This is intended to educate people about crypto regulations.

You may think BEP2 tokens are similar to ERC20 tokens. But are they really?

➕ Virtual Tokens are exempt from many regulatory obligations.

➕ Virtual Financial Assets come with many regulatory obligations.

Are Binance Chain's BEP2 Tokens always at least classified as Virtual Financial Assets, and therefore subject to VFA regulations at minimum?

And what about US @SEC_News securities laws?

=== Virtual Financial Assets ===

What's a VFA?

A Virtual Financial Asset (or VFA) is a token of which its issuer (the team behind its ICO) must follow clear and strict regulatory guidelines.

➕ Hire a custodian for the safekeeping of their assets.

➕ Hire a compliance officer, VFA agent, and systems auditor.

➕ Register their whitepaper with the MFSA and file any whitepaper updates in the future.

➕ List specific details in a whitepaper, including information about the issuing company's shareholders.

From my perspective, a token can generally be classified as a Virtual Financial Asset if the issuer intends for it to be traded on exchanges, or it must hold some sort of monetary value in order to realize its utility.

What's a VT?

A Virtual Token (or VT) is a legal classification for a DLT asset that is *exempt from VFA regulations*.

From my perspective, a VT classification generally applies to "pure utility tokens".

➕ Tokens that exist to power decentralized networks or smart contract applications (dApps) that do not need to be traded, nor do they need to hold monetary value in order to realize their intended utility.

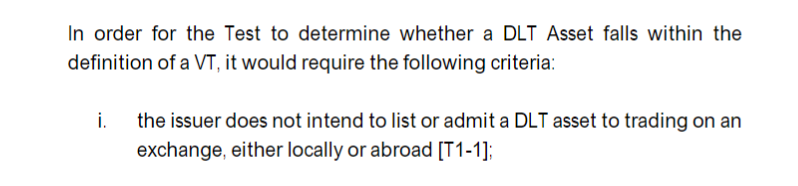

Page 10 of the MFSA's Virtual Financial Instruments Test Guidebook mentions that a token can only be classified as a Virtual Token, if (among other restrictions):

According to US Securities Laws, tokens are considered securities if they are most likely to be issued with the intent to allow for speculation.