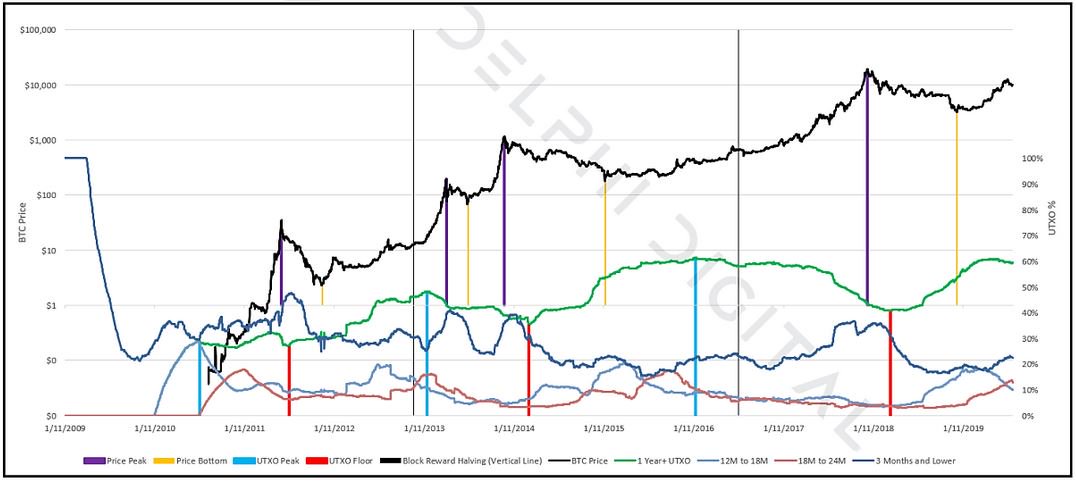

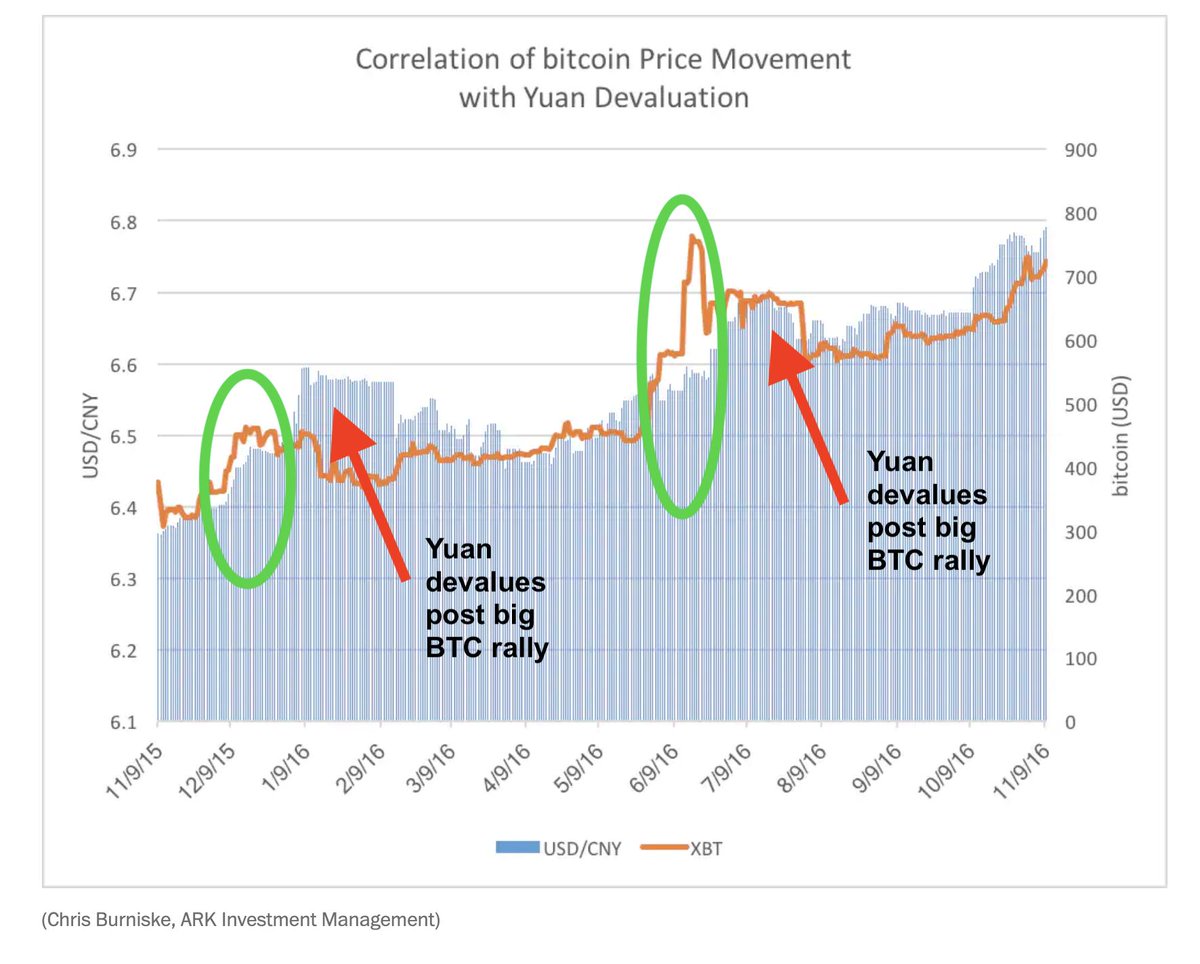

As a foreshadowing, below is a graph showing the correlation between $BTC’s price and China's yuan ($CNY) in 2016.

Article: washingtonpost.com/news/wonk/wp/2…

Sometimes a #bitcoin rally preceded a CNY devaluation, as shown in green ovals below (presumably Chinese insiders stockpiling BTC before PBOC's action)

Other times bitcoin would show sustained strength post yuan weakness

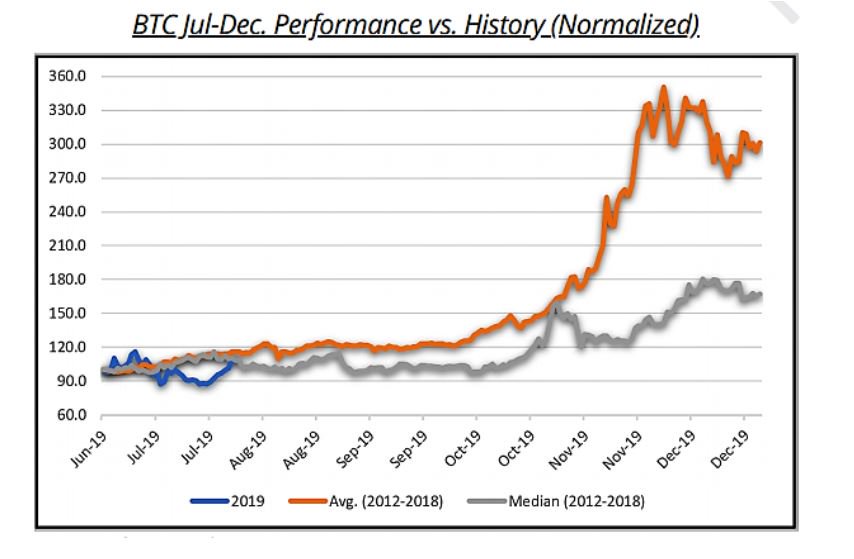

We were oversold then, we rebounded, but we rebounded more than the fundamentals would justify imo.

