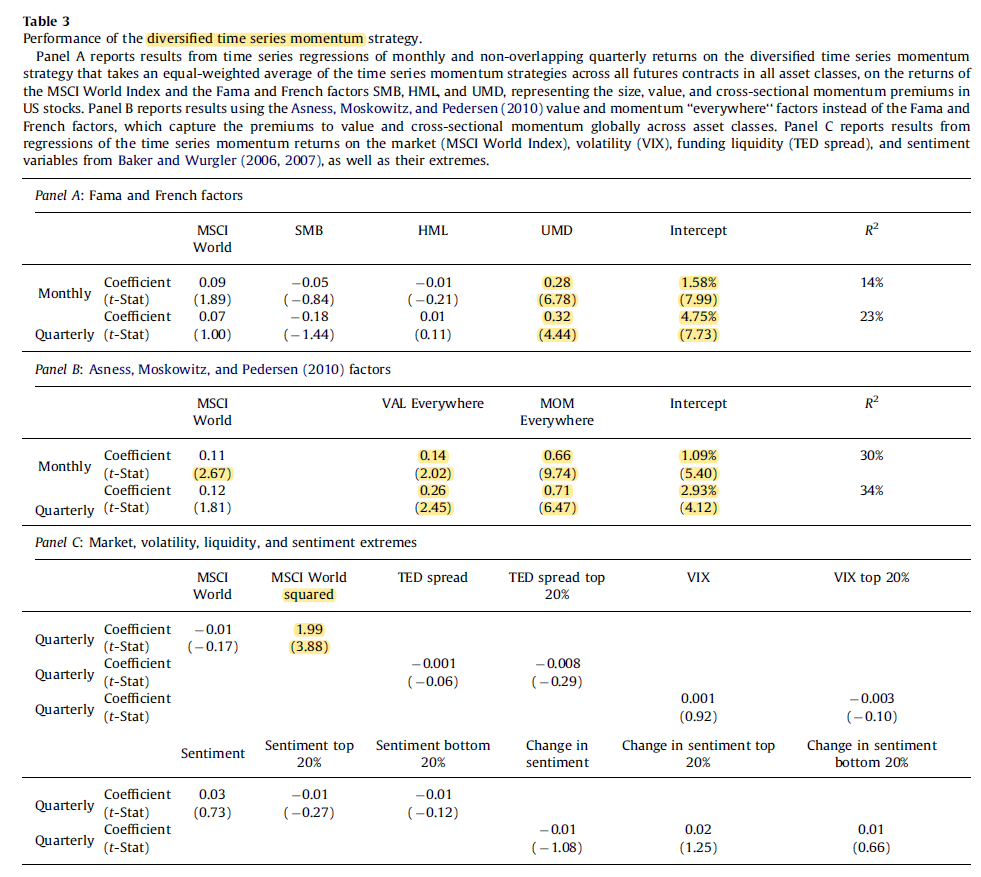

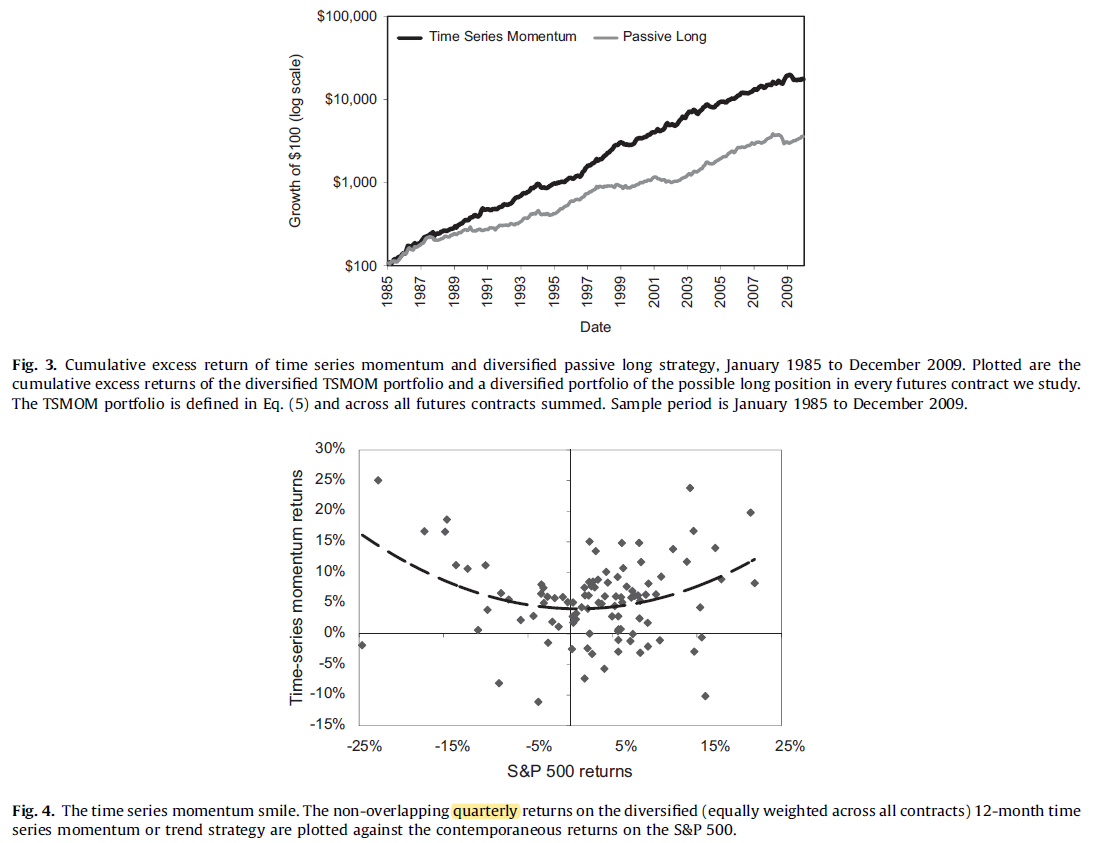

