Done right you can even pay 0.

This will be pretty long but gets into the details of how Long Term Capital Gains can benefit you.

If you want to learn more about Taxes, Real estate, or investing this is for you.💰💸

A thread. ⬇⬇

LTCG is a tax on assets such as a stock or property that you have owned for over one year

This tax is applied to appreciation of asset. (Primary residences 2 years)

There are plenty of broker options.

Many have recently started offering free trading to compete and add investors.

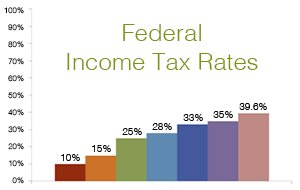

Short term capital gains (Held less than one year) are taxed as ordinary income whatever your normal tax bracket is.

Long term losses can also be deducted from your long term capital gains

In retirement (no working income) If you are married filling joinlty you can withdrawl up to $78,750 per year & pay 0% on taxes.

This can obviously change in the future.

But if you are in the 22% bracket or higher paying 15% is better.

You can only do this if you are not taking a loss.

You must wait 30 days to invest in the same stock or fund if a loss occurred.

This is not the total amount you can withdrawl. LTCG applies to the change in price over time.

Meaning what you invested initially is not applied to LTCG tax.

Here is an example-

If you pull all 12K out of your account and since your total income + LTCG was 38K. You pay 0% LTCG tax on the 5K profit

You can deduct up to 3K (half if married so 3k between you) per year in loses from your income.

This can be done for as many years as needed to reach your total losses (15k loss= 5 years at 3K max loss)

Most go with First in first out but there are other methods too.

No matter what income bracket you are in.

This is a huge deduction and helps make homeownership lucrative.

More below.

But you cannot deduct capital losses if the value goes down for personal property like you can for stocks.

This is also great for rental properties 👇

If you live there for 2 years as your primary residence you do not owe LTCG.

It’s also of note that high income earners (over 200K single or 250K married) you will have to pay an additional 3.8% on investment income this includes capital gains.

Welcome aboard to all of the new followers.