CRYPTO IS IN A FINANCIAL CRISIS.

now that i have your attention, let’s talk about the crypto market puking up 20% across the board yesterday 🤮 (thanks to @CNBC for the headline inspo - writing clickbait is fun!)

ICYMI:

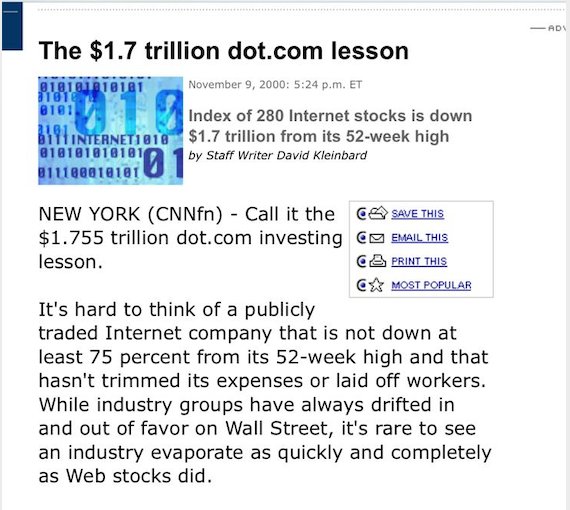

as my biz partner @dannylmasters pointed out earlier this year - history rhymes - and nothing goes up in a straight line forever 👇🏾

medium.com/coinshares/his…

- crypto is in crisis (unless you're bitcoin)

- the market knows it, and eased some of that pain. we have to look beyond the assets themselves for value creation.

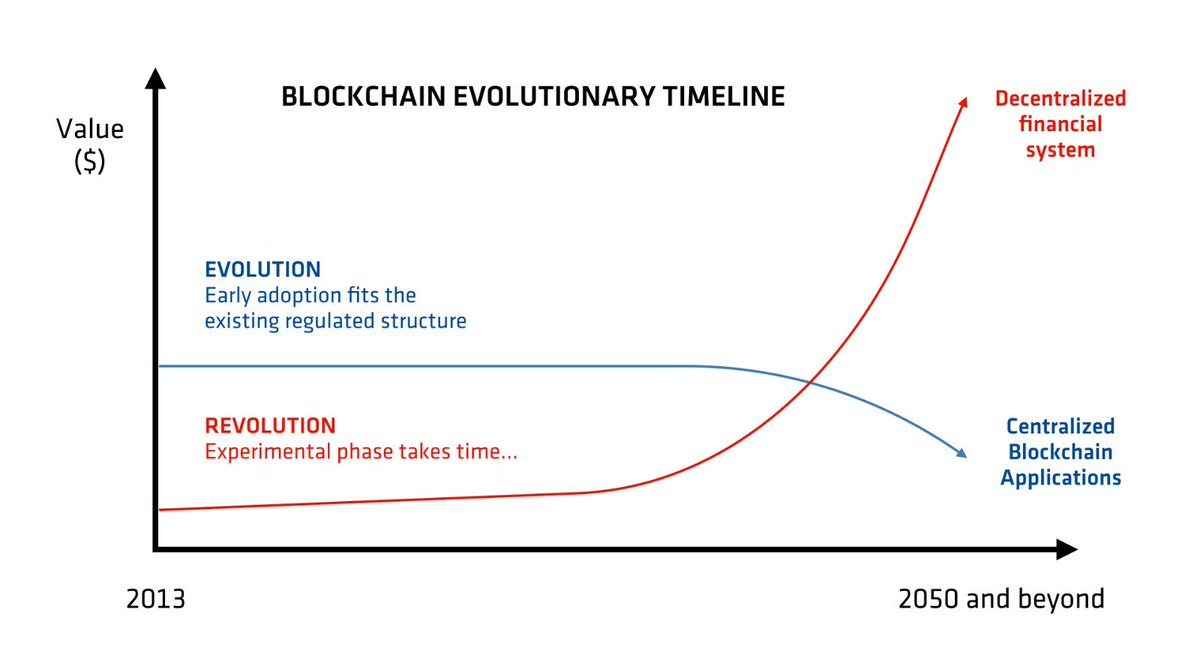

- building a less centralized financial system is going to take a long time. plan wisely.

- over 80% of cryptos have less than $10MM in 30-day trade volume

- code commits in the low double digits last quarter

- only a few hundred tsxns per day, if that

(see @onchainfx)

numbers don't lie. many assets are trapped in a vicious spiral.

- in the assets, especially networks w/ proven governance

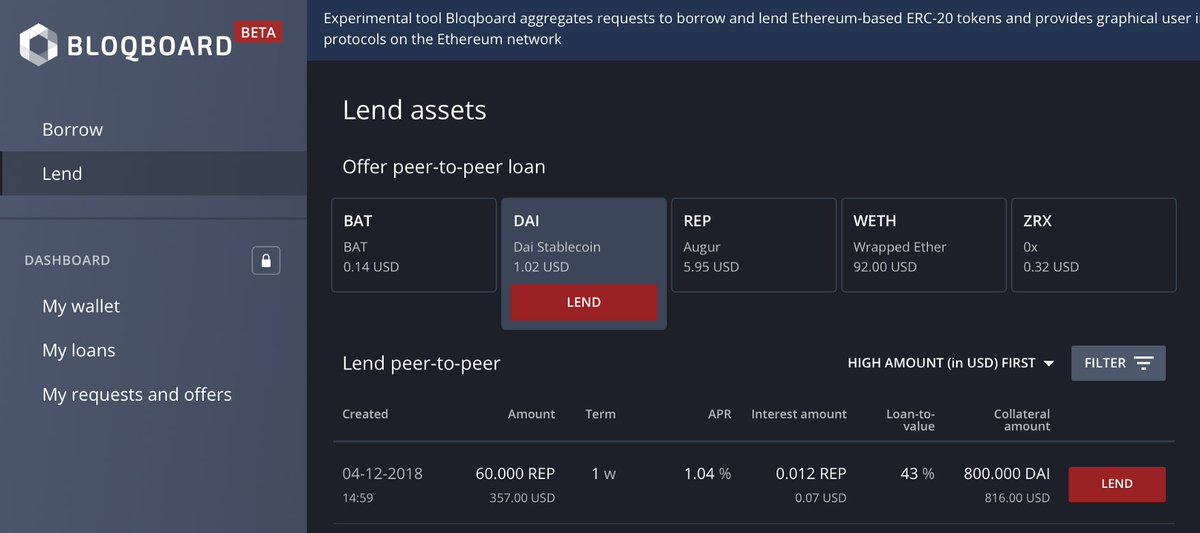

- in the new companies building infrastructure and services

- in the funds and asset managers providing exposure

- in publicly traded co's

....

@RyanRadloff does the math 👉🏽 medium.com/coinshares/hal…

for now, our collective hopes and fears are expressed as speculative price moves.

projects don’t die the way companies do, and the arc of time is long.

we can't pinpoint *when* that shift will happen, but here at @CoinSharesCo - we believe it's inevitable 🚀

/fin/