nytimes.com/2019/01/05/opi…

The End

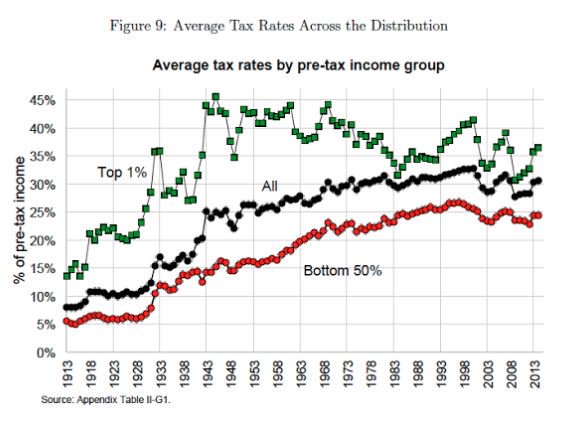

Regardless of the marginal tax rates, at no point in history in the United States, the average tax rate paid by the top 1% earners has exceeded 45%. Here's the data.

During the heady days of 80-90+% marginal tax rates, i.e. during 50's, 60's and 70's, the Top 1% actually paid a lower average tax rate on their earnings than they did during the 40's when marginal tax rates were lower. Chew on that!