I had to check & glad I did. I get revenues down around -32% YoY for Jul/Aug, or a -$1bn YoY drop so far in Q3.

Euro: -4% YoY; yuan: -3% YoY; Norway's krone: -6% YoY. This is just for Jul/Aug. $ strengthened more in Sept.

1) China: +14% YoY (despite 50% volume growth)

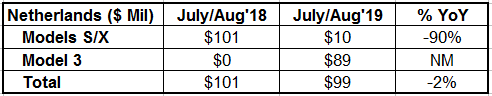

2) NL: -2% YoY (depite 124% volume growth)

3) Norway: +198% YoY (despite 410% volume growth)