Here's why it should be on your radar:

➕Anyone can buy smart contract insurance

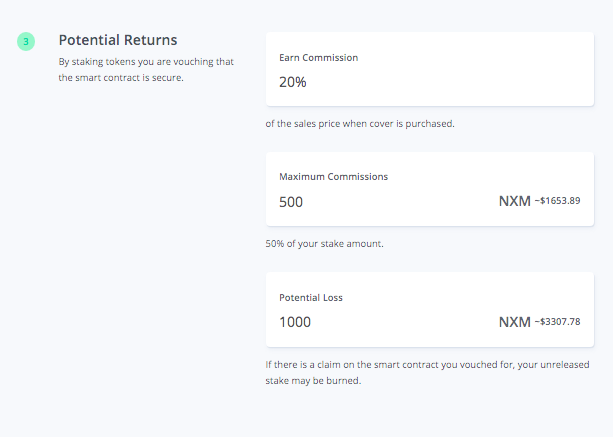

➕Being a backer (staker) can earn up to 50% ROI

➕It's powered by #Ethereum

So if your options are:

❌No protection

✅New insurance that has 28% more capital on-chain than required to pay all claims, what do you choose?

Duh! [see nexustracker.io/capital_pool]

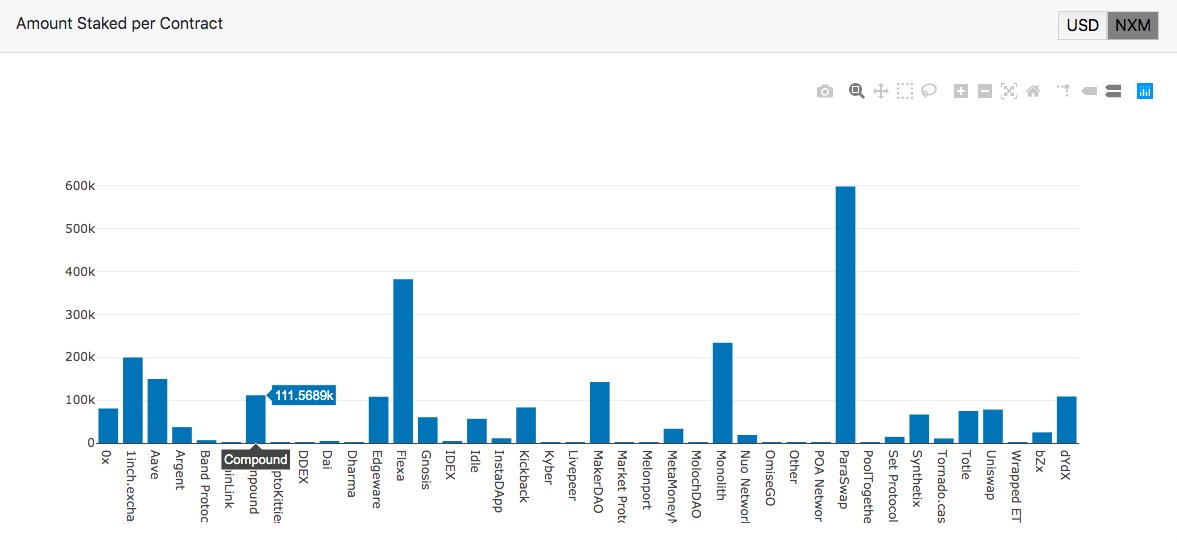

🚀$2.9M USD (13,141 ETH) staked by backers (Risk Assessors)