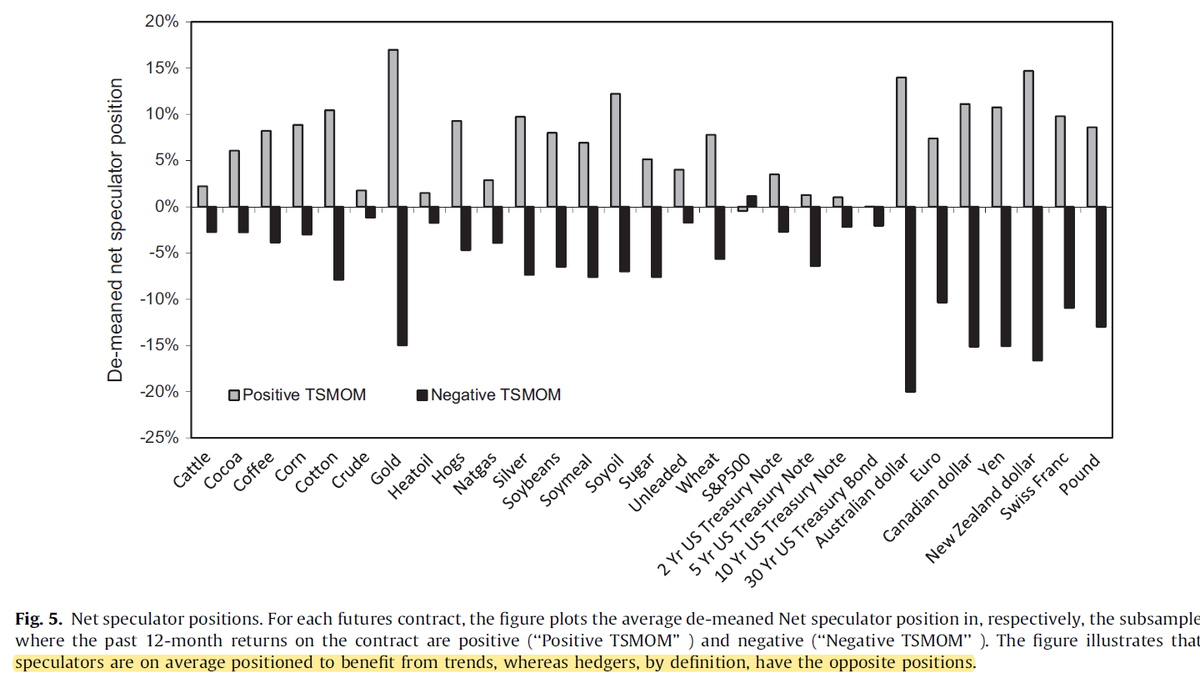

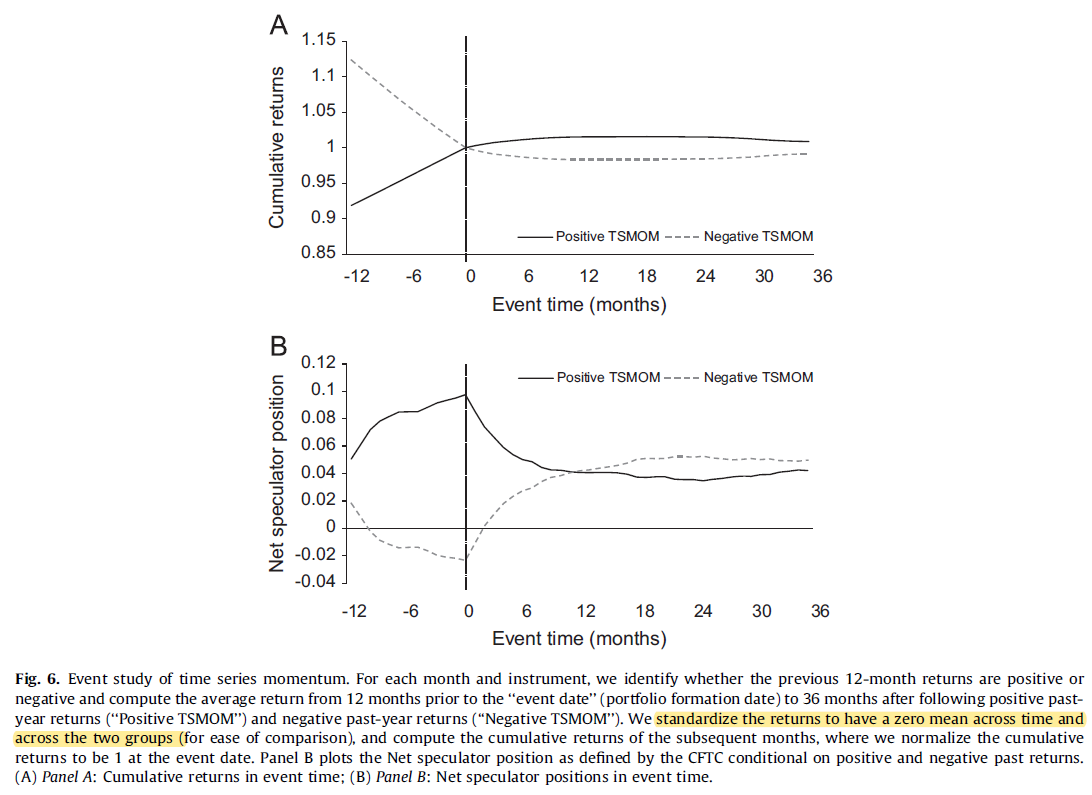

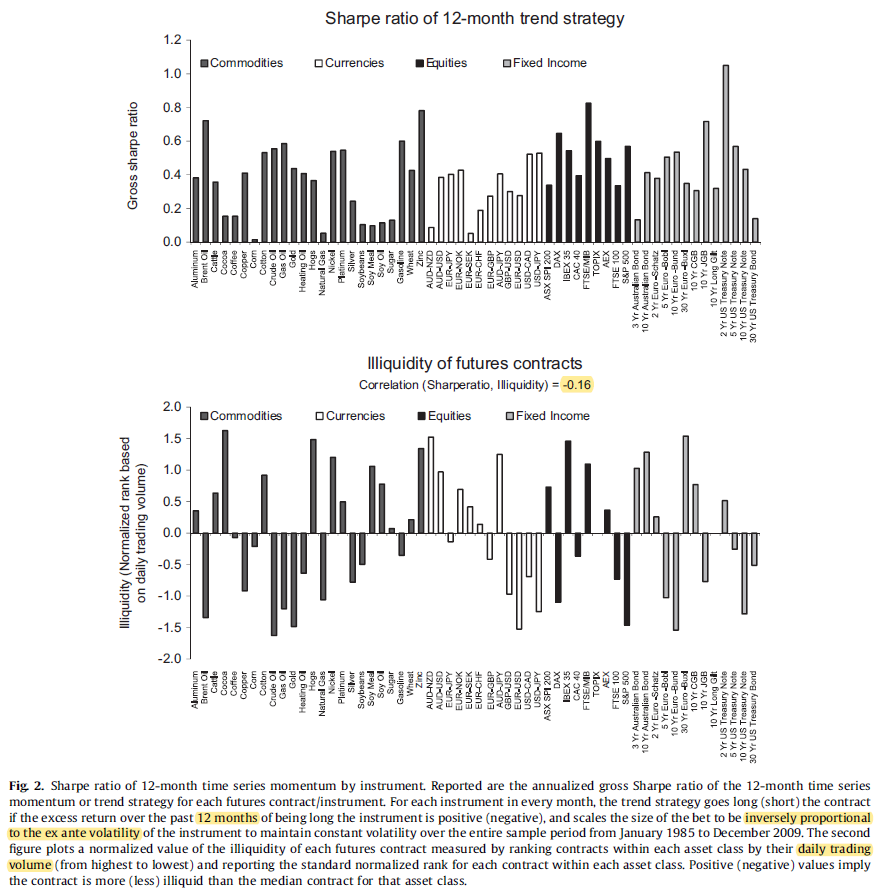

"A diversified portfolio of time series momentum strategies across asset classes delivers abnormal returns with little exposure to standard asset pricing factors & performs best during extreme markets."

