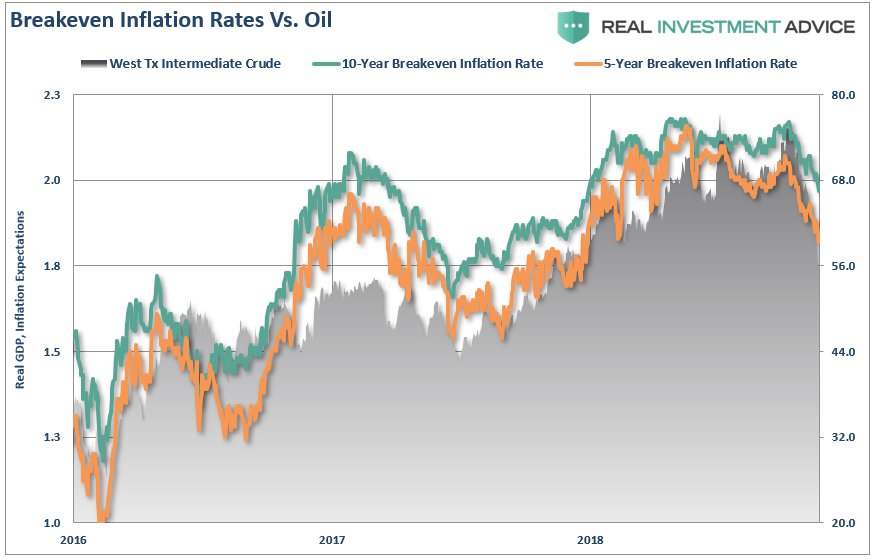

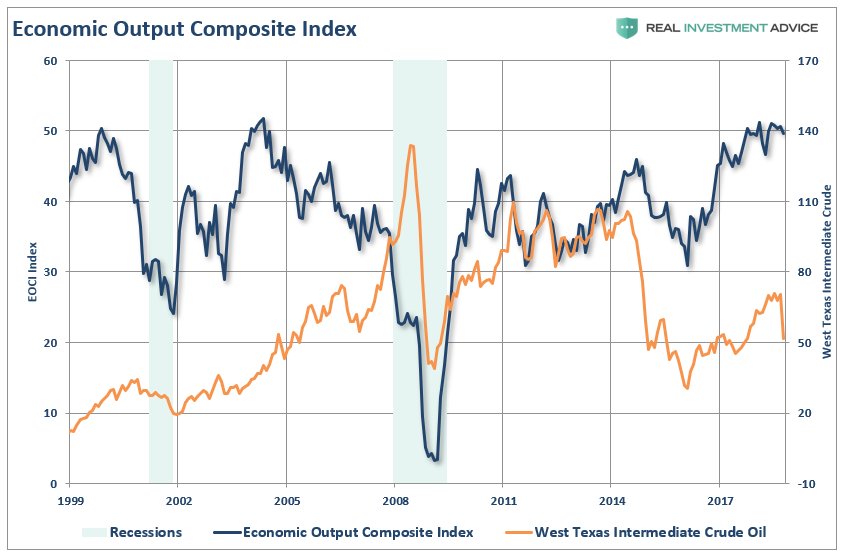

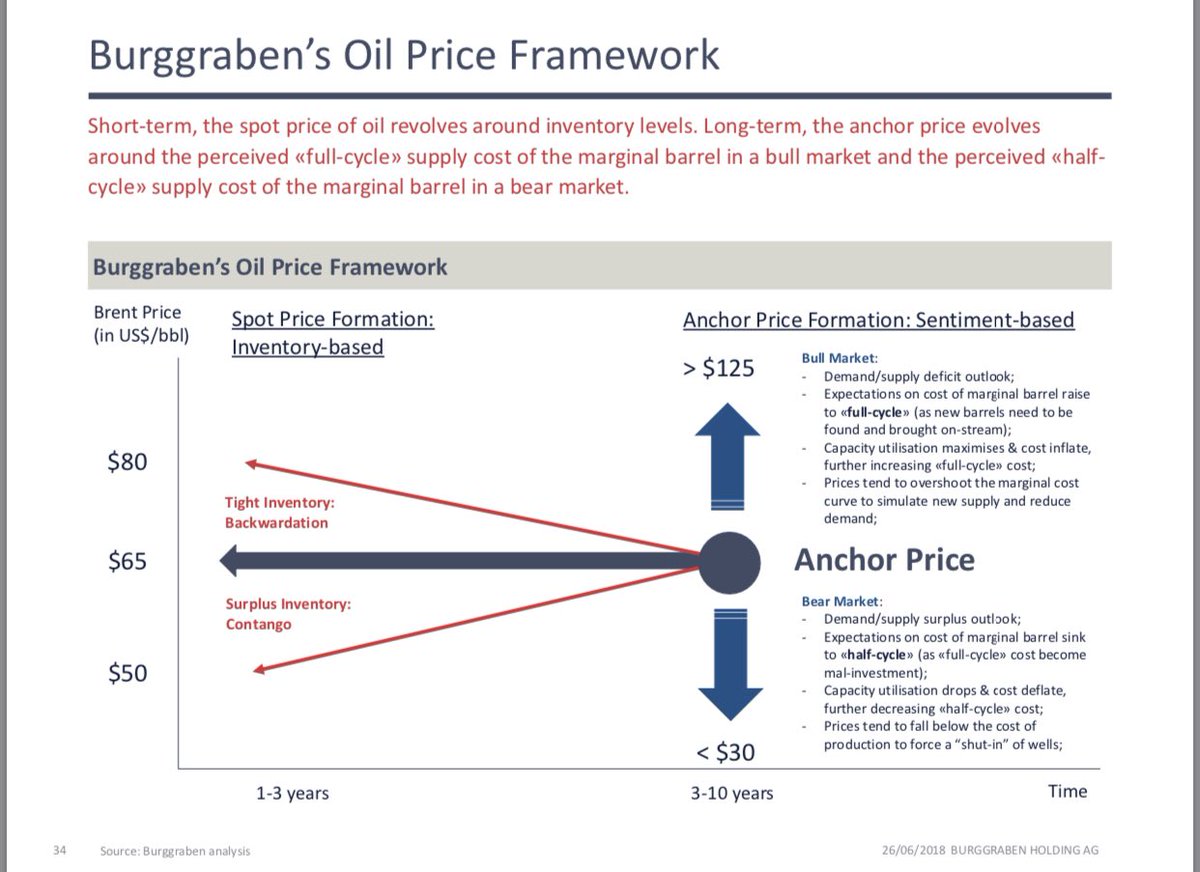

Short term, spot prices #trade around inventory levels.

However, it is hard for #Brent and oil equities to go up on declining inventories while demand/macro weakens (macro outlook uncertain). #OOTT #WTI @HFI_Research