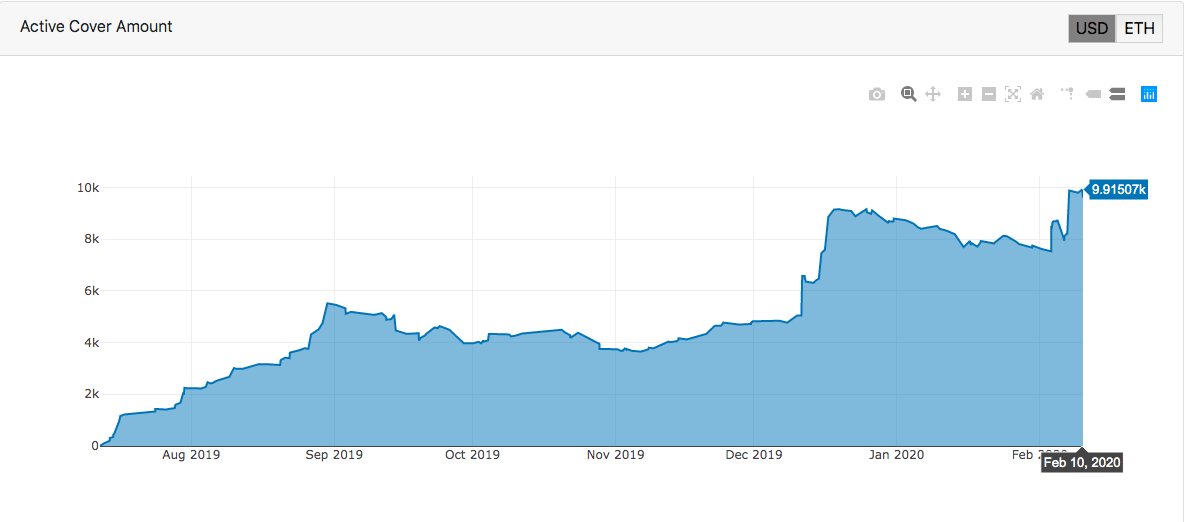

🚀9,915 ETH in total coverage (what's insured)

🚀Avg coverage = 93.5 ETH

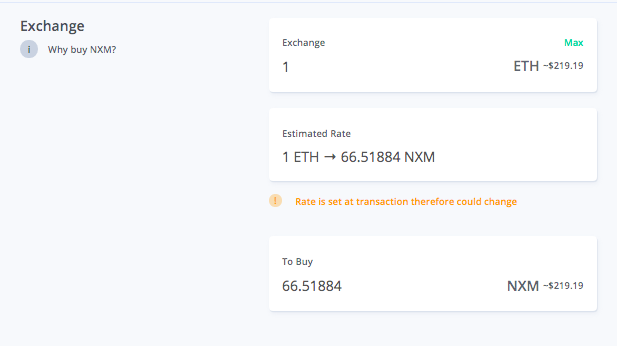

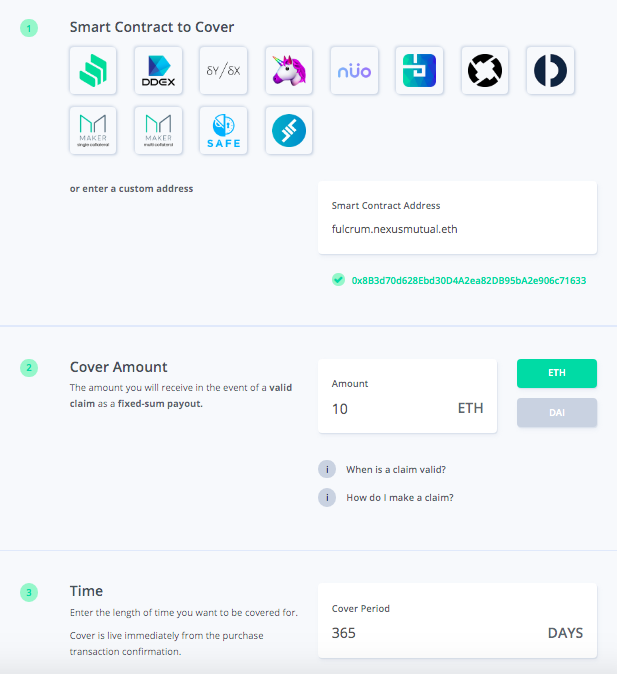

Here's how I bought coverage myself against hacks:

💥Go to app.nexusmutual.io/#/SmartContrac…

💥Choose a dapp icon or paste in an SC

💥Choose cover to be in ETH or DAI

💥For how long

💵Become a member by paying a small fee in ETH (<$2)

💳Submit to KYC (I know it sucks but it's reality)

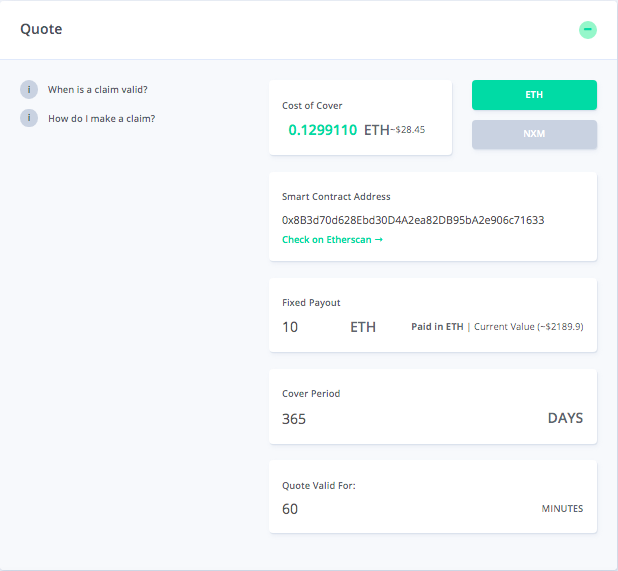

💥365 days coverage costs ~1.3% of cover amt, if you prefer payout in ETH.

