it, no earnings or revenue measures, just price.

So a market cap index often overweights expensive stocks.

mebfaber.com/2016/09/07/epi…

But let's chat about one of my preferred weighting methods, VALUE.

@CAPE_invest

theideafarm.com

@Barclays

@RobertJShiller

@AswathDamodaran

globalfinancialdata.com

mba.tuck.dartmouth.edu/pages/faculty/… …

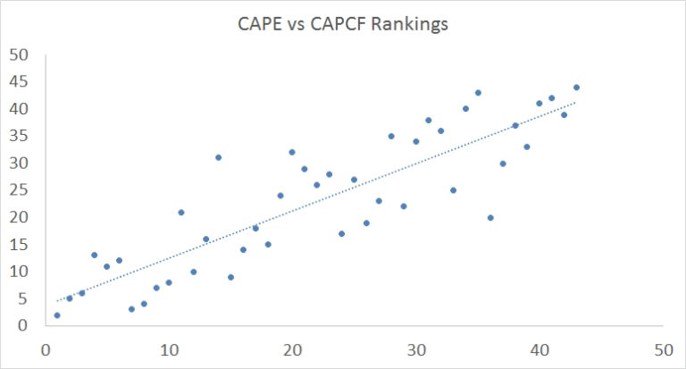

Most of the valuation metrics in general move together (not surprising that stocks are broadly correlated.)

But often at times there is a wide spread of some monster and low valuations.

Paying less for something is usually a better idea than paying more, whetether it's classic cars, houses, stocks, or 1989 Ken Griffey Jr. @UpperDeckSports cards...

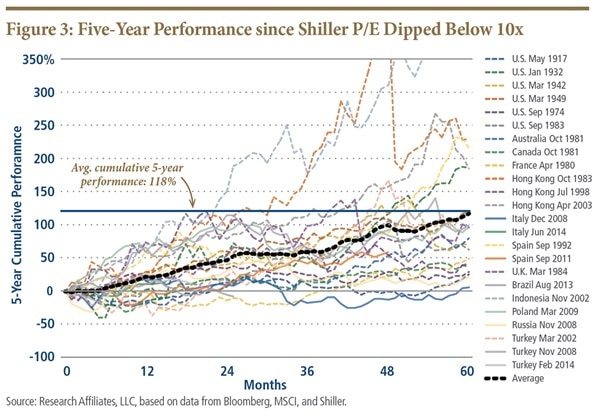

Well because mean reversion is the most powerful force in investing.

Just when you think you are hot sh!t, the market has a way of humbling you...and when things look bleakest, better times are often ahead...

When investing in true bubbles, CAPE > 45, future 5 year returns were negative.

Similar chart below from @PIMCO

Russia 7

Turkey 9

Czech 10

Poland 12

Portugal 13

Spain 13

Brazil 13

For Emerging 17 (lower depending on index)

For Developed 21

US 32

The good news, most of the world is normal to cheap, and emerging markets are really cheap. The cheapest bucket is screaming cheap.

I guarantee it’s not to jump off @twitter, call your husband/wife/clients and say “I just read this brilliant thread by this handsome fellow online, let’s go buy Russian and Turkish stocks!”

Client or spouse maybe thinks you are slightly smarter.

If you do poorly, then you’re likely fired or divorced, as what IDIOT would go and buy Russian stocks?!

Which is why people like buying the expensive countries where all the economic data is great (ahem US), and avoiding the bad countries where all the economic data is usually awful, revolutions, depressions, invasions, etc.

Rebalancing more actually hurts. This deep value strategy takes a looonnnggg time to play out.

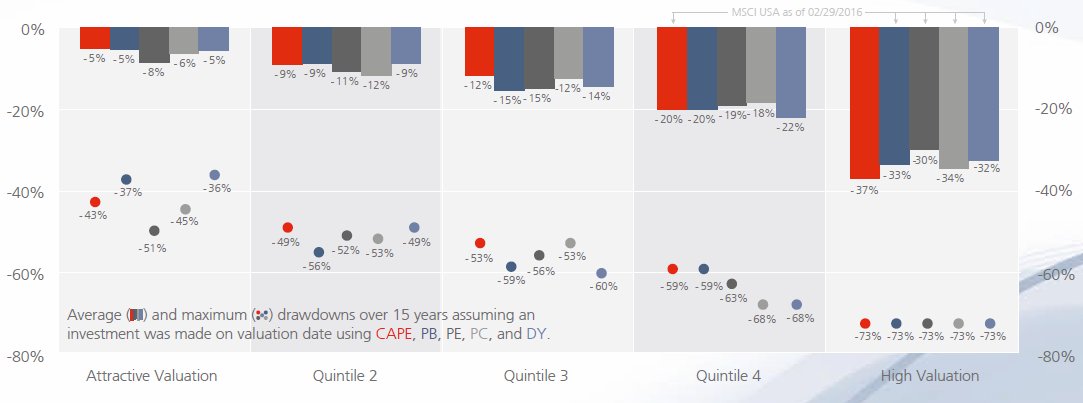

Lots of studies have shown that buying expensive markets leaves you more exposed to a big fat drawdown in the next 5 years…here's @CAPE_invest

We had two good podcast discussions with Rob Arnott and @HowardMarksBook lately where they discussed the concepts of “over-rebalancing” and “calibrating” a portfolio.

mebfaber.com/podcast/

Volatility and drawdown were roughly the same, but returns inched up a few percentage points.

The problem? You're gonna look DIFFERENT.

But you also can’t pay too much. If you’re expecting alpha of 2%, but pay 2% in fees to achieve that, you are better off in market portfolio paying zero.

The global market portfolio is a great starting point, but tends to be suboptimal due to market cap weights. This is especially true right now as the US stock market is one of the most expensive in the world, so consider value tilts in your portfolio.