So I thought I'd write a thread so I can answer everyone at once.

First of all, nothing has been definitively proven one way or the other yet on either gold or the dollar.

Second of all, if you think being wrong is something I'm not capable of handling, I assure you I am.

I have been wrong many times in my life/career. And I will undoubtedly be wrong many times going forward. Nobody gets it right all the time. Getting things wrong from time to time is part of this job. To think you are not going to get things wrong...is hubris, pride, etc

1st part of trick is making a lot of money when you get things right. 2nd part of trick is not to lose a lot of money when you get things wrong. If you can do that you may last in this business. Do not, and you will likely have a short lived time in this business.

A few examples. SPY was extremely oversold in December so bot calls. Got it right and made a lot of money in Jan & Feb. In May, thought things were looking frothy & bot puts. They were up in May but ended up giving it back June. Got it wrong but the loss was minimal.

Lets now talk asymmetry of $ trade. US has higher yields than ROW & many places have neg rates. Currency vol is near its lows. This means that for less than 1% of portfolio, I can buy over 100% exposure of my portfolio via options on the $ strengthening over next 2 yrs.

If I'm right on dollar strengthening I have huge upside. If I'm wrong I lose less than 1%. I'll take that asymmetry every day. And this is just one trade idea.

So now lets add Gold to the conversation. In 2016, I put out a presentation called "Step into Liquid" which was where I first laid out my strong $ position. Here I said gold would not break out yet even thought it was testing the $1350 range.

