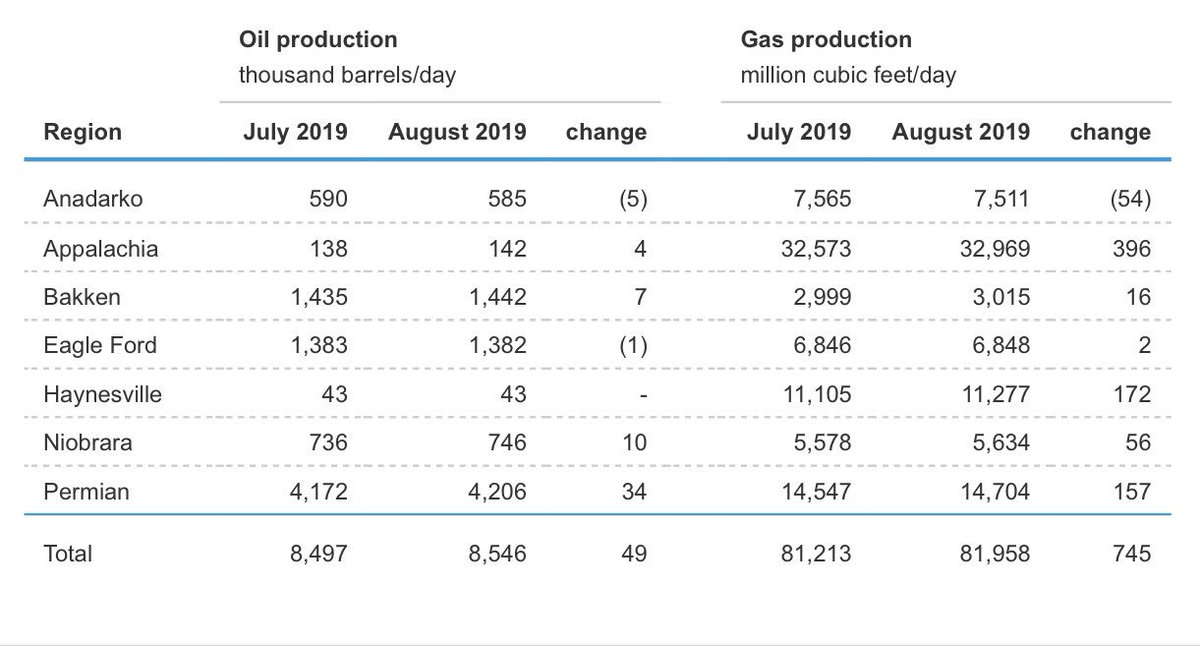

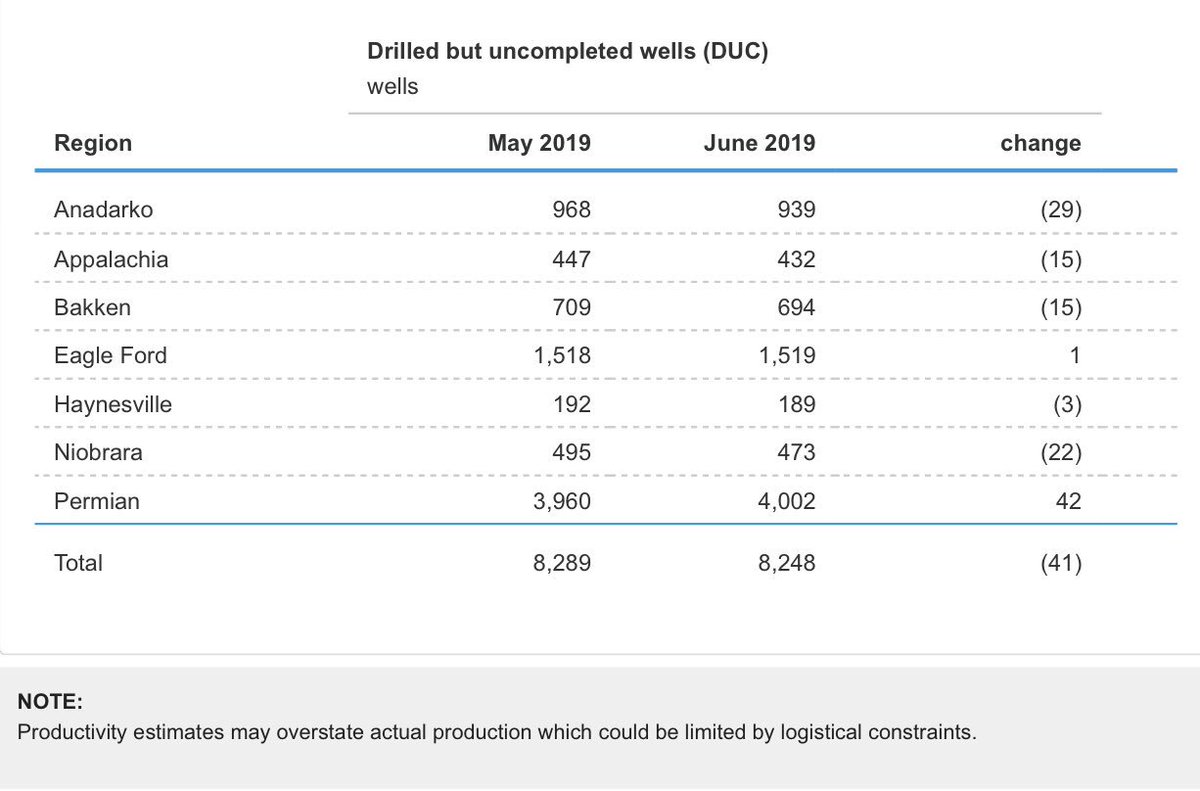

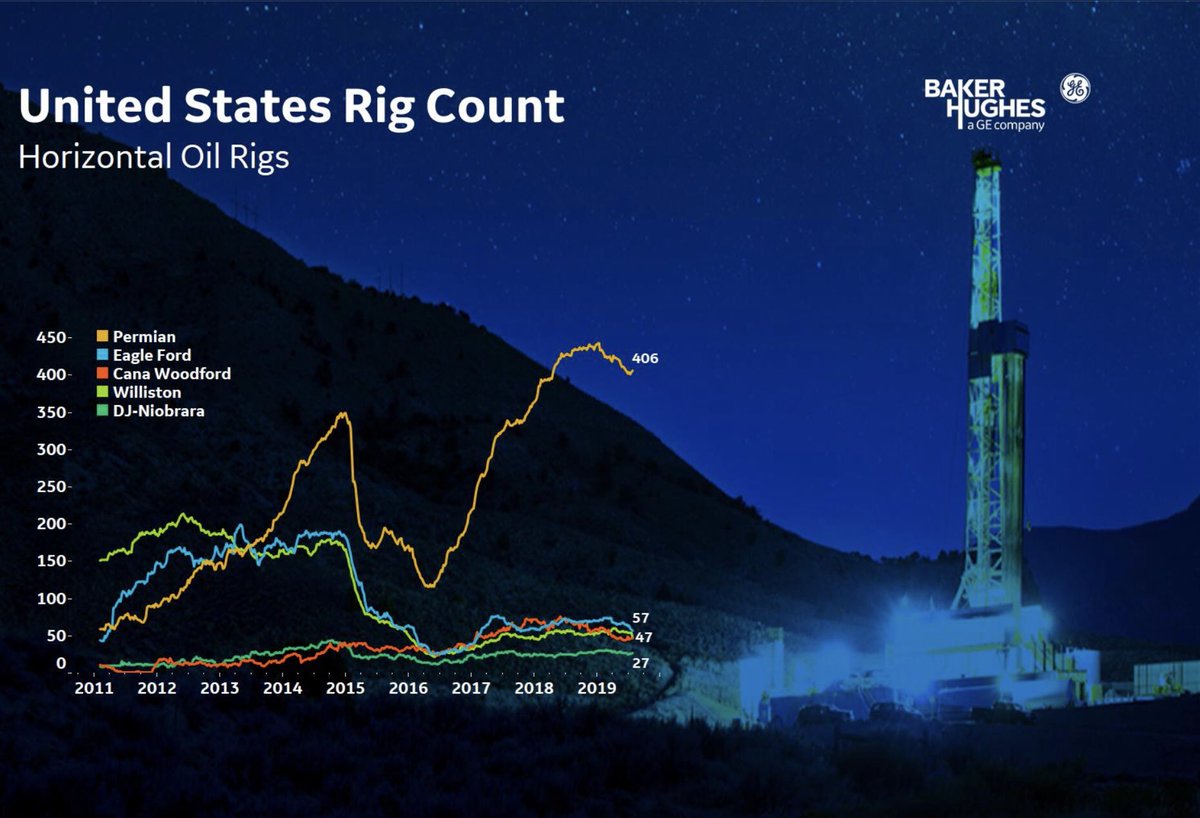

Common view suggests that, even without higher rig counts, lower 48 production of 8.5 mb/d can grow this year by running down drilled but uncompleted wells - or DUCs - inventories of more than 8,000 wells.

#oott

DUCs are the result of modern division of labour. A baseload inventory of DUCs therefore will always be present due to the scheduling of proppants, water, frac crews and other requirements.

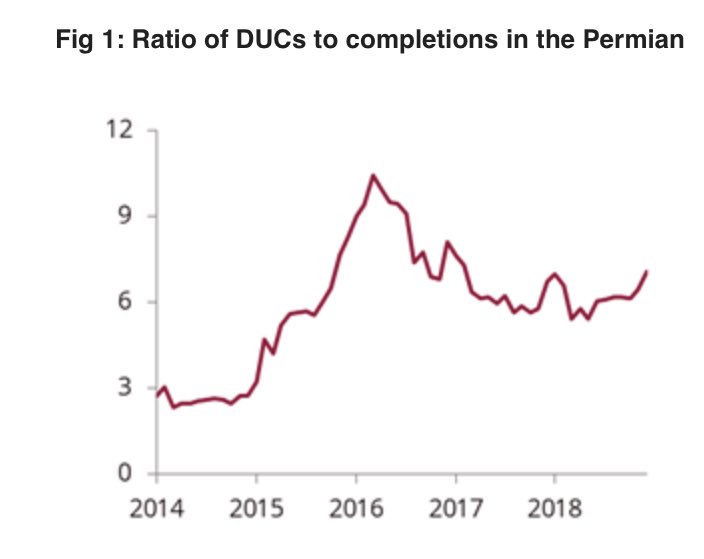

Recently, the ratio of DUC wells to completions has been rising. Producers build DUC inventories in low price environments—such as the weak Midland price environment of H2 18 related to pipeline constraints—and complete them at more attractive prices later. #oott

