"United Capital Announces Goldman Sachs Executive Rachel Schnoll to Lead FinLife CX" bwnews.pr/36AJyxH

1) Slap a custody/clearing firm on the back end as an RIA custodian;

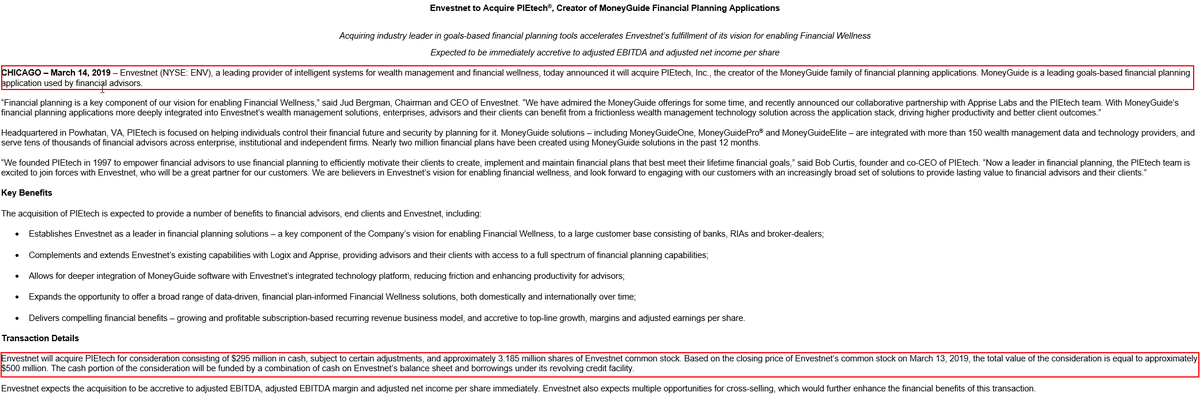

2) Attach asset management distribution to the back end (e.g., GSAM + more), akin to Blackrock buying FutureAdvisor & Envestnet stake.

Going to be an interesting few years of advisor #FinTech #WealthTech to come! /end