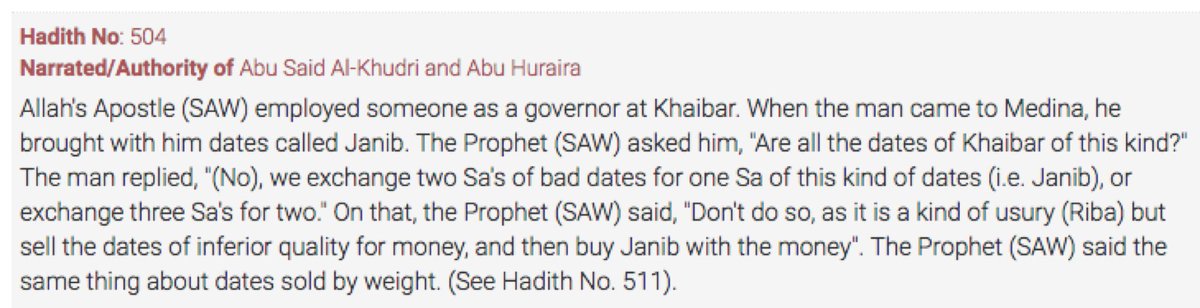

Hadith, from ibrahimm.com

Ok, so the superficial meaning is clear – do not trade lower quality dates for higher quality in different quantities – this amounts to Riba.

But, there is much wisdom to be discovered here – the problem is

If we think a little deeper, we can see the real benefit in this.

There are 2 key benefits in following the advice in this hadith:

1) it prevents a layman being taken advantage of

2) it prevents manipulating market prices to deliver (normal) Riba, which is interest.

So let’s talk about how it does each of these things.

PROTECTS LAYMAN

Let’s imagine person A has 2 bags of

Further, let us assume the fair market price for HQ is £10 and for LQ is £5.

Now, if A goes ahead, he is making a loss, clearly.

Now let us assume, he follows the hadith and asks the trader how much A can sell the 2HQ for. Instead of the correct market price of £20 for 2 HQ, the trader says £15. They go ahead.

Now with this £15, A asks the price of LQ,

Now, A has STILL been manipulated, because he still got 3 LQ bags instead of 4. So the hadith did not help him here.

Ok, now let us imagine an open market with several traders, and not

Now, when A goes to the first trader, and is informed that the first trader will pay £7.50 for HQ, now he can go to other traders and ask their prices. Now, unless they all want to rip him off, he will find out he can actually sell HQ for £10 each.

Next, he asks all the traders the price to purchase LQ from them, and they all say £5 each, as before, so he buys 4 bags from any trader.

Here, we can see the clear benefit of this hadith.

So this hadith protects the consumer in the following

1) Where the consumer wishes to barter or exchange goods of one type for another

2) Where there are several price providers in the market and

3) where at least one price provider is honest!

In fact, once we discover that the wisdom of this hadith is fully revealed in the above conditions, we conclude that these conditions are also very important ones to exist in a market that claims to act in transparency for the benefit of the customer/layman.

Now, this hadith has a second angle, to do with another type of Riba (interest). Remember dates were also used as a form of currency, and indeed are one of the six commodities

So, given that dates can be used as a currency, and that dates come in good and lower quality, let’s see how this hadith prevents this Riba.

Let’s imagine, that A wants to give a loan to B

(sound familiar ??)

So the plan is that B will deliver £10 in cash (this is a Qard ul Hassan,

So they hatch a cunning plan. B will deliver 2HQ to A (worth £20) and A will exchange these for 2LQ (worth £10).

But A and B will say “this is not Riba, this is genuine trade!!” (sound familiar huh?)

OK, now, to highlight their duplicity,

All the other traders know the price is £10 each, and thus wait for A to deliver £20. But, A tries to agree a price of £10.

There will be uproar!!

Of course, this guy is also trying it on. Now, hopefully, another honest trader will say “No, I will pay you the market price which is £20”.

Maybe he will, but that is not what he wants. Because what can he do with this £20? He can buy 4LQ. But then he is where is started off

What this means is this – if you have two parties insisting on a closed transaction, occurring off market

They are up to something.

Otherwise why not follow the advice of this hadith, which is to (effectively) take precautions to ensure the trade occurs at a genuine market price.

So, what is this hadith really saying?

Another way to look at it is like this; this wisdom inherent in this hadith only becomes apparent in an open market, with several price providers, and looking to do genuine trading.

Sometimes you are unable to do this, not all markets are open and liquid, in which case, take care!

So, we have seen how a simple hadith about exchanging dates has direct

There is real wisdom in all Hadith about Riba and Riba comes in many forms.

However, dishonesty and manipulation, is reflected in the characteristics in transactions

/THREAD