If you haven’t heard 🙉, CAC is rising.

Yes, VC money plays a part in this outcome, but we should also talk about the mechanisms at the execution level that impacts almost all online businesses.

+ percentage of ad spend incentivizes scaling ad spend instead of optimizing CAC.

By leaving meat on the bone, we all end up paying a little more for every bite.

The Farmer’s Dog @thefarmersdog - raised $47M

Ollie @olliepets - raised $17M

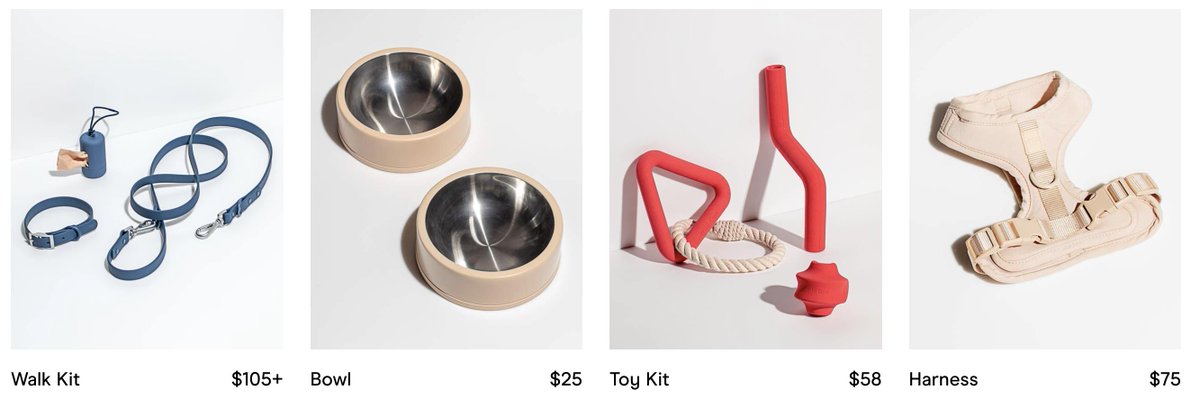

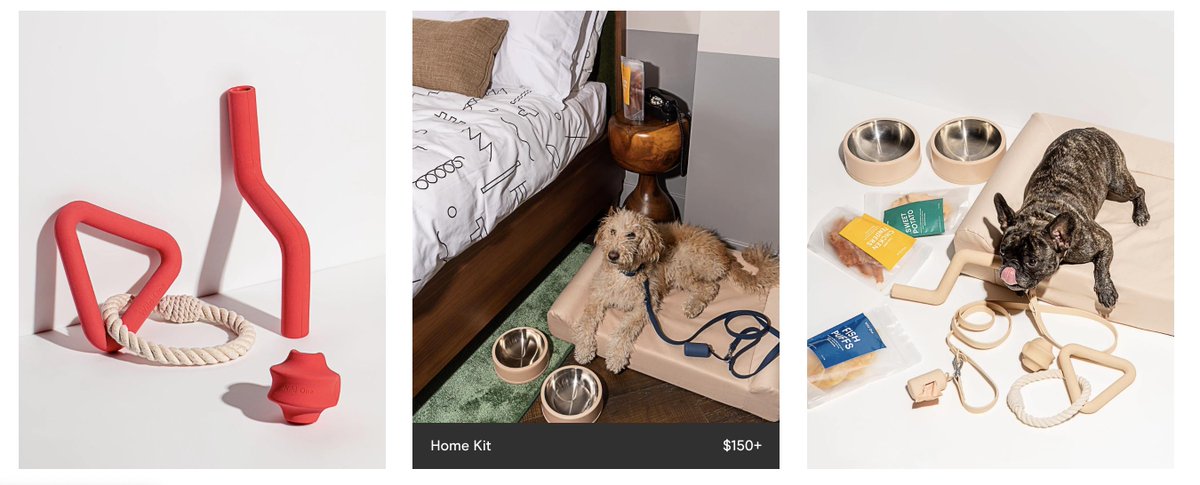

Wild One @wildonepets - Seed Round $unknown

It really tickles my millennial fancy from almost every angle:

1/ Priced to spur my consumer reflexes into action

2/ Aesthetics: dog toys + my wife’s macrame piece + accent wall = 👌🏾

3/ Digital: their site is a doggy daydream 🐶😴

- prioritize audience development and sell directly to their owned channels -

... it requires consistent high quality and engaging content, and good content is expensive to make.

And even harder to differentiate in a crowded market.

*Every* brand in this thread is facing this challenge.

The competition to acquire in other verticals has a direct effect on the acquisition models of almost all digitally native products and services.

Startups lose.

Customers lose.

Platforms win.