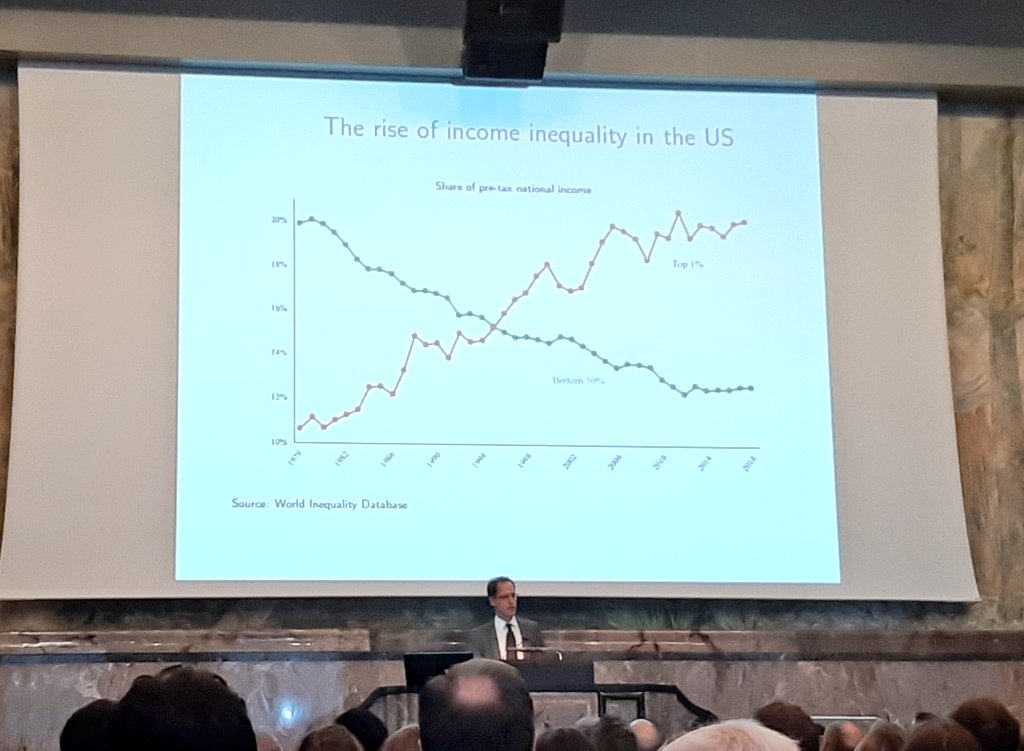

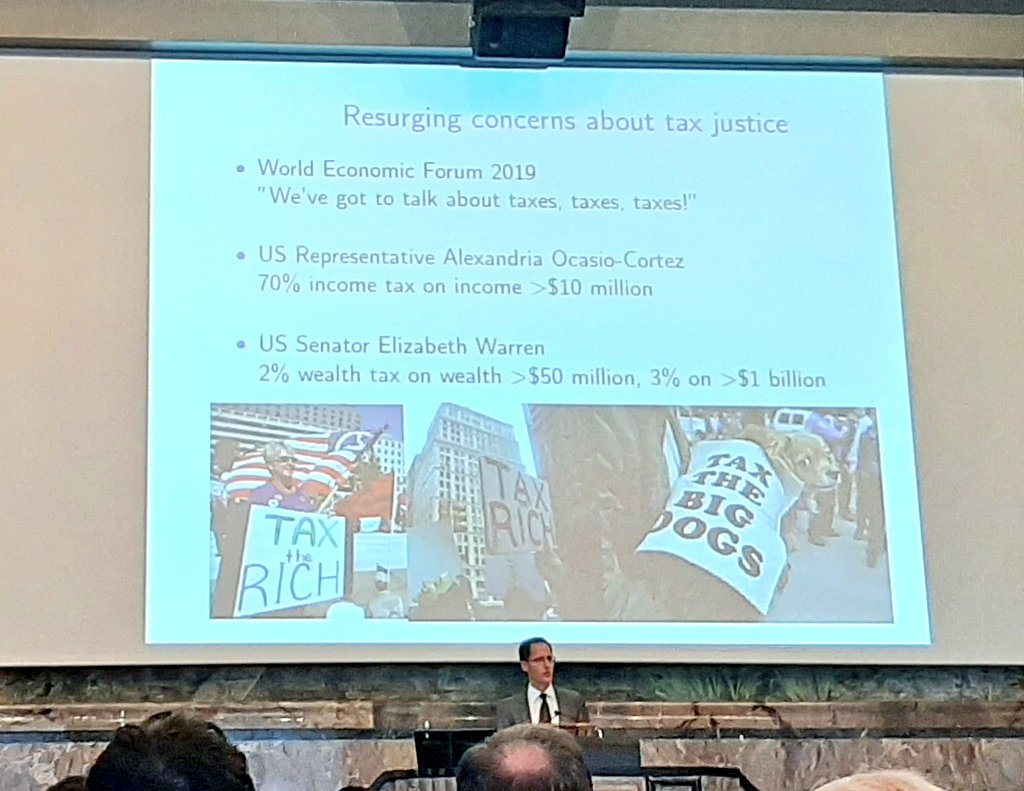

@Florian_Scheuer references the intensive recent debates on Twitter regarding the image on the right.

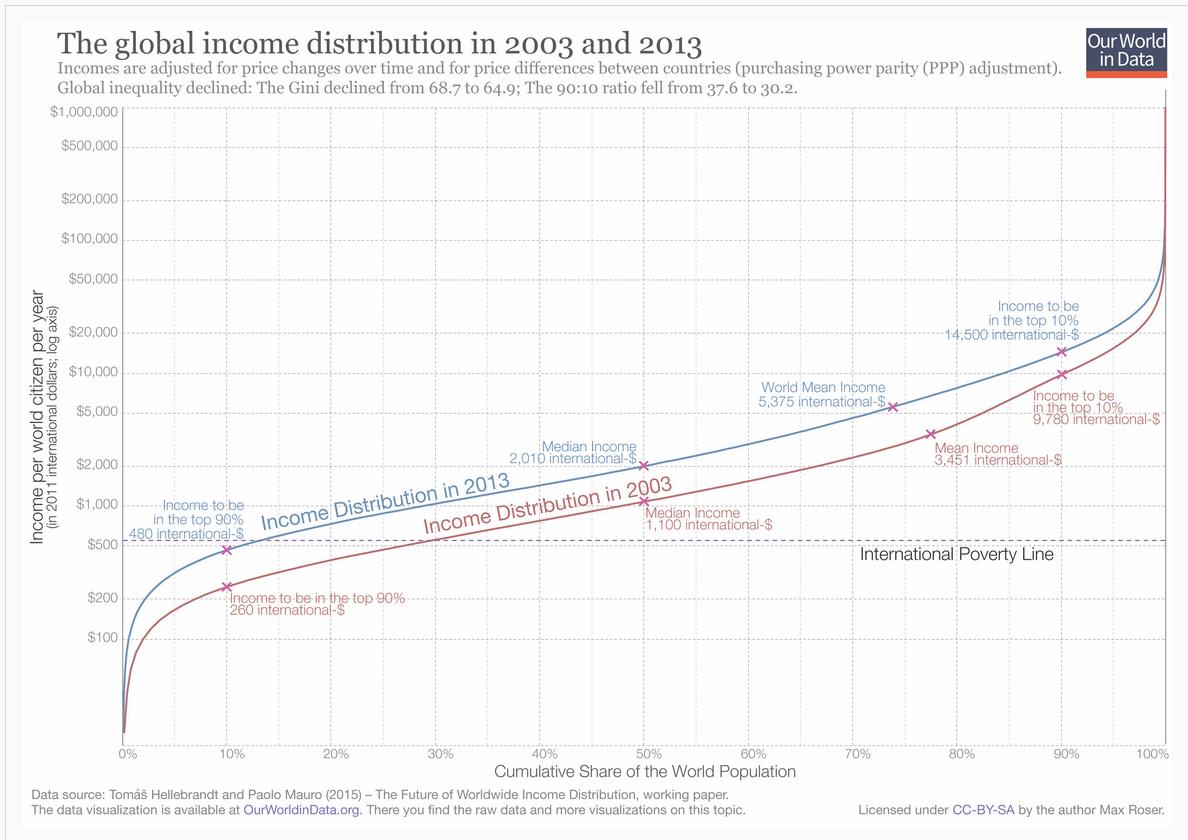

But wealth tax doesn't target excess profits from monopoly rents. Capital income tax does that. We need more evidence. So far it looks like the latter may be large. We see growing mark-ups.

- Getting rid of exemption for capital gains tax at death.

- Strengthening estate tax.

These are also important for equality of opportunity etc.