#GstTransformsBharat

#GstTransformsBharat

#GstTransformsBharat

#GstTransformsBharat

#GstTransformsBharat

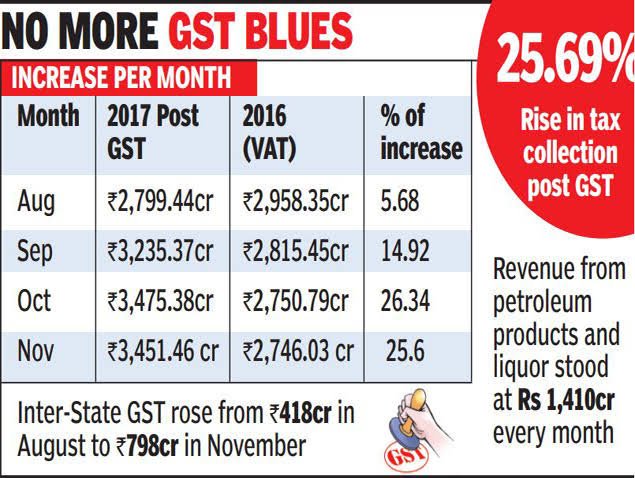

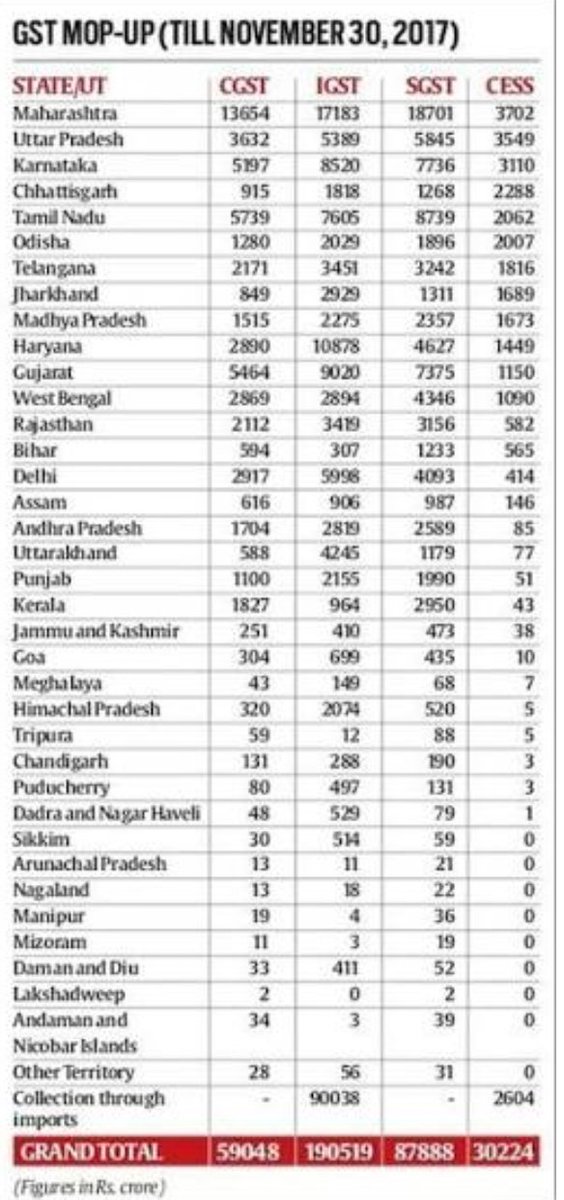

You can see there is a huge increase in Tax Collection under GST when Compared with the Tax Collection under VAT.

#GstTransformsBharat

Beauty of GST is in this chart you can see that the Average monthly Collection is 94k Crs.