@anasalhajji @chigrl @ericnuttall

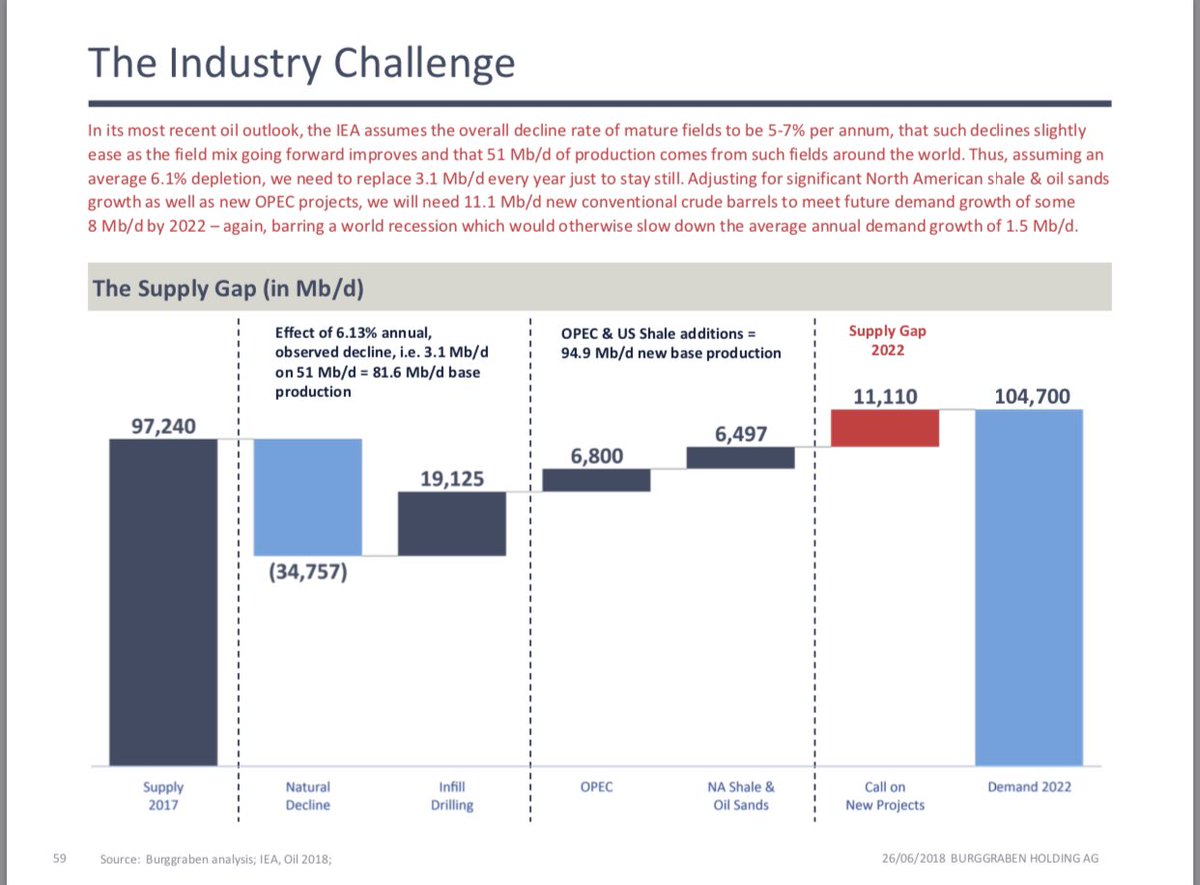

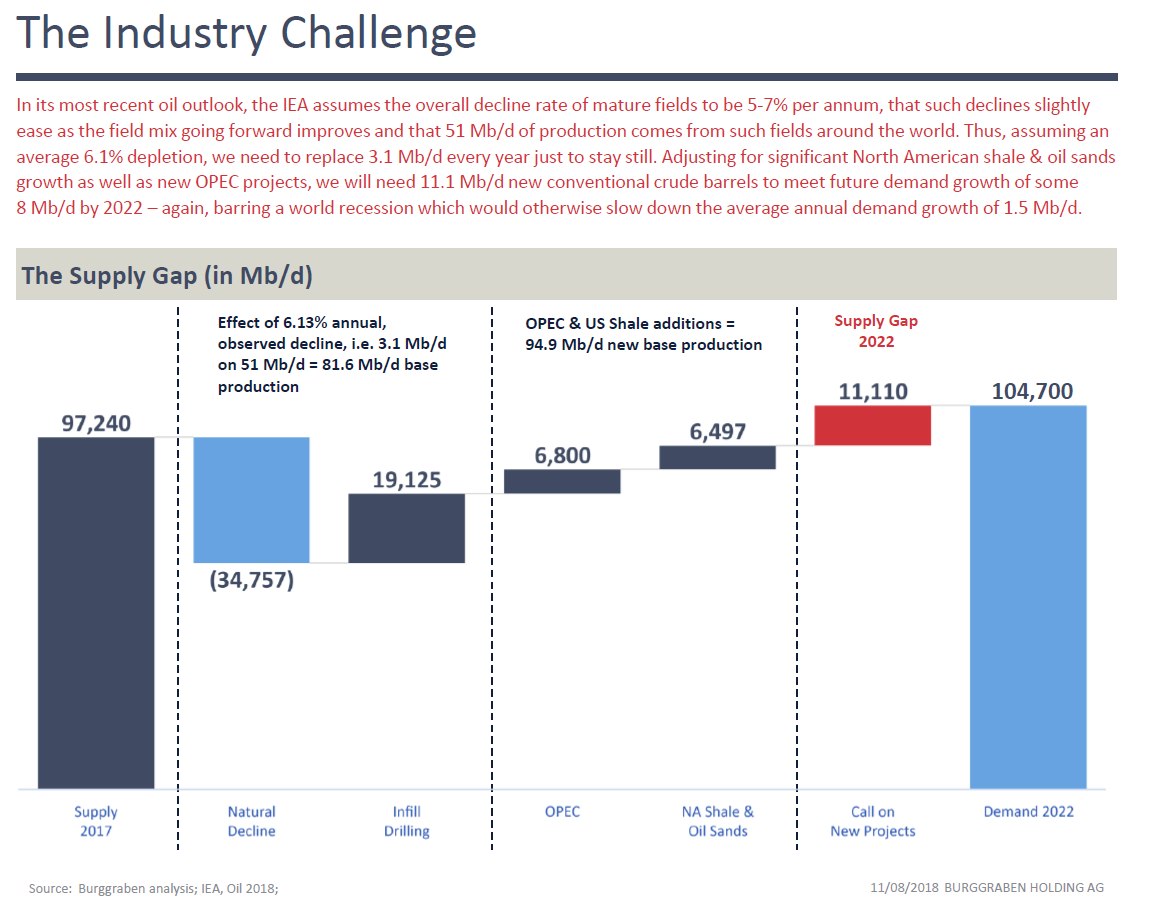