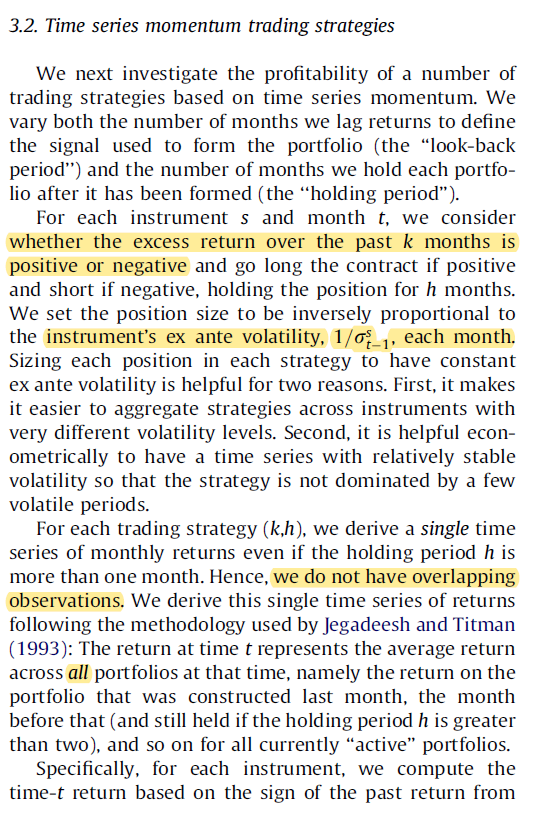

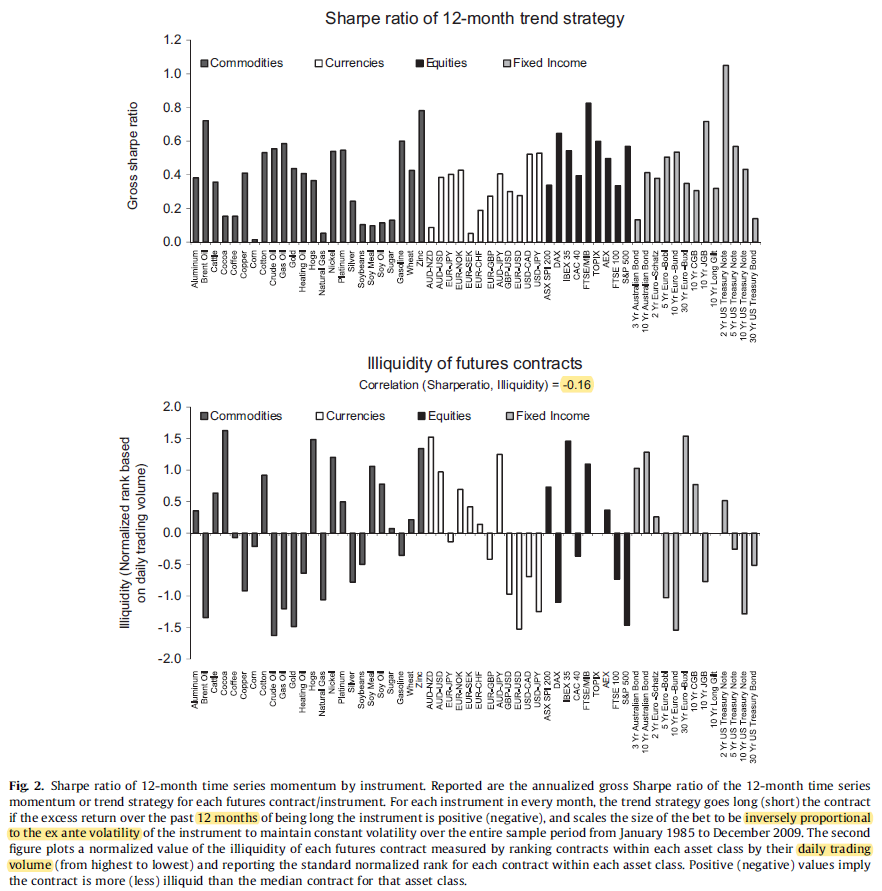

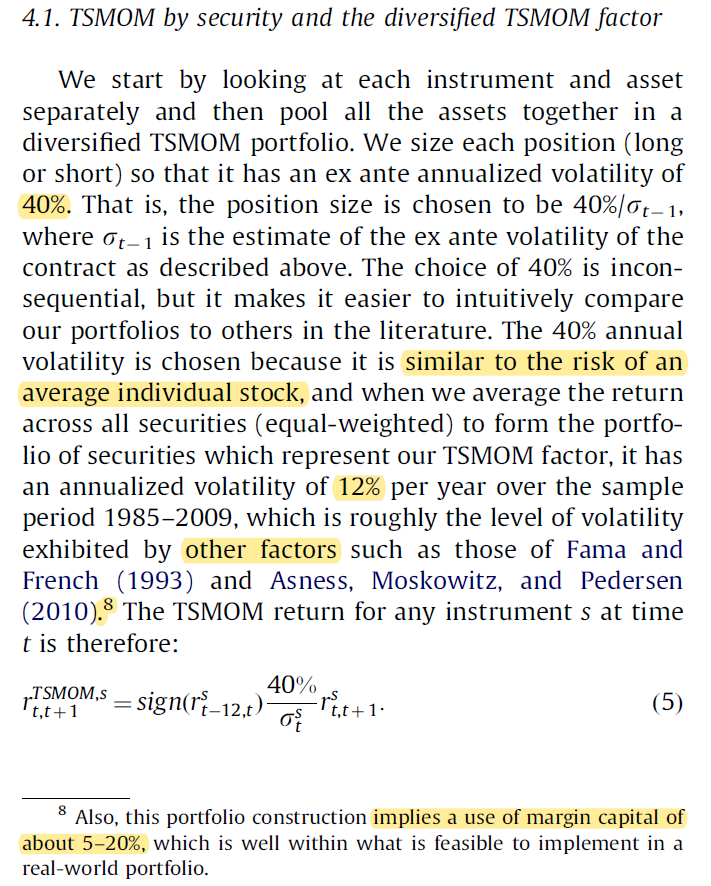