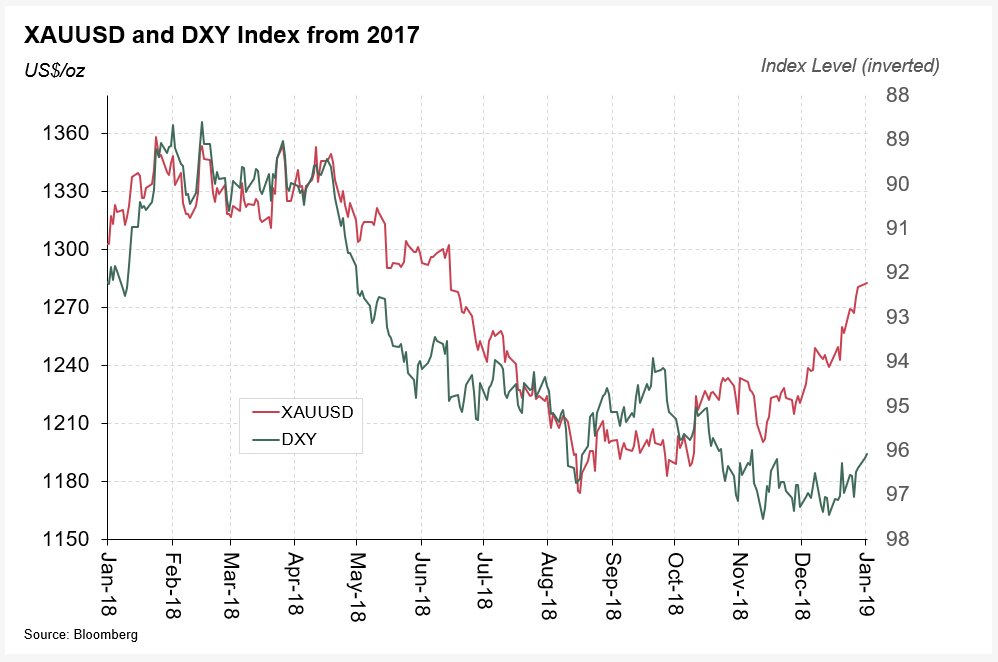

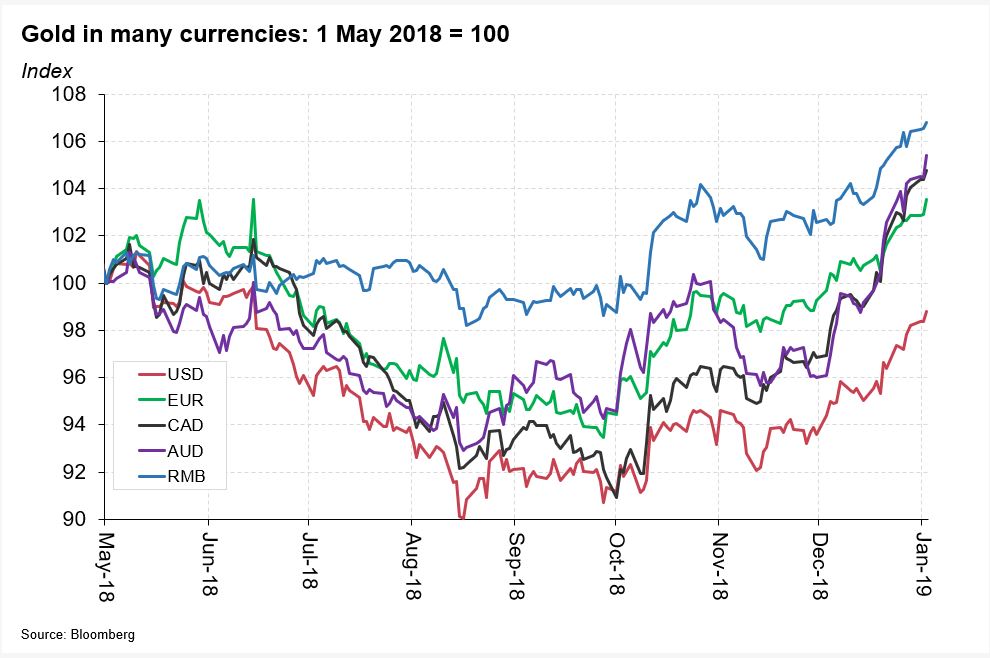

This turned out to be right. I also said the dollar would break out first. This also turned out to be right as the dollar rallied for the next 6 months. However, it then backed off. Since then both dollar and gold have been in the 1200-1350 and 90-103 range respectively.

I also said that in in 3 yrs at the 2019 G20 meeting would probably be about the the CBs would throw in the towel. So far that seems like it could be correct! But now that we are here...is dollar move over and gold ready to break out?

Well...3 years later, we are basically at the same levels in both gold & dollar as the summer of 2016. Has my dollar view paid off? No. Has my dollar view hurt me? No

Wait...I STILL don't think its going to pay off yet? Despite what the Fed said yesterday and despite the fact it is "clearly breaking out now"?

No...I don't think Gold is going to definitively break out yet.

Why? Several reasons.

a) I still don't think dollar move is over

b) The breakout is less than 24 hours old and nothing has been proven yet - need to see weekly, monthly, quarterly close

