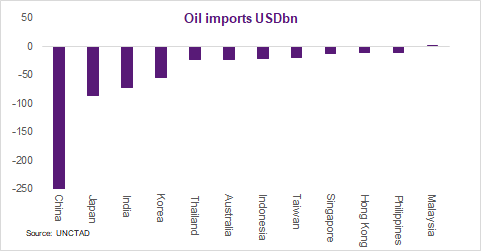

The downturn of the electronic cycle is hitting South Korea and Singapore rather hard & calls for diversification 👈🏻

South Korea -13.6 🇰🇷

Indonesia -10 🇮🇩

Singapore -8.9 🇸🇬

India -6.1 🇮🇳

China -1 🇨🇳

Vietnam +4.5 🇻🇳

August Imports 👇🏻👇🏻👇🏻

Note this: we will have a very favorable base effect in December 2019 but don't get too excited b/c that is a statistical illusion even if data starts to look OK.

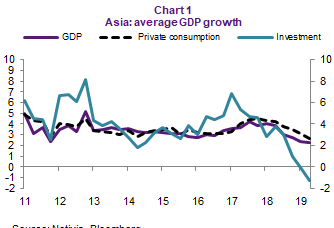

If u look at Asia import data, then see that China is not the only economy w/ CONTRACTING IMPORT DEMAND.

China is reducing cap ex in the private sector. State not up much.

Hong Kong -12.1

Philippines -4.8%

Australia -3.7

Korea -1.9% (📉 since Q218)

Singapore -0.3%

Malaysia -0.6% from -3.5%

Japan +2% (base effect)

Thailand 2% (📉

India 4% 📉

Indonesia 5% 📉

Taiwan +7.5% 👑policy driven👏🏻

Vietnam 🇻🇳 and China 🇨🇳

Why? Both have legacy of command economies (communism) & so DON'T DISCLOSE QUARTERLY EXPENDITURE DATA.

We only have annual data so no investment & we get production data. Notice that VN & China have GDP targets.