papers.ssrn.com/sol3/papers.cf…

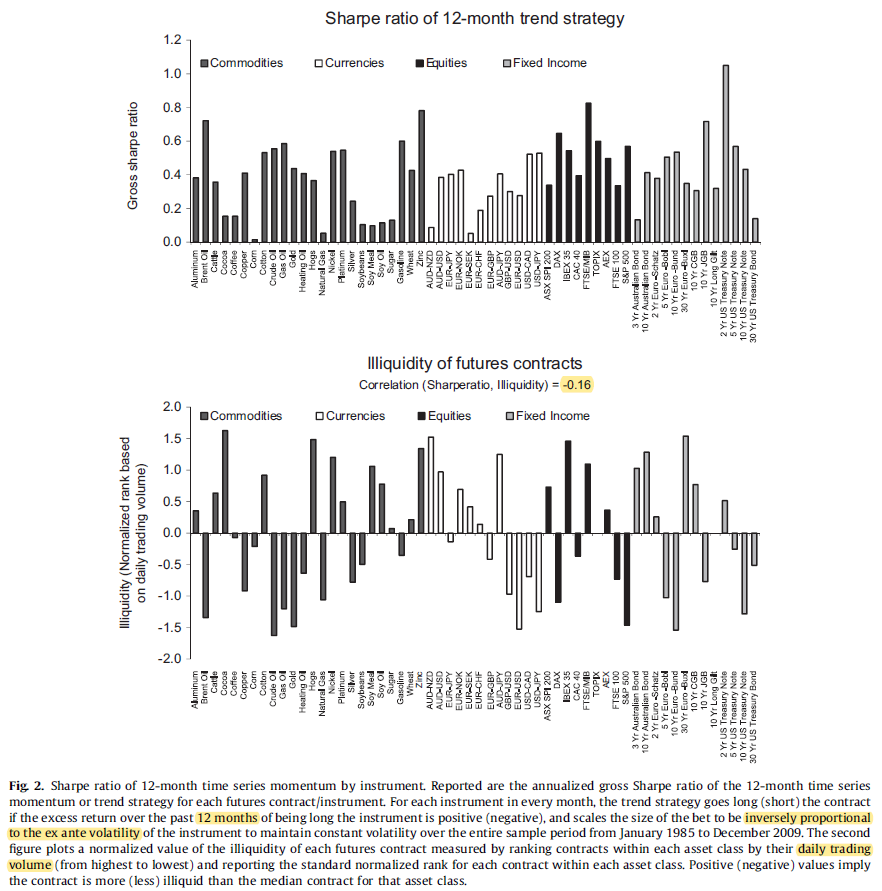

(They also found that much of its benefit comes from the inverse vol weighting.)

