And of course that means more buyers to risk-free assets (@USTreasury & bund etc) & 10yr now 2.12% & that is 38bps below Fed Fund Upper of 2.5% & the last time we were here was summer of 2006 & 2007 🤢🤮

Semiconductor -30.5%🤮

Display -13.4%

Computers -27.2%

Phones -41.3%

Petrochemical -16.2%

Steel -7.6%

Shipping +44.5%👏🏻

Autos +13.6%

General machinery +5%

Question: Too bearish or not enough🧐

And of course if he agrees, would be very helpful b/c the USD lubricates global finance & econ. Thread here 👇🏻

Be there for be square. Okay, too early? Fair play 🤗

Job advertisements -8.4% mom according to ANZ 😬

🇦🇺🦘🌏✂️✂️✂️

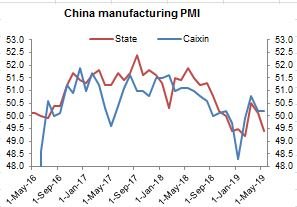

Look at the divergence b/n state & Caixin 👇🏻👇🏻

Q: Is Caixin a leading indicator of SHCOMP?