In such a scare, people sell their most experimental assets, such as #bitcoin and other #cryptoassets (exacerbated by endogenous doubt).

And so risk-appetite has increased, including for $BTC.

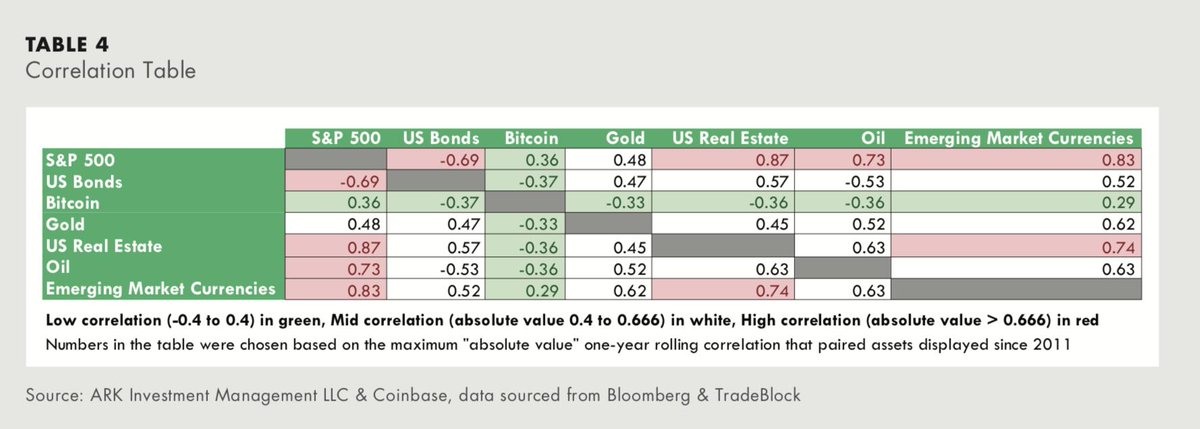

"Remarkably, the maximum correlation, positive or negative, that #bitcoin exhibited with each of the other assets is the minimum correlation that any of the other paired assets displayed with each other."

My intuition is over the next 5-10 years $BTC will continue to swing between being risk-on & risk-off, as with 2018 and 2019.