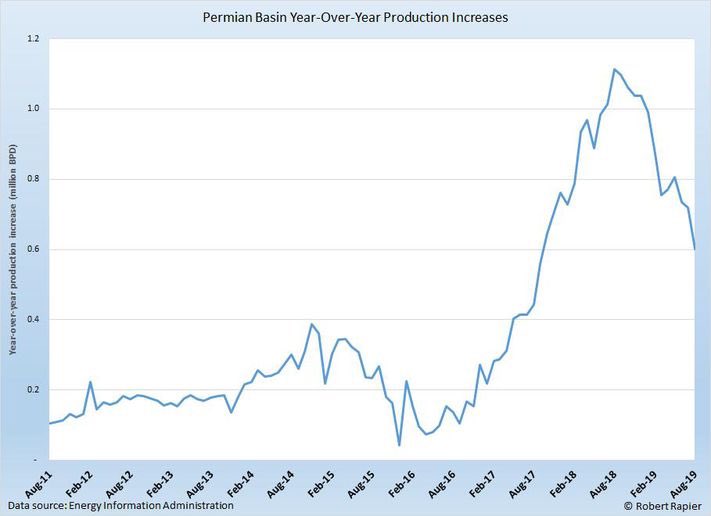

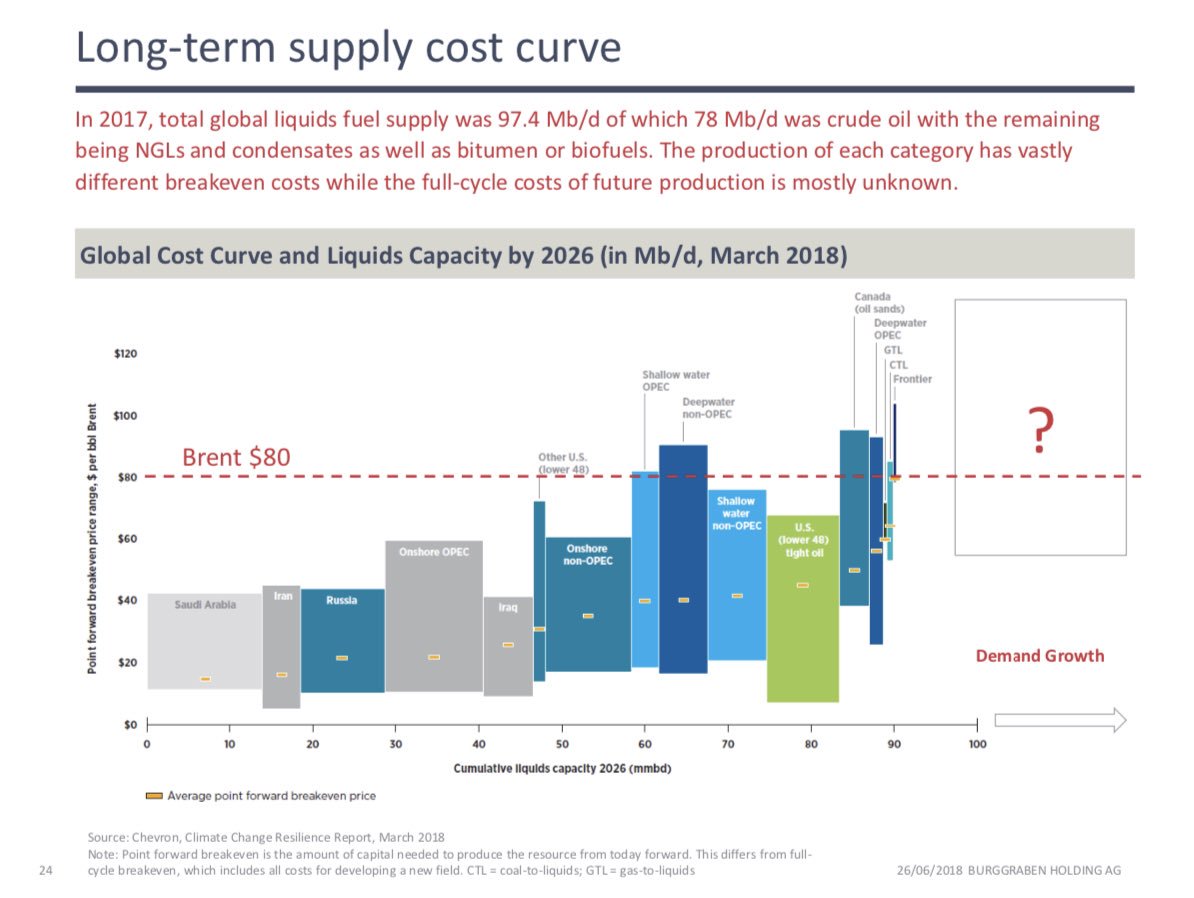

>100 mb/d...!

#OilPrice #Crude_Quality_Matters

