The 1st half is solely focused on the evolution of investment management through the last 4 millennia.

And rightly so. Because #history matters.

A quick summary below.

[Retweet if helpful]

Slack regulations, inadequate company disclosures & the general inability to systematically analyse investments kept most investors out of the market.

The first step involves a rudimentary understanding of diversification (as evident in the next tweet).

The second step involves the publication of Graham & Dodd's 'Security Analysis' in 1934.

Evidently, this was one of the earliest known instances of "diversification" by geography.

This fund also severely restricted changing portfolio weights, in what can also be termed as the *world's first passive investment strategy*.

This was the *world's first value fund*.

This act was enacted in response to the South Sea Bubble, which resulted in massive losses to investors.

Britain's first mutual fund (Foreign & Colonial Government Trust ) started not before 1868.

But it still trades today -- the world's oldest.

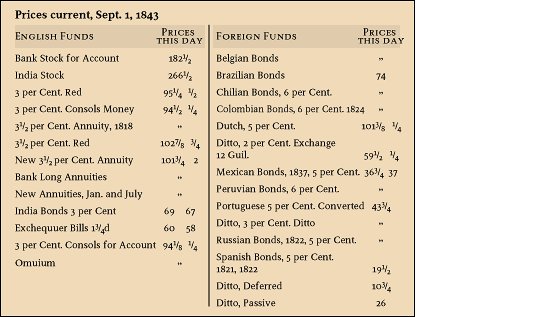

But 1720's Bubble Act considerably reduced incentives to publish stock prices. In 1843, however, @TheEconomist mag started offering monthly list of stocks & bond prices.

A fun fact:

Back in 1850s, Reuters employed more than 200 carrier pigeons to transmit stock price information to investors.

Then came Poor's Publication in 1860 (which combined with Standard Statistics Bureau in 1941) to form S&P.

But in the US, companies often kept sales figures hidden from investors, well until the stock market crash of 1929.

After the crash of 1929, two US acts -- Securities Act & Securities Exchange Act -- mandated financial statement disclosures & audit.

These developments effectively catalysed a raft of academic research into systematic approaches to #investing.

First, the authors argued for the value of rigour & hard work in investment analysis.

Second, they provided a framework to analyse earnings & dividends.

Their work effectively distinguished systematic investing from speculation.

His findings contradicted the rumours, which claimed that the company's subsidiaries had massive earnings

He also discussed the constant growth model (formalised by Gordon in 1956)

Many publishers rejected it for its heavy focus on math. @Harvard_Press published it only after he agreed to cover printing costs.

Meanwhile, this book may interest you @Invest_Books @PRSundar64 @abhymurarka @equitree @proxy_investor @RichifyMeClub @FI_InvestIndia @VenkateshJayar2 @Gautam__Baid @liberatedsoul3 @FreeFinCal @alphaideas @deepakshenoy @shyamsek @drvijaymalik