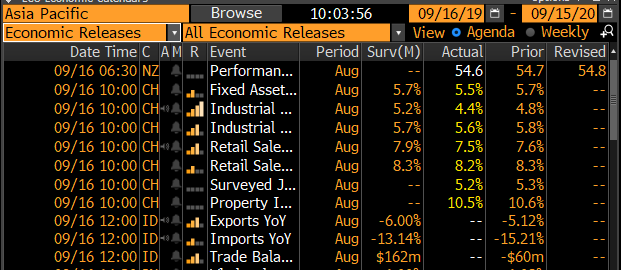

IP 4.4%YoY vs 4.8% previously & lower than 5.2% expected. Fixed asset investment also disappointed with 5.5% growth from 5.7% & exps of 5.7% (this is closely watched as it means future growth weaker); retail sales also lower at 8.2%

😬#china

This is why it is important to watch HARD data, which mirrors manufacturing PMI.

Tightening purse strings & so don't expect China demand to lift u up!

This is my call & I am sticking by it!

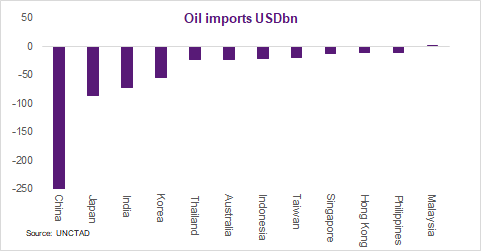

🇮🇩 Indonesia -15.6% 🥶

🇮🇳 India -13.5%🥶

🇨🇳China -5.6% 🥶

🇰🇷South Korea -4.2% 🥶

🇹🇼Taiwan -2.7% 🥶

🇻🇳Vietnam +7.5% 🤗