💥Coverage in DAI is much more costly.

💥Use "Manage Cover" in your dash but there's no reminders when it expires app.nexusmutual.io/#/ManageCover

@NexusMutual is still early, so there's fewer #DeFi users paying for SC insurance.

If there's only $2.9M in active covers and still $973M in DeFi TVL (excluding Lightning Network no one uses), Daddy is excited!

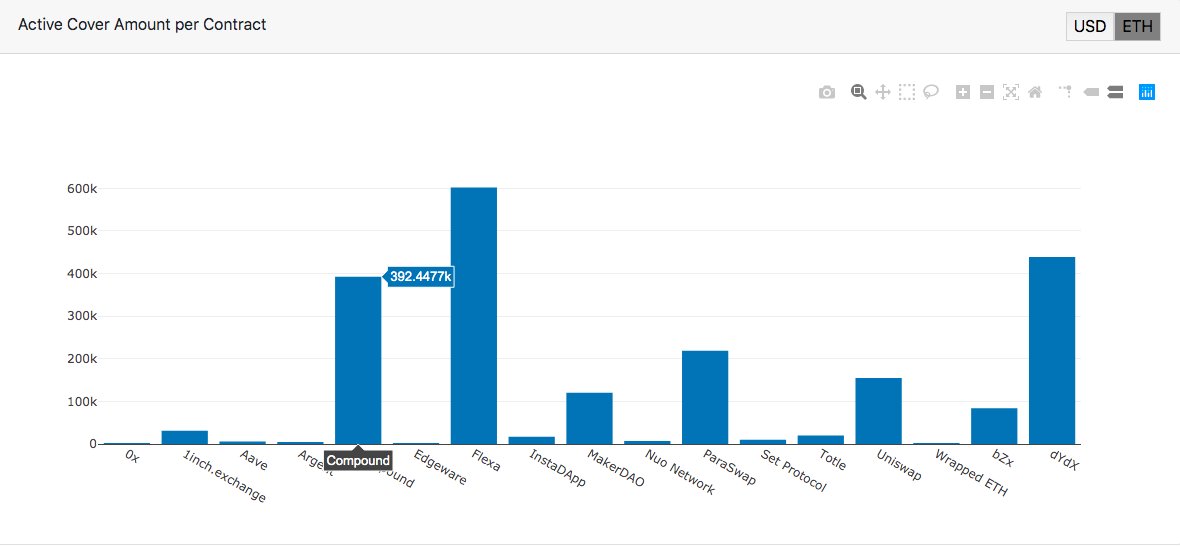

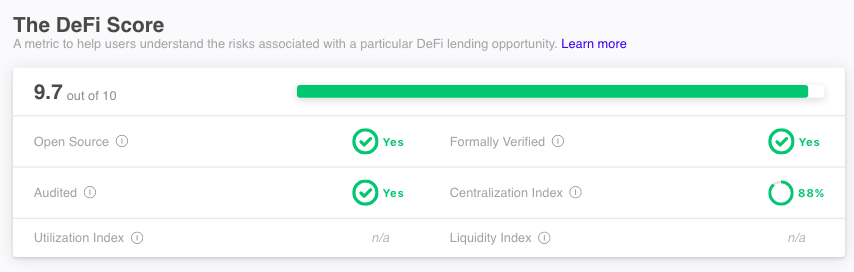

@compoundfinance is a great example of potential for Nexus because it has:

📊$125.2M in TVL

📊Only $392,000 in active coverage

So, Nexus is only insuring 0.3% of Compound's TVL

$120k / $597.6M TVL (0.02% of @MakerDAO)

$439k / $19M (2.3% of @dydxprotocol)

$84k / $11.8M (0.7% of @bzxHQ

$9.8k / $4.5M (0.2% of @SetProtocol)

$7.1k / $3.9M (0.18% of @getnuo)

@NexusMutual is underutilized in covering @MakerDAO so I'm willing to try this.

