I - IX

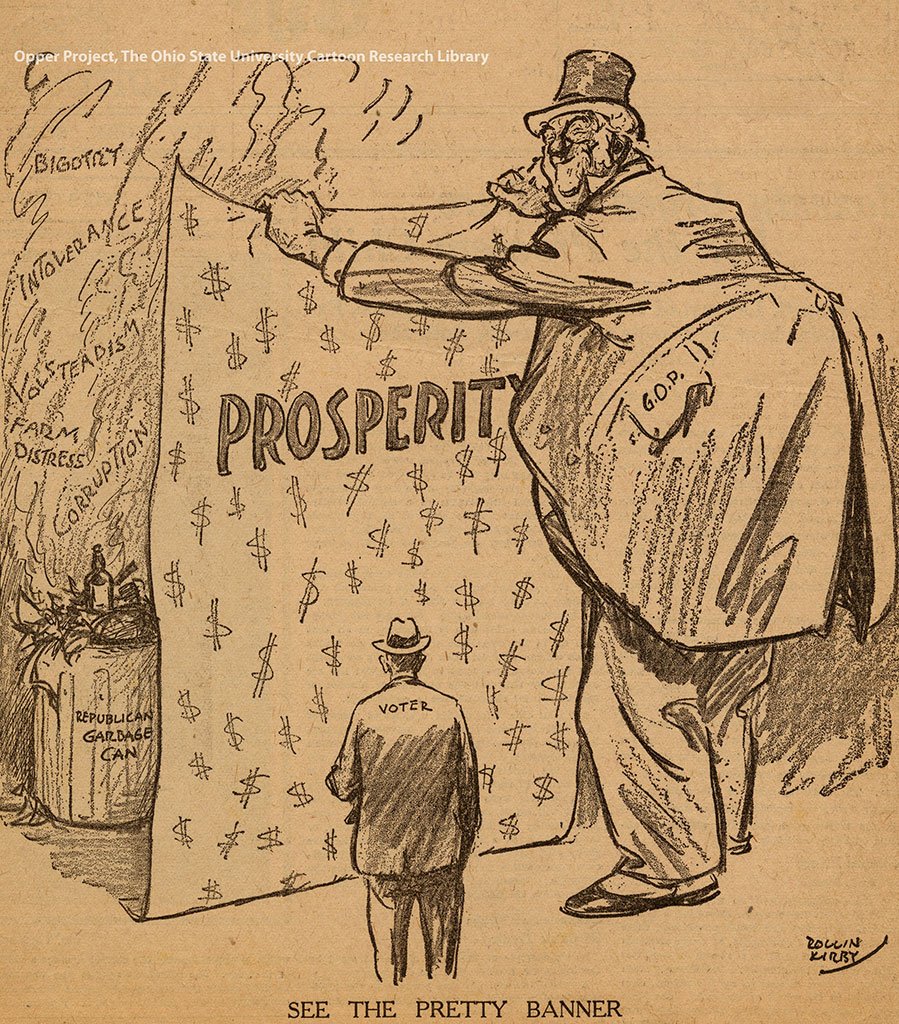

Some of them are familiar names which played a large part in the 2008 global financial crisis.

(Info below is from SEC 13-F filings put together by Nasdaq.com)

IX - IX

Holding shares worth $11 billion among 56 coal plant developers.

(Research by the German NGO Urgewald released at UN Climate Summit in Katowice on 12/5/2018)

4/11

urgewald.org/medien/new-res…

With total reserves amounting to 9.5 gigatonnes of CO2 emissions (or 30% of the total energy-related emissions from 2017).

5/11

foe.org/news/new-repor…

6/11

reuters.com/article/us-ger…

Affected at least 11 European countries and caused damage to state treasuries from lost tax revenue which could be as high as €55.2 billion.

8/11

dw.com/en/cum-ex-tax-…

The bank acted as a custodian bank in deals done by investigated individuals.

The settlement is related to raids conducted in Sept 2015.

9/11

bloomberg.com/news/articles/…

10/11

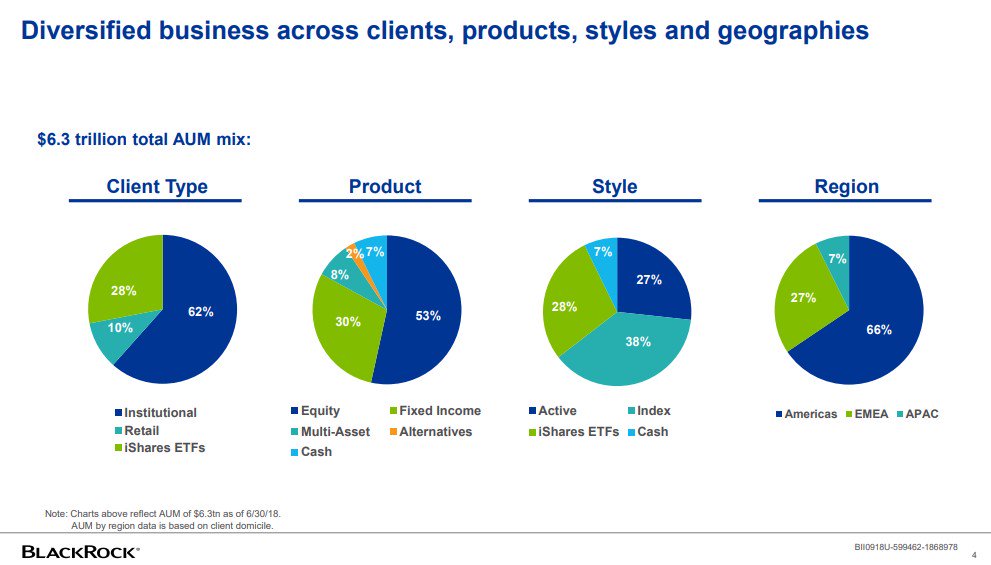

pionline.com/article/201704…

The SEC ordered BlackRock to pay $12 million in 2015 for another breach of fiduciary duty.

11/11

sec.gov/news/pressrele…

Cerberus is an American private equity firm specializing in “distressed investing.”

SEC filings from November 2018 show the firm manages assets of $50.3 billion.

7/11

cerberus.com

Including fraud, false claims, wage & workers safety violations, violations of the Foreign Corrupt Practices Act, and Controlled Substances Act violations.

8/11

violationtracker.goodjobsfirst.org/parent/cerberu…

A private military contractor the US has used in ever increasing roles since the late 1940’s.

Over 90% of Dyncorp’s revenue is from the Defense Dept & State Dept.

9/11

dyn-intl.com