(Speaking individually)

2016 ACCC found abuse of pipeline market power, not restrained by competition, countervailing power or the threat of regulation.

COAG EC asked Gas Market Reform Group to look at solutions

Evidence: customers faced opaque pipeline market, power imbalance, tough terms, more probs.

Int’l comparison: Aust pipeline returns above those in other countries

Main recs:

1. enhanced disclosure inc on full range of services sought;

2. Framework for binding arbitration in Nat Gas Law

Agreed by COAG EC in 2016

Expected arb to be used rarely.

Transparency rules were expected to reduce disputes.

Unfortunate that EC accelerated start date - left less time to finalize rules, made stakeholders grumpy

Macro: contracts are being entered, greater satisfaction with pricing outcomes. Threat of arb has had effect, though no real test of pt23 arb yet.

New pipeline proposals advance, no freeze on investment

Warns against pressure to add yet more requirements to framework - wait five years to assess, and don’t slide into full regulation.

Reform should be viewed in microeconomic terms, not just shallow chase for price reductions

Pipeliners still have work to do to respond to customer and ACCC concerns.

Market is evolving due to high prices and uncertainty about role of fossil fuels.

Key role for APA is to increase supply to market and meet customer needs

Eg 23 PJ allocated through pipeline capacity auctions.

But customers are doing it tough; gas has to travel further to market with higher costs.

Multi-asset services simplify transport, eg $2/GJ for Qld to Melb

We’ve made our service offer simpler for customers.

Capacity trading is facilitating seasonal peak, mostly at zero cost.

Disagree with Reg views that transport costs are too high.

Without customers we don’t have a business.

Still working on new pipeline proposals.

Nobody knows where the market is going

Fundamental gas price problems in Australia

Jemena’s role is in efficient supply, including early-stage work with producers for low cost

ACCC is positive about pt23 reforms so far and suggesting reform/action focus now is more on supply than transport

More policy uncertainty through more pipeline reforms would be counterproductive.

Need a number of years for current reforms to settle down and generate evidence.

Five years would be a good assessment period. If industry can’t resolve any issues, we’d expect more reform.

New connection points for gas supply into markets are needed. Need to get away from fights between segments of gas supply chain and solve overall problems.

Agree we shouldn't assume more intervention will necessarily deliver lower prices; we aim to provide the best information to judge policy/market decisions

Prices in QLD dropped in line with netback metric, but south remains $$$

Transport pricing - most new contracts are for 1 year or less, only one signed of 5 years or more.

Shippers seek more flexible services - as available, interruptible. Response to producers offering less flex

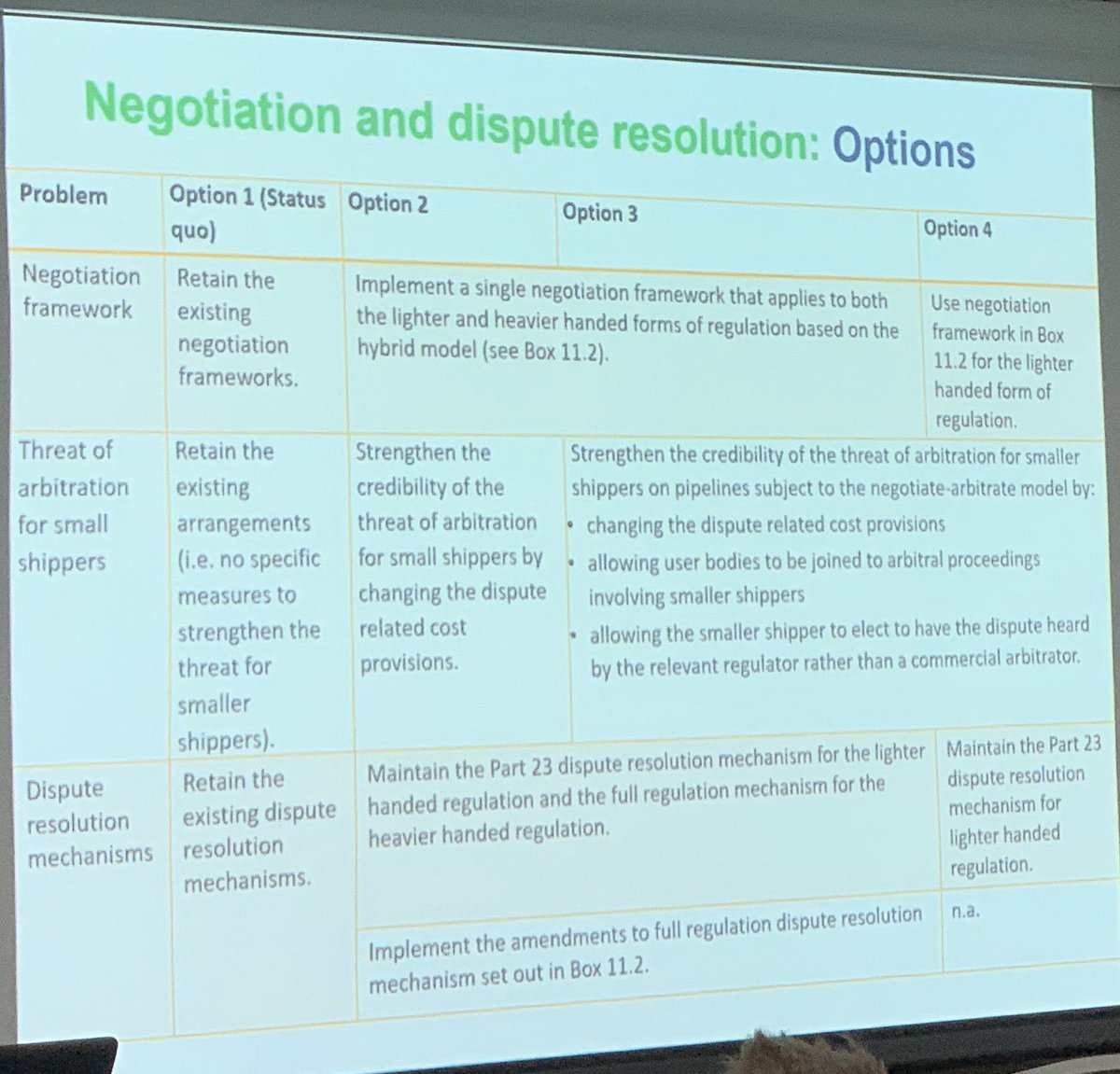

- change AER financial reporting guidelines

- change National Gas Rules

A big stick for gas is not in anyone’s interests (inefficient), but will happen if there is no improvement.

Lots of consultation, survey, modelling inputs so far.

Threshold for regulation may over-regulate

Greenfield exemption may distort investment

Coverage test may under-regulate

Governance may create delays

Workshops coming soon (mid-late Nov) for stakeholders to give evidence/perspective for all this.

Register interest at GAS@environment.gov.au

Q: how will RIS consider risks to investment?

AP: keen for input on this in consultation.

APGA: new pipeline projects are highly competitive, wants greenfield exemption from access regulation.

AP: open to input on better combinations.

APGA: monopoly infrastructure regulation is Govt bread-and-butter; harder to see intervention in competitive sectors delivering better outcomes than even minimal competition.

MG: we don’t want to have no alternative but blunt intervention.