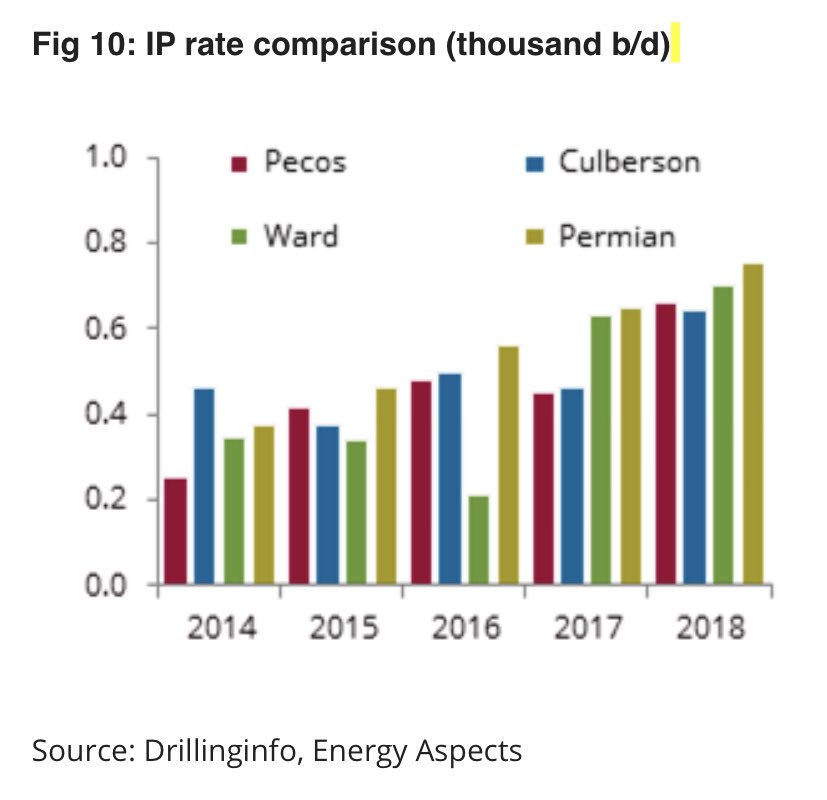

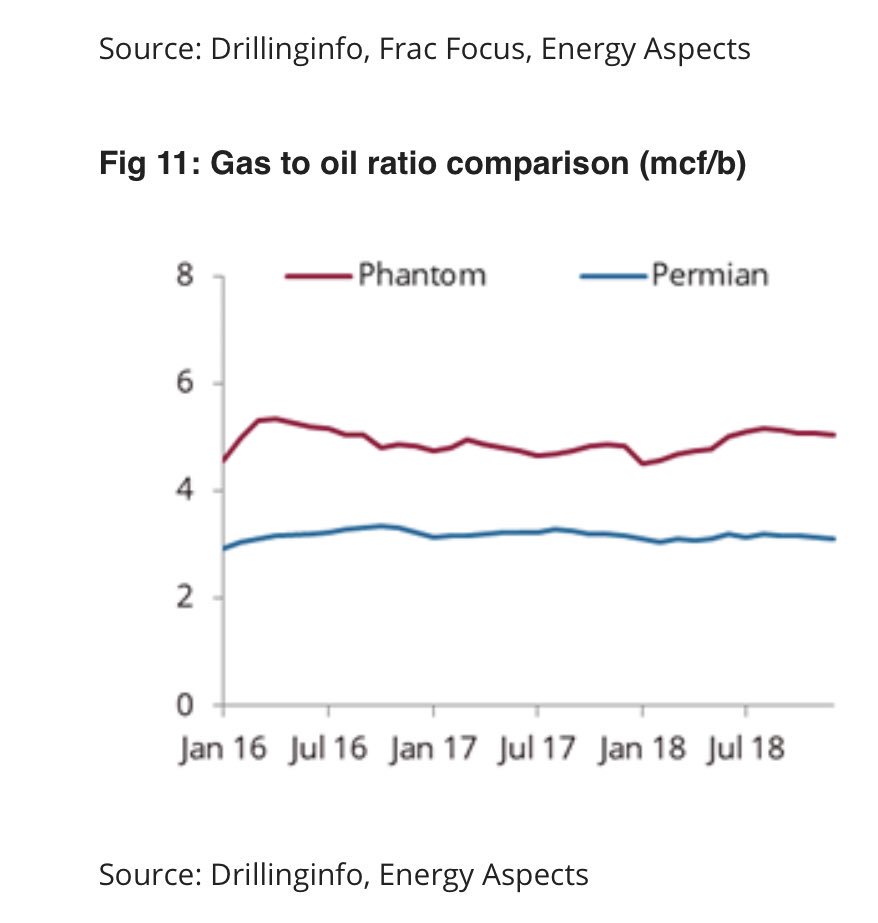

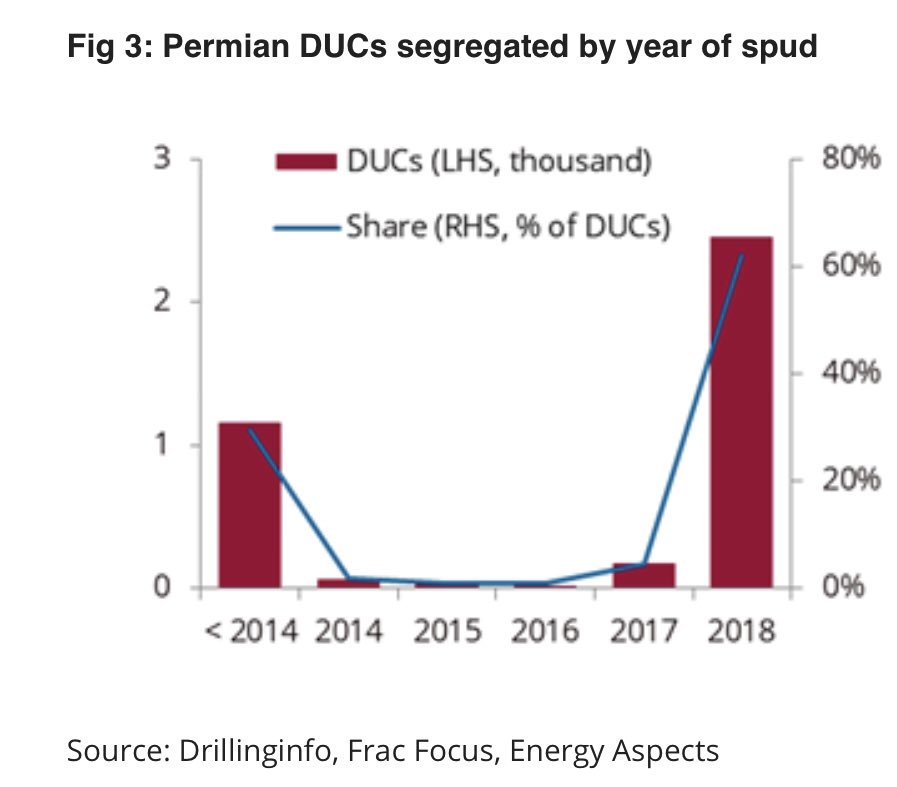

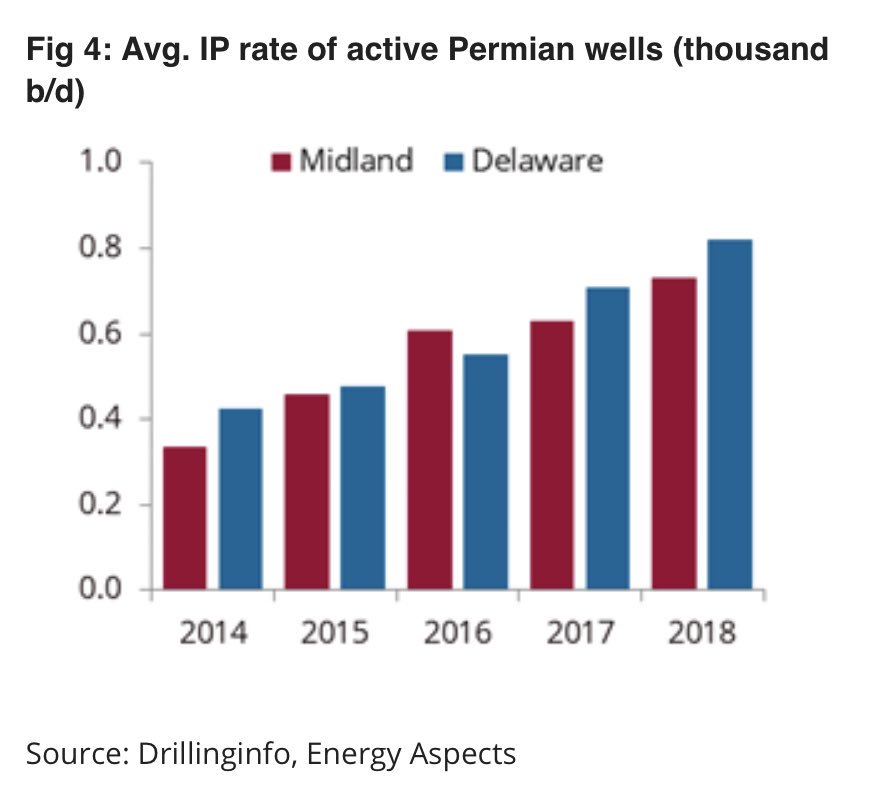

Within the #Permian DUC count, >30% of DUCs are >five years old, and due to integrity or other issues, may never be completed. Moreover, lower IP rates