instead, a team decided to sell a large portion of tokens to one single investor without consulting other $MKR holders or communicating with their community.

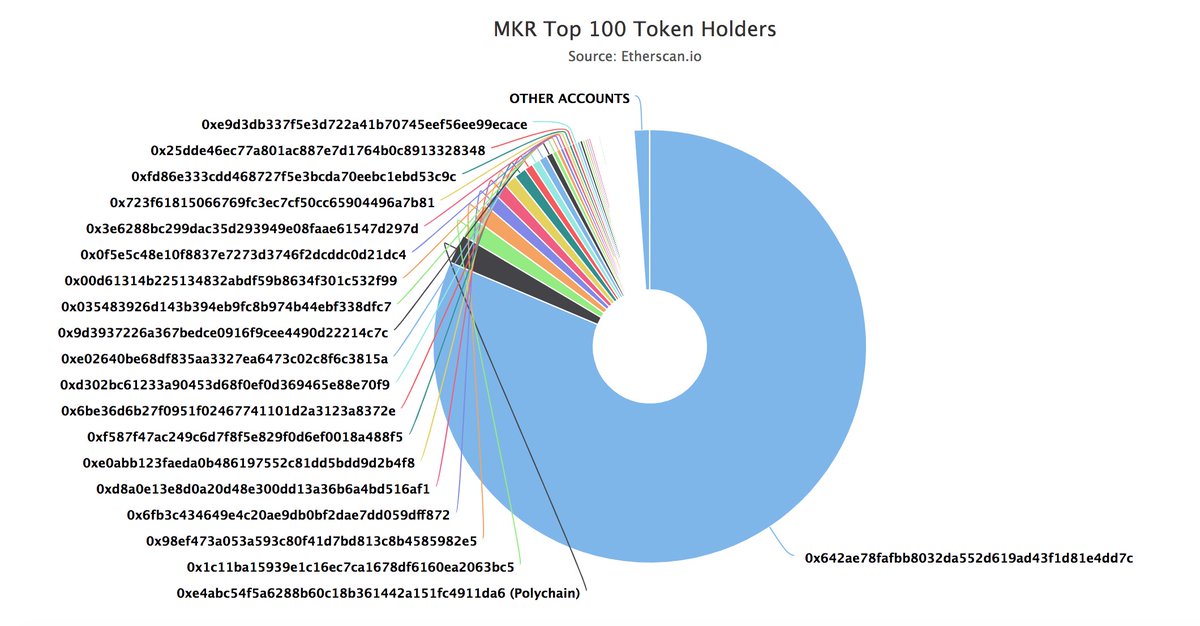

- 39% in the development fund (the DAI foundation, no website)

- 61% trading publicly on the market (onchainfx.com/asset/maker)

- 15% held by core team members (no details on lock up, etc)

so where did this 6% come from?

link: thecontrol.co/lessons-from-m…

see @etherscan: etherscan.io/token/tokenhol…

messari.github.io/research/profi…