c) There are a number of warning signals flashing red

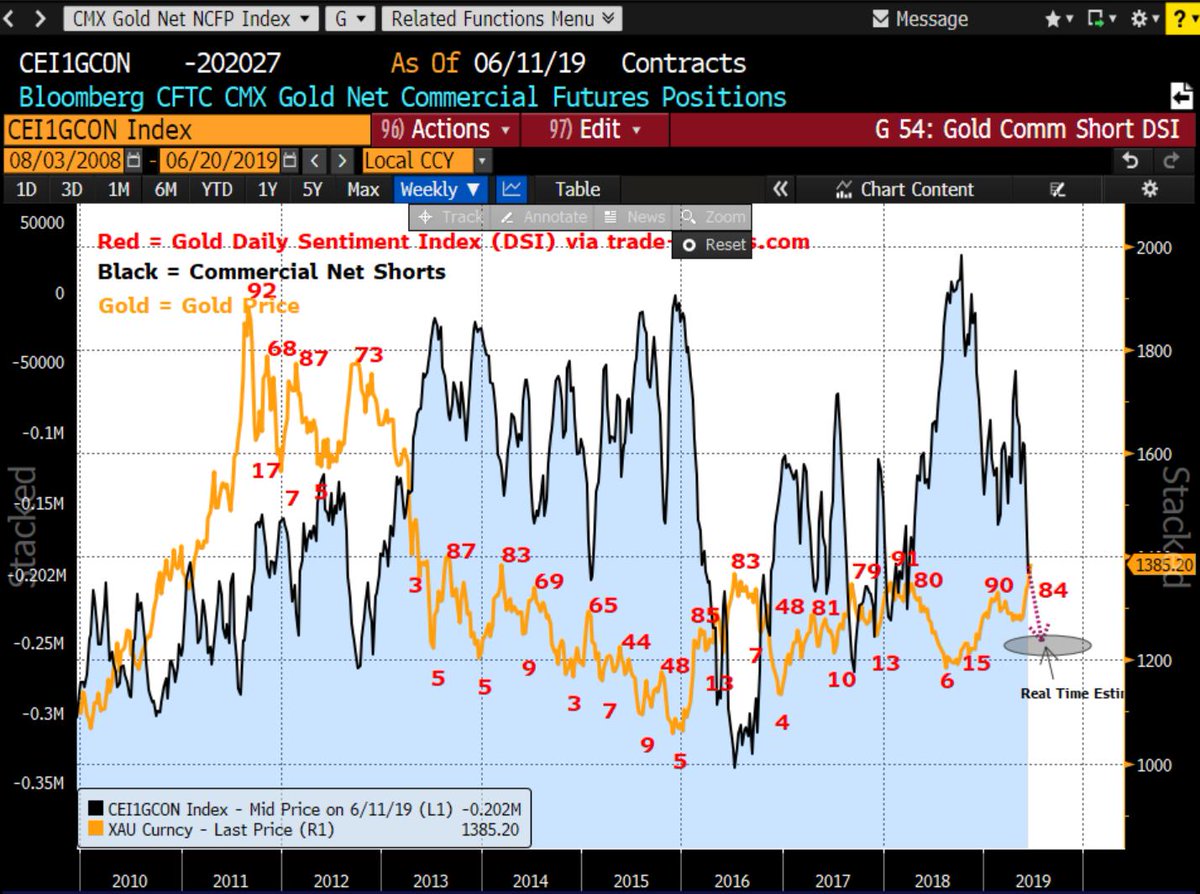

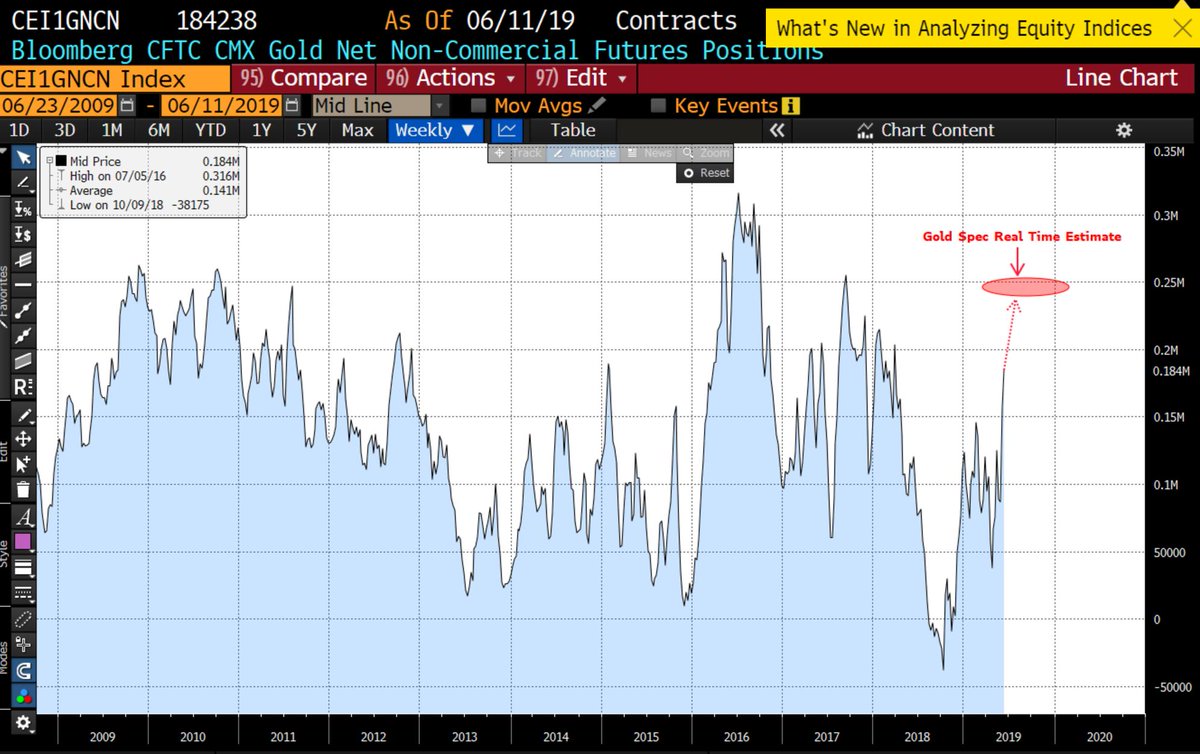

Warning signs: RSI is at highest level since 2011. After today DSI will be in 90s, near all time highs. After last 24 hours Commercial Shorts will be well above 250k, maybe close to 300k (back near all time highs). And Specs have come flooding back.

#IsItDifferentThisTime?

I just added puts. Why? Bc its an easy trade. Why? Bc if I'm right I can make some quick/easy money. And if I'm wrong, i will know it very soon. Thats a great trade set up. Doesn't mean it will work. Just means its a great set up.

Best of luck.