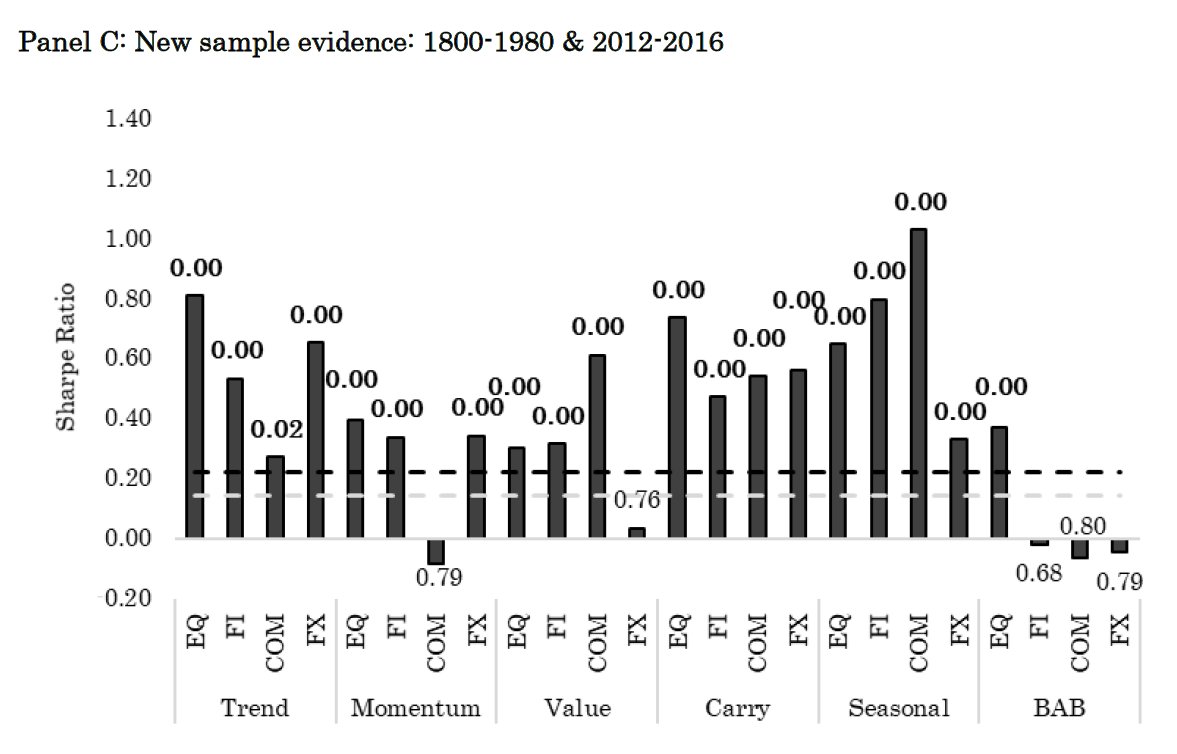

"New sample evidence reveals that the large majority of global factors are strongly present under conservative p-hacking perspectives, with limited out-of-sample decay."

papers.ssrn.com/sol3/papers.cf…

(Results differ for low-beta "defensive" they estimate betas using *local* market indices.)