#GstTransformsBharat

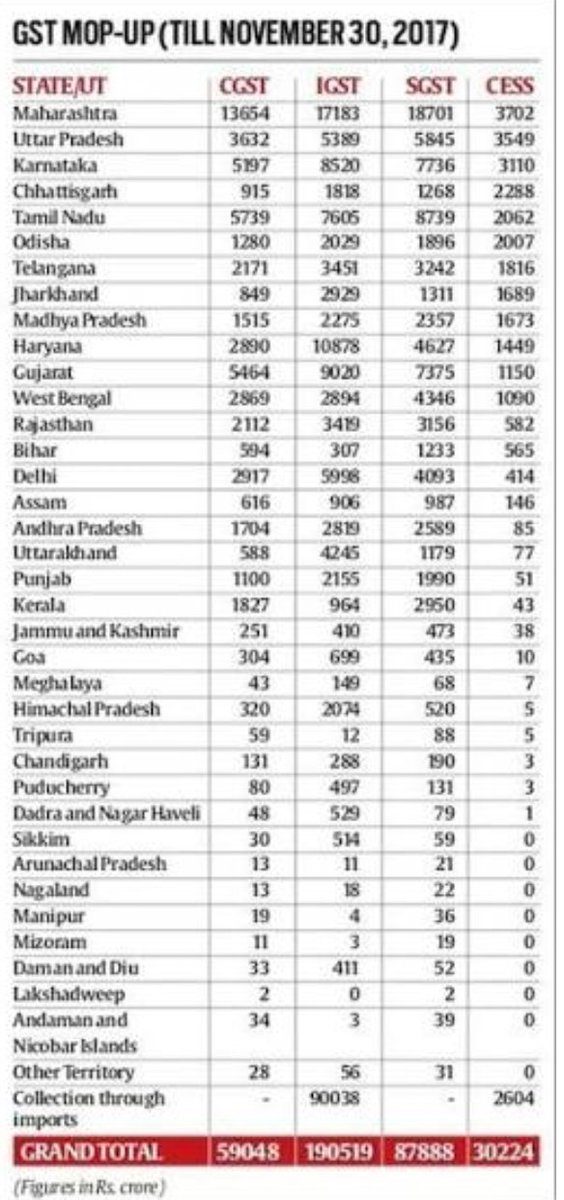

I see no reason why the State Government are crying GST is impacting their state revenue.

I request no politics when it comes to National Intrests

#GstTransformsBharat

You can see GST Compensation collection are well ahead the Positive margins

#GstTransformsBharat

Which was not the case with the previous tax legislations including current Income Tax act

For the first time #JK was financially intergrated with India

#GstTransformsBharat

In India's History it's for the first time this state has actually contributed to our revenue.

Otherwise it's always a One way Drain.

