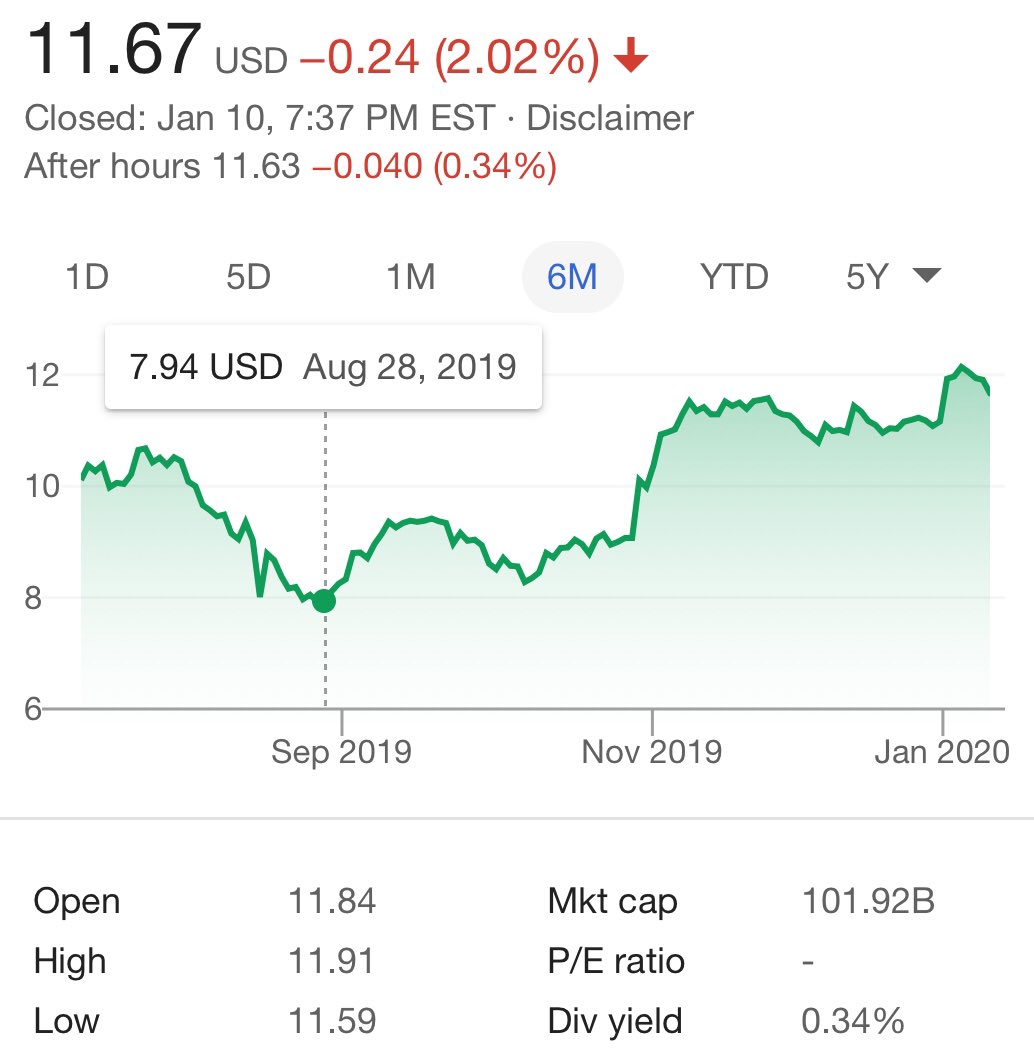

"Expected long-term cash flows, discounted by the cost of capital—not reported earnings—determine stock prices."

The real work is unavoidable unless you are a speculator (ie, not an investor). "GE once saw break-even cash flow as best-case scenario for 2019." google.com/amp/s/www.bizj…

I am saying making a decision about valuation based only on whether the business is "losing money" is like trying to solve a murder mystery with only one clue (that may be false). If you want an investing edge: work!

Did you "lose money" in the first quarter you owned that bond?