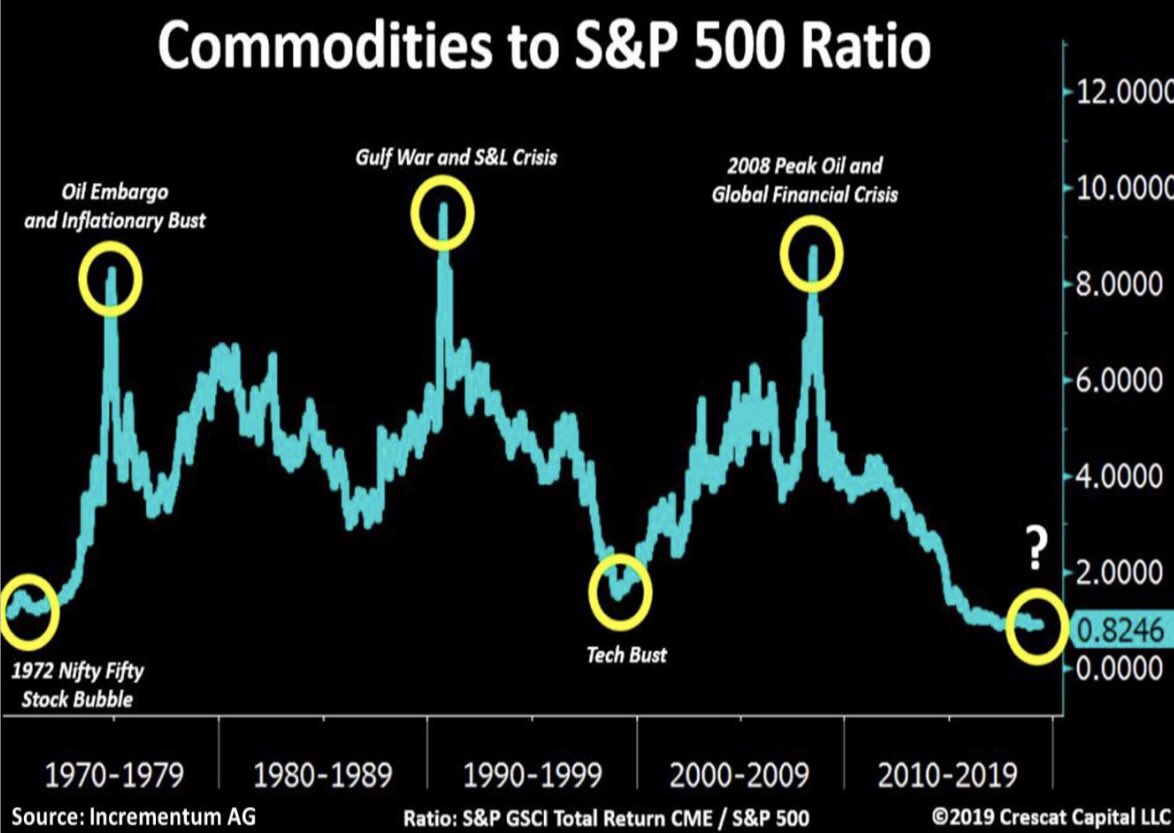

@Bob_McNally calls this a boom bust market in his excellent book Crude Volatility. @TSXcapital @Go_Rozen