I did the first State of Play on the 16th of Dec, 2018 (the bottom of the bear market).

(thread)

*ETH Locked in MakerDAO: 2,202,279 (~2.1% of ETHs total supply).

*Last major liquidation: CDP 4492 on the 23rd of Feb for 8800 ETH

*New CDPs opened over the last 7 days: 299

*Stability fee: 7.5%

*Current $DAI price: ~$0.97

3228 has been very busy - interacting with their CDP on a daily basis. After being liquidated to the tune of 55,000 ETH back in December, they've managed to work themselves back up to having 46,300 ETH locked in their CDP.

My favourite fact about this CDP? It was opened on December 20th 2018 - just 4 days after ETH bottomed at ~$83.

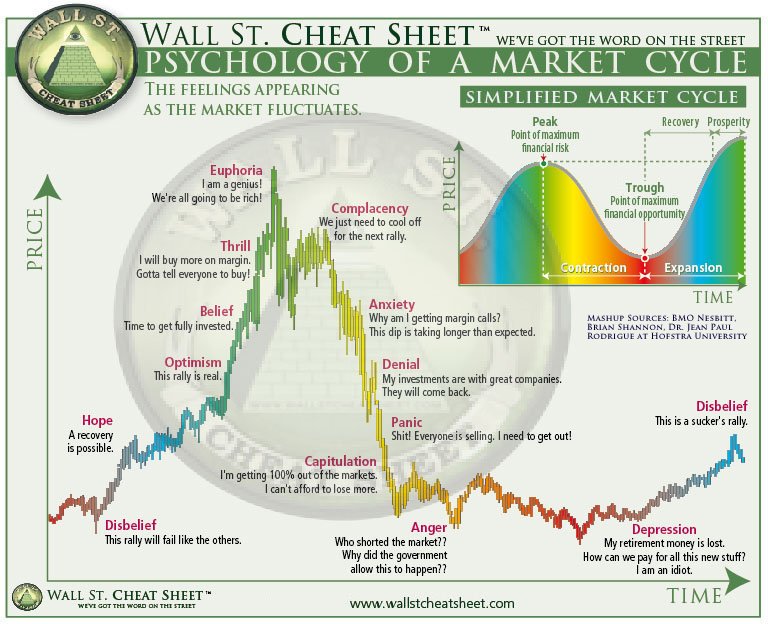

We've since learnt that the Maker system fairs very well during a bear market but, as the system currently stands, it suffers during a bull market.

-Lowered to 0.5% from 2.5% on the 22nd of Dec 2018

-Increased to 1% on 10th of Feb '19

-Increased to 1.5% on 24th of Feb '19

-Increased to 3.5% on 10th of March '19

-Increased to 7.5% on 24th of March '19

Image source: stablecoinindex.com by @myles_snider

The tweet below explains why this is happening.

I hope you have enjoyed the second MakerDAO 'State of Play'! If you have any questions, please @ or DM me :)

Sources for all data:

daiprice.info by @latetot

mkr.tools by @mikeraymcdonald