#GstTransformsBharat

#GstTransformsBharat

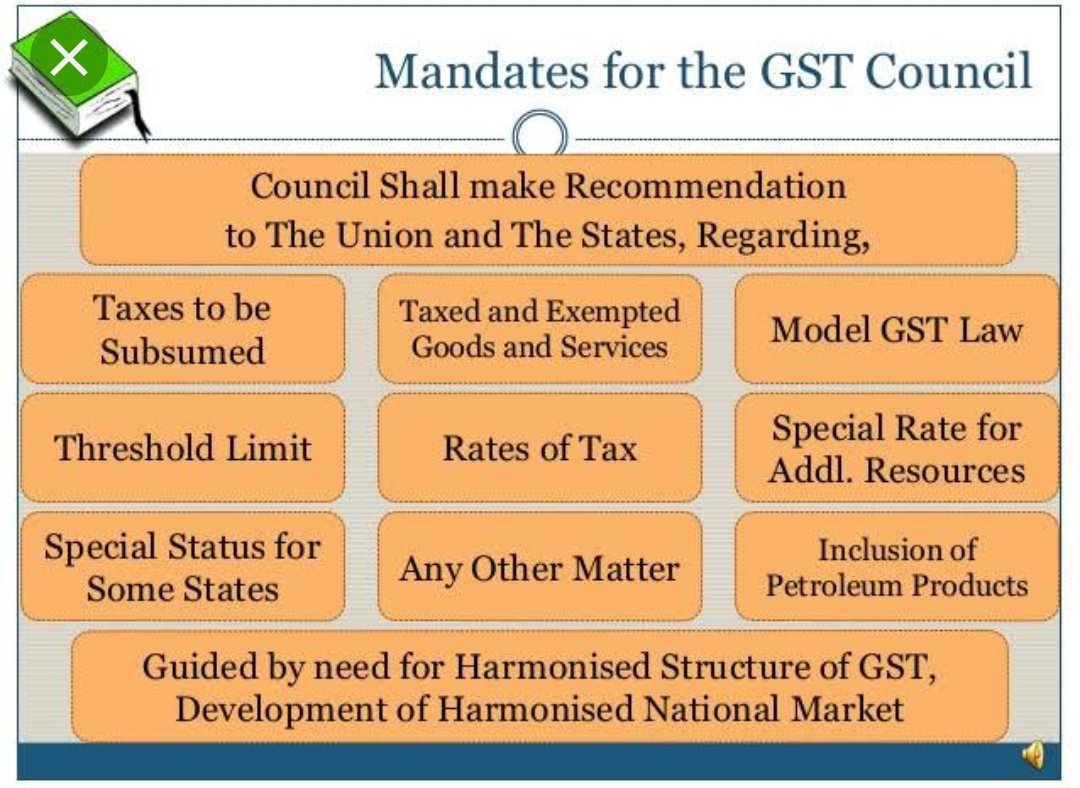

Remember, all the Rates and Taxes and Threshold limits are fixed by this council and not the Central Gov.

#GstTransformsBharat

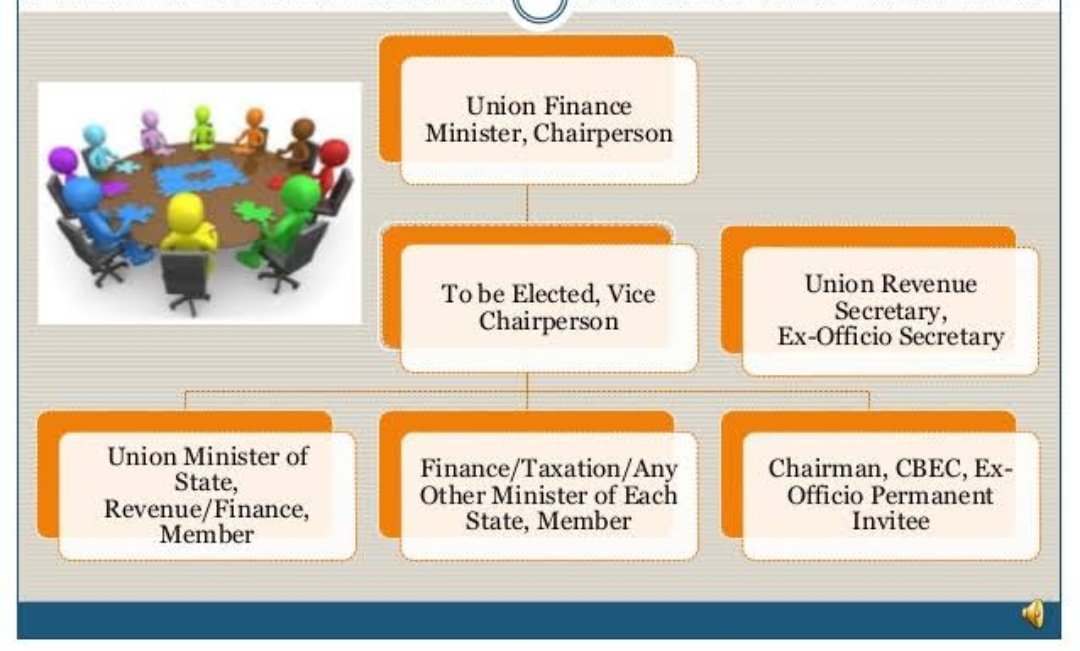

Union Finance Minister or his representative

One State Minister or his representative

This is how robust our GST Council is constituted.

#GstTransformsBharat

For every decision regarding Rates, Tax & Limits needs to be unanimously accepted by all the members in the GST Council.

#GstTransformsBharat

Expose these Hypocrites.

#GstTransformsBharat

In front of Media & Public criticise high Tax Slabs. But in the GST Council meeting Oppose it full might as their state revenue will be impacted