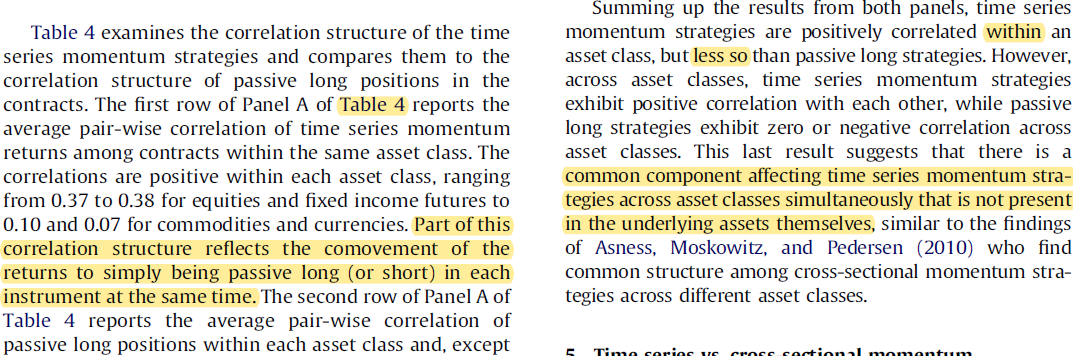

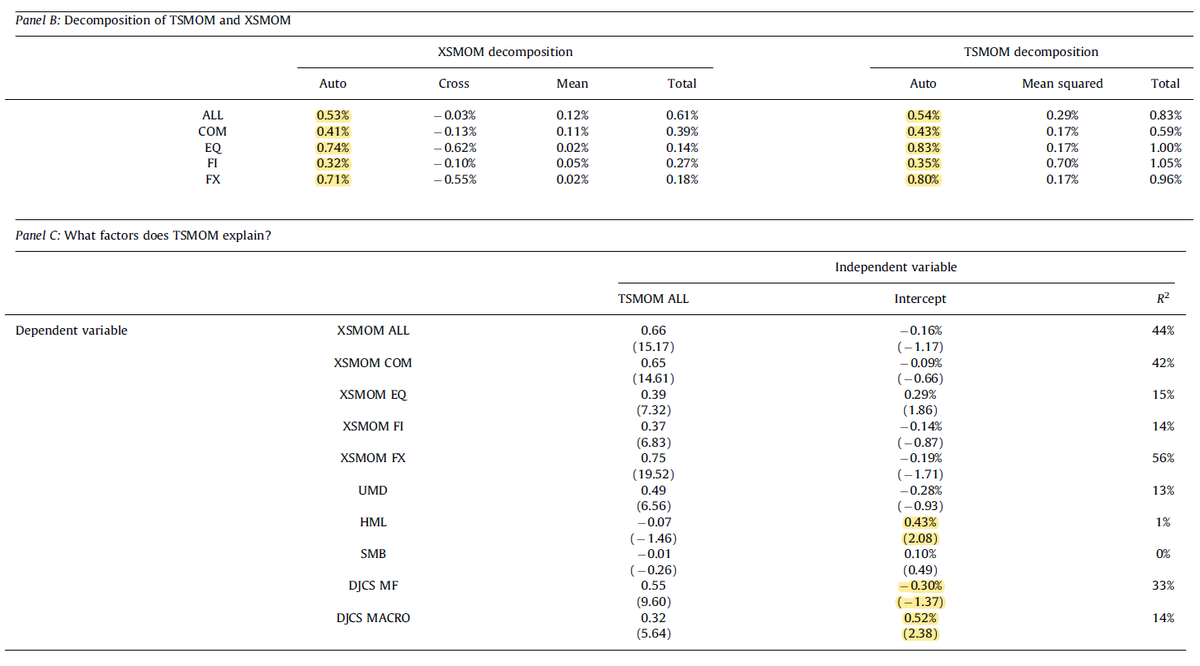

Goyal and Jegadeesh break down TS mom into cross-sectional, market timing, and long-term net exposures. (The third could make TS mom long-term net long stocks.)