These are the most common #Options strategies when one would start with #OptionsTrading.

Let’s understand from a broader perspective what’s the difference between these two.

#Straddles

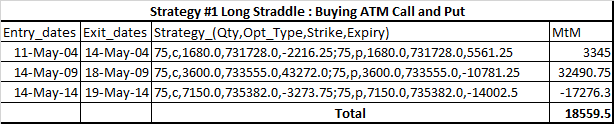

You get higher premium so pnl would be higher compared to #strangles

But from where are you getting higher premiums is that your selling 0.5 #delta.

Delta management is the 🔑 in #starddles as the more you manage more your goin to give in reverse scalps or reverse #gamma.

Generally deltas are higher for straddles compared to strangles

The maximum possible #negative gamma is goin to come from #selling a straddle.

This is the reason #delta management is the key to success

#Vega for #Straddles

View on #volatility is of highest importance for straddle as #vega is highest for #ATM options

#Theta for #Straddles

This is again goin to play an important role as its maximum at #atm so the more you hold the more benefit is goin to kick in.

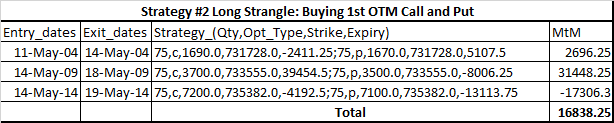

The premium received is lesser whereas you may see wider fluctuations on your pnl if markets start fluctuating or trending a lot.

#Delta for Strangles

These tend to be lower compared to #straddles but can suddenly start to rise.

#Gamma for Strangles

The sudden rise is delta is defined by the

Gammas are relatively lower as compared to straddles.

#Vega for Strangles

Though it’s lower than straddle the ratio for vega to theta is much higher comparatively.

#Theta for #Strangles

This is one thing which is goin to benefit you as long as the strikes are not being #breached.

#theta generally would be lower compared to straddles in this strategy.

Better strategy for beginners would recommend only #straddle they tend to move and that’s where learning would come you wouldn’t wait long to act on.

Whereas on the other hand #patience would be developed only through #strangles but that’s not what beginners have.

#Risk is similar on both the cases but a lot of case studies have proved #strangles to carry higher risks.

#Returns would be higher for #straddles.

#OptionsTrading #volatility #optiongreeks #quantscapital