Link:

google.com/amp/s/www.indi…

#GstTransformsBharat

#GstTransformsBharat

#GstTransformsBharat

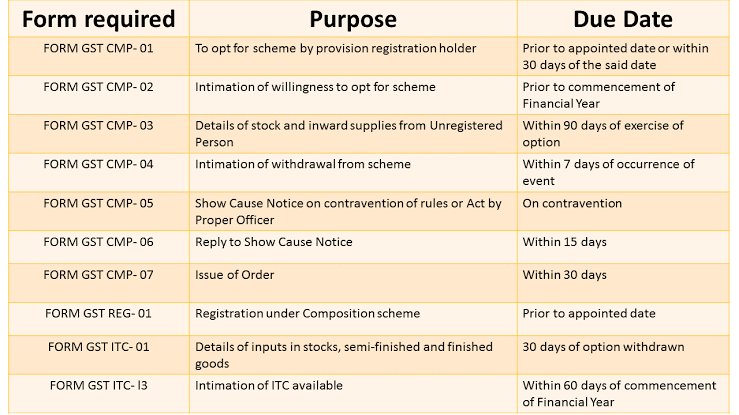

Now tell me will any sane business man who was earlier made to file multiple forms under various acts be worried if he has to file just 3 inter related forms once a month.

#GstTransformsBharat

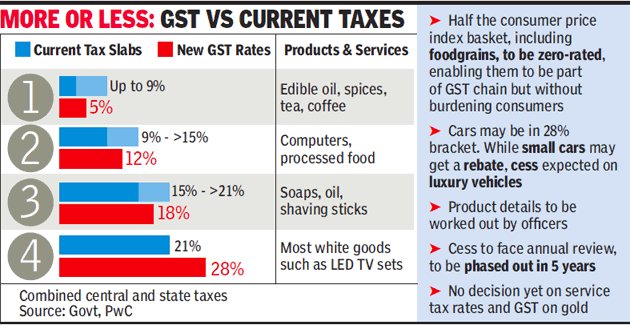

This is a review of rates with previous laws at the time of rolling out of GST Law. We know since then only rates have been reduced and never increased.

You can see pretty much everything less than the prev levys

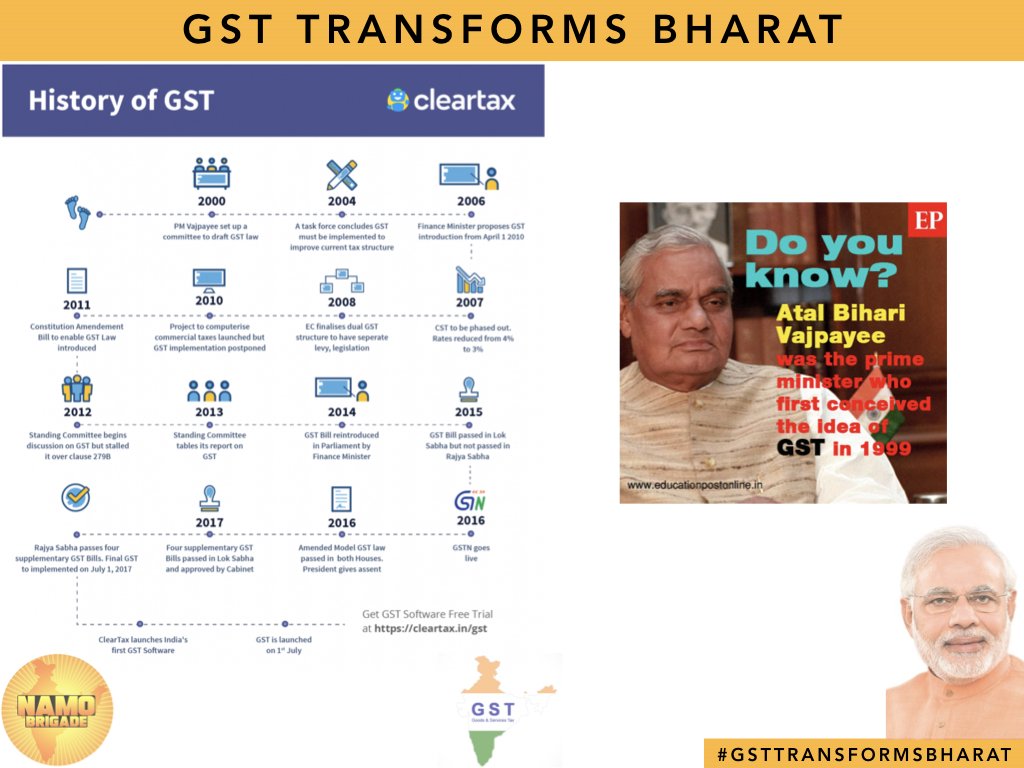

Such a good Structural Change had never moved between 2004 to 2014 why ?

#GstTransformsBharat