Several reasons why I liked (key word, notice past tense) a sub sector of private credit — real estate debt — for awhile now.

While there is $11 trillion of wealth in IRAs in just the US alone, only 4% is invested outside of Wall Street. I believe many are missing out.

This gives everyday investors an opportunity to diversify their portfolios & increase risk adjusted returns.

Your capital is protected with a “real” asset-backing.

Some senior debt yields as high as 10% and some mezzanine debt can yield as high as 25% or even more (per annum).

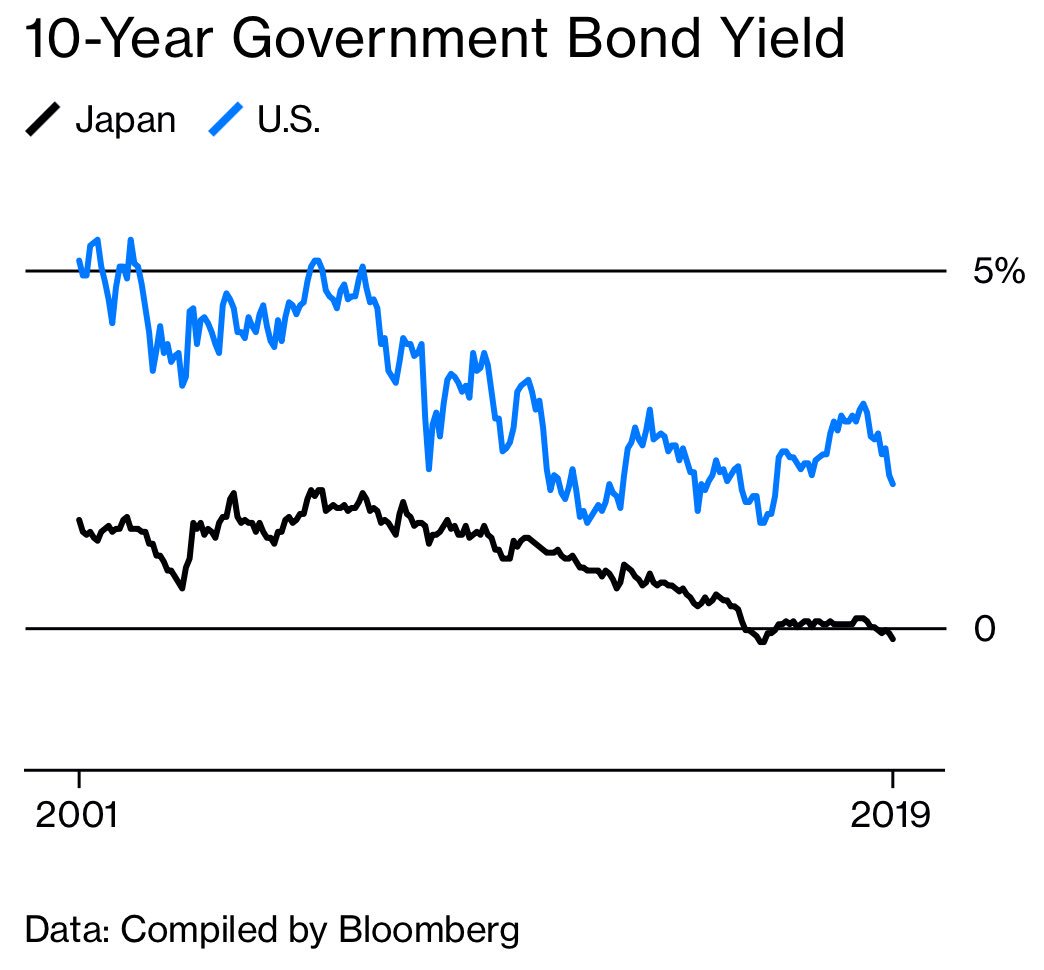

Everything is being bought in a hurry with a flood of hot money. Investors are starving for yield.

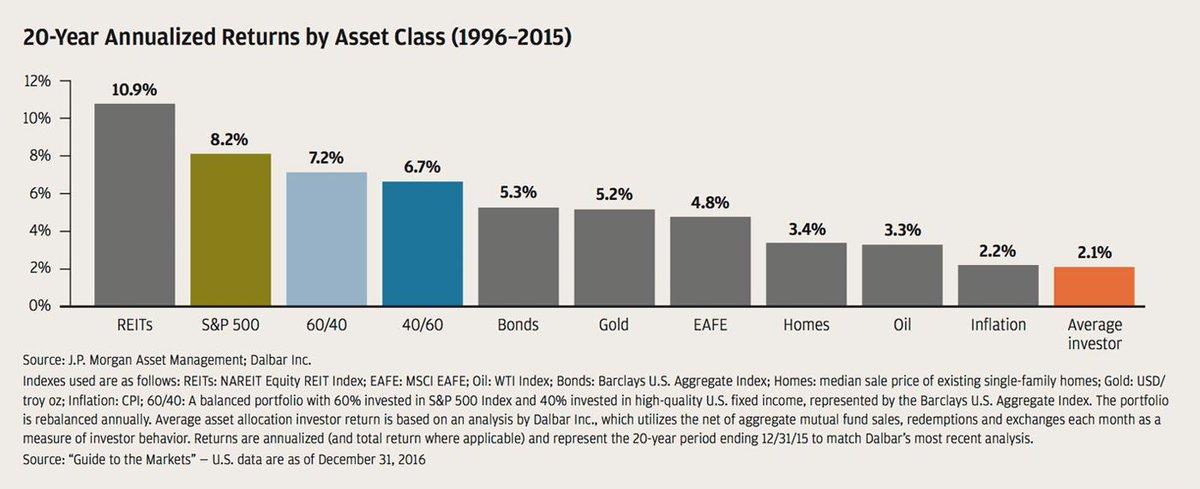

While every Tom, Dick & Harry is obsessed with FANGs and SaaS stocks, this asset class has, in some cases...

But I’m noticing a huge flood of money into this asset class due to mess central bankers have created in the public fixed income.

You can’t blame them. They have a mandate to achieve a certain hurdle.