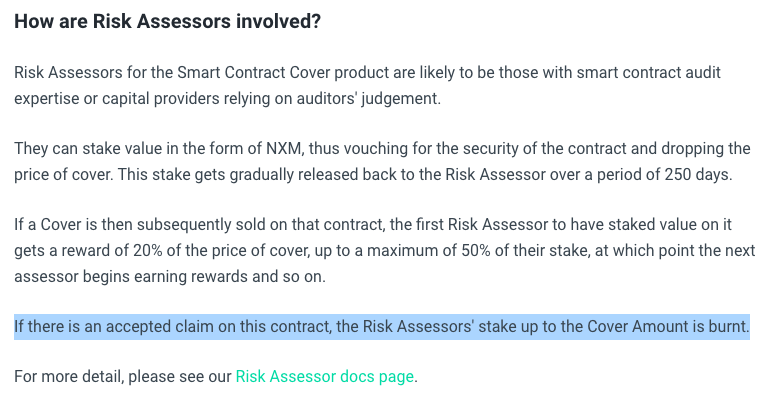

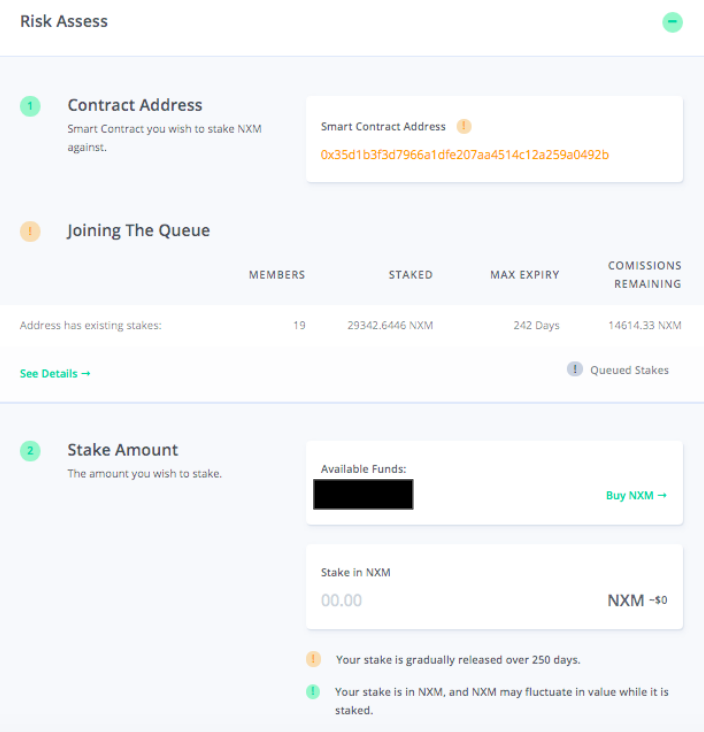

🖋️Go to app.nexusmutual.io/#/RiskAssessme…

🖋️Paste in the @MakerDAO SC (0x35d1b3f3d7966a1dfe207aa4514c12a259a0492b) which I found searching nexustracker.io/staking for listed stakers against MakerDAO

