You also have the difficultly of protecting capital & applying risk management. Other difficulties, too.

But one worth talking...

Be very afraid of people who are super sure of themselves. Their track record speaks louder then their convictions & narratives...

They will tell you great stories on how they are betting on deflation, on hyper inflation, on banking collapses, on currency pegs breaking, on oil spikes & market crashes.

They are great story tellers.

You must be strong & wise to resist their influence & stay the course, because real money is on the line & it’s easy to lose it on some narrative...

Why are the old, tested, proven ways so unpopular & what is it with human being’s need to speculate, gamble, predict & entertain the mind that is so desperate for these addications like a gambler on a riverboat?

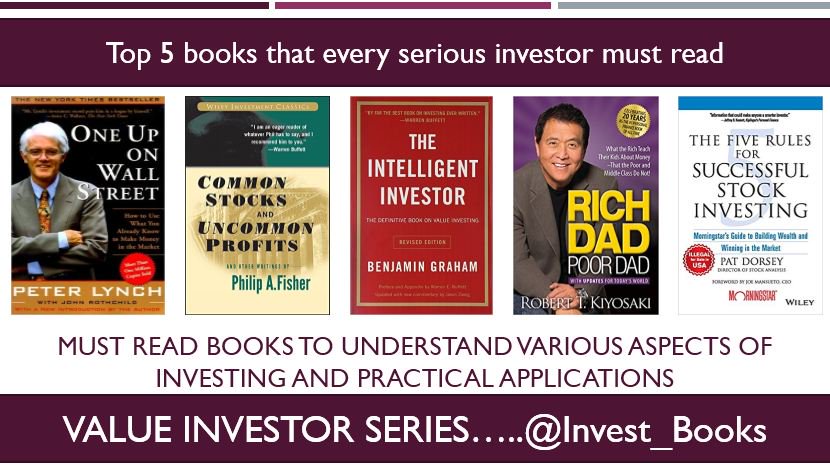

Ye, these greats have given you the “secrets” and told everyone out there the whole blue print to riches...

The old friend of the successful.

Mr Discipline never visits the masses who are mesmerised by the promise of the next great macro bet, some narrative a celebrity hedge fund manger did in a recent interview you saw, which is a wild trade, asymmetrical payout...

They are in it for the ego trip, for the intellectual stimulus & the addiction + need to always be doing something.

Always be in the next trade, next Big Short...

They don’t care about being extremely profitable or financially independent.

They just tell themselves those lies.

Good luck to you Macro Guru.

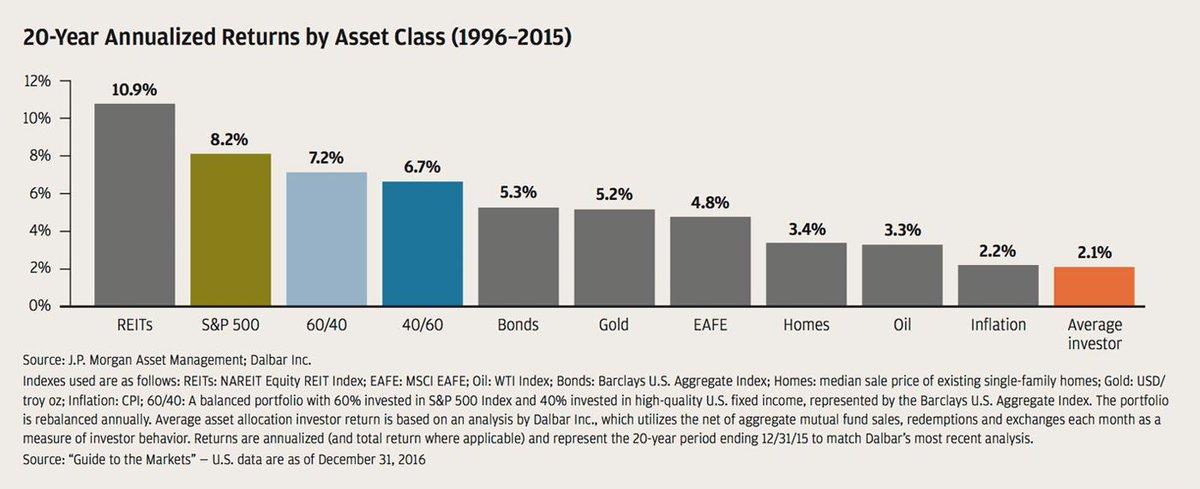

I’ll stick to simple ways of investing my hard saved money into stocks (when cheap) & real estate (only good deals).