in islamic finance, as Muslims, it is easy to be offended at the suggestion that some of it might, in fact, be controversial and be breaking Shariah Rules.

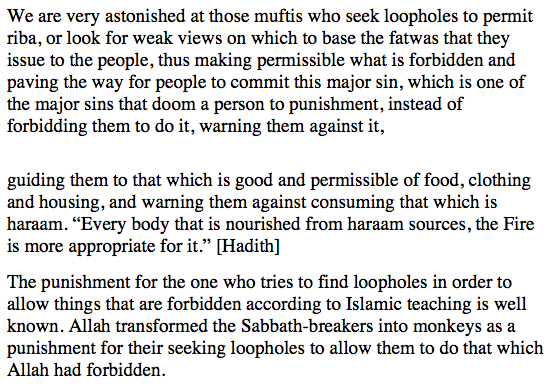

However, we must recognise that there is significant amount of disagreement on a scholarly level about this.