🖋️Choose NXM stake amount

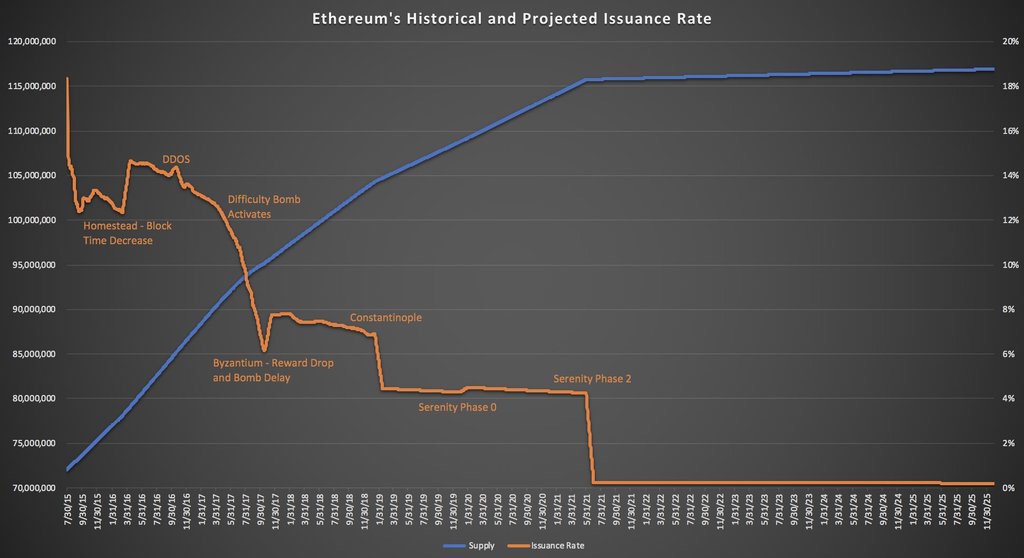

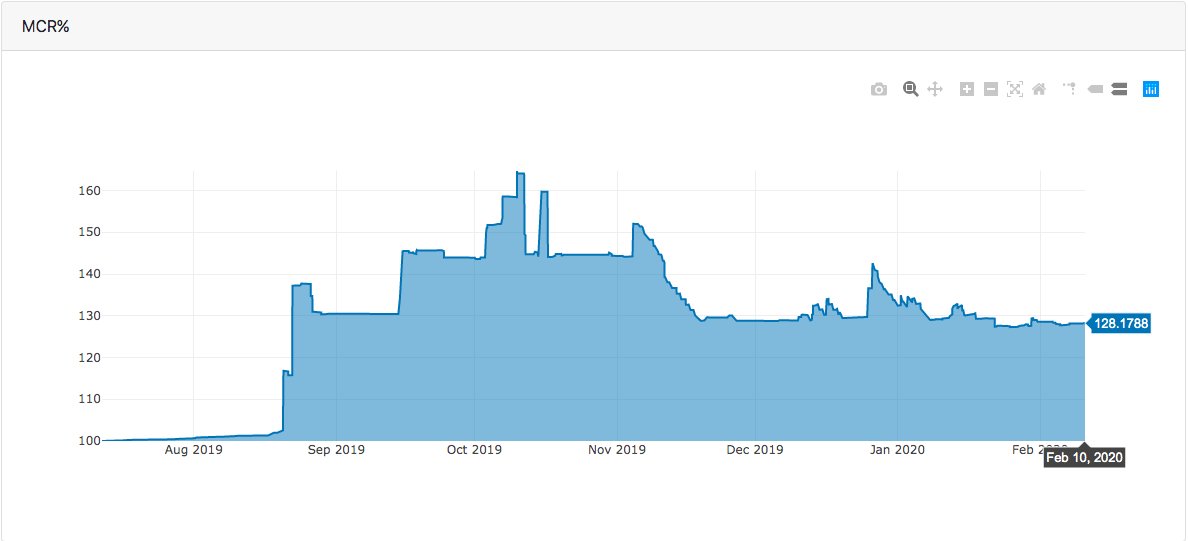

💥Nexus has adequate funds when the money it holds (known as the "Capital Pool") is greater than MCR.

💥MCR% is the ratio of funds held to funds required

👇See how this impacts NXM price

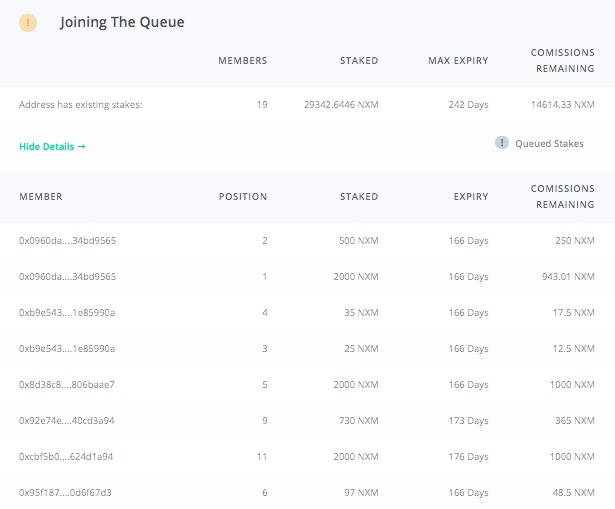

💥I could be in queue waiting behind others like below with 19 ahead of me for @MakerDAO SC stakers. 146,000 in NXM commissions has to be paid before me.

💥If this coverage remains unused, I could go the full 250 days without earning commission.

1⃣Anyone risking money in #DeFi, ought to consider insuring it with the best/only option in #DeFi--@NexusMutual

2⃣If you are looking to earn up to 50% ROI backing Nexus, consider staking NXM.

3⃣Share this with others!

Rn most of the $1 billion in TVL is uninsured. I don't think one can debate my logic: better to try and protect oneself than to just not try at all.

@0xProject

@1inchExchange

@AaveAave

@argentHQ

@compoundfinance

@FlexaHQ

@InstaDApp

@MakerDAO

@getnuo

@paraswap

@SetProtocol

@TotleCrypto

@UniswapExchange

@bzxHQ

@dydxprotocol