would diminish their impact, while shorter laterals and shallower verticals also dampen their prospects.

DUC counts may be overstated in estimates because of how they are defined. EIA defines DUC as well tnot completed for 20 days after the start of drilling, but different basins have different time spans bw drilling & completion that may reduce DUC count.

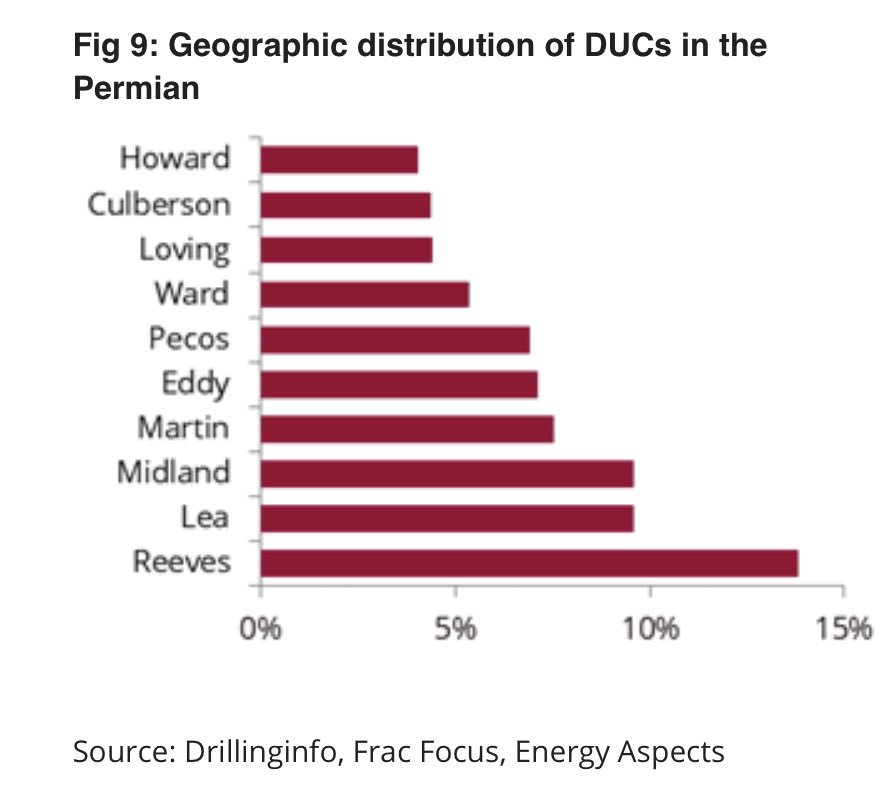

The potential of DUC well is affected by both its location and which company holds it. Approximately 73% of DUCs in the Permian are located in 10 counties: Reeves, Lea, Midland, Martin, Eddy, Pecos, Ward, Loving, Culberson, and Howard.

#oott