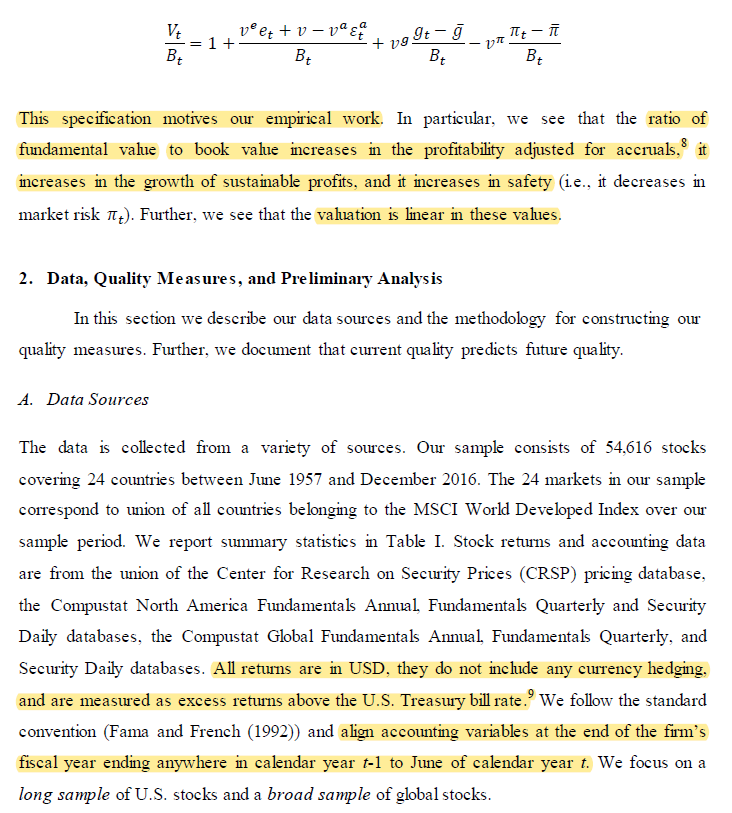

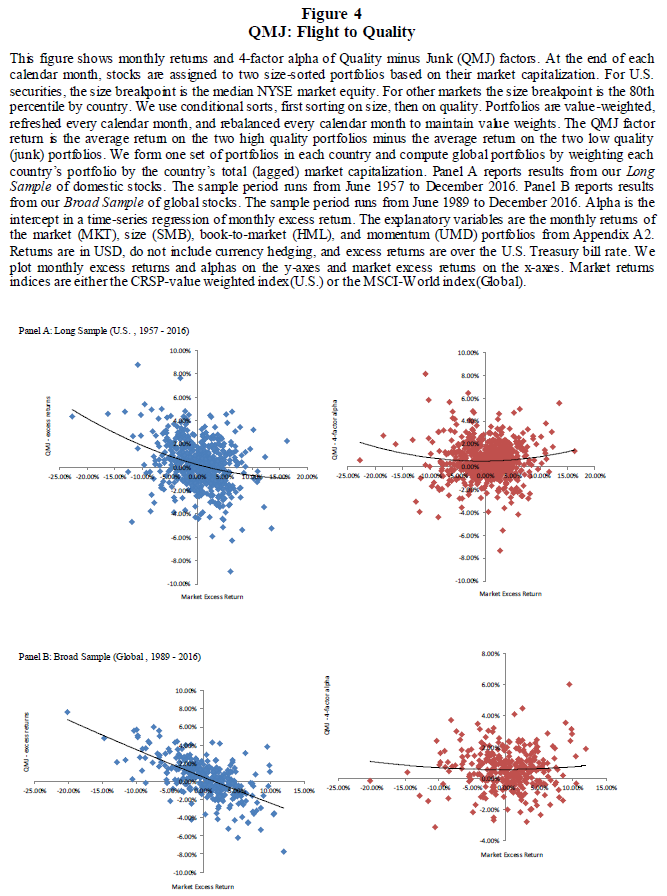

"Higher-quality stocks have higher prices (P/B) on average, but not by a very large margin. A quality-minus-junk (QMJ) factor earns significant risk-adjusted returns in the U.S. and globally."

papers.ssrn.com/sol3/papers.cf…

Analysts are on the wrong side of most factors. Large forecast errors are associated with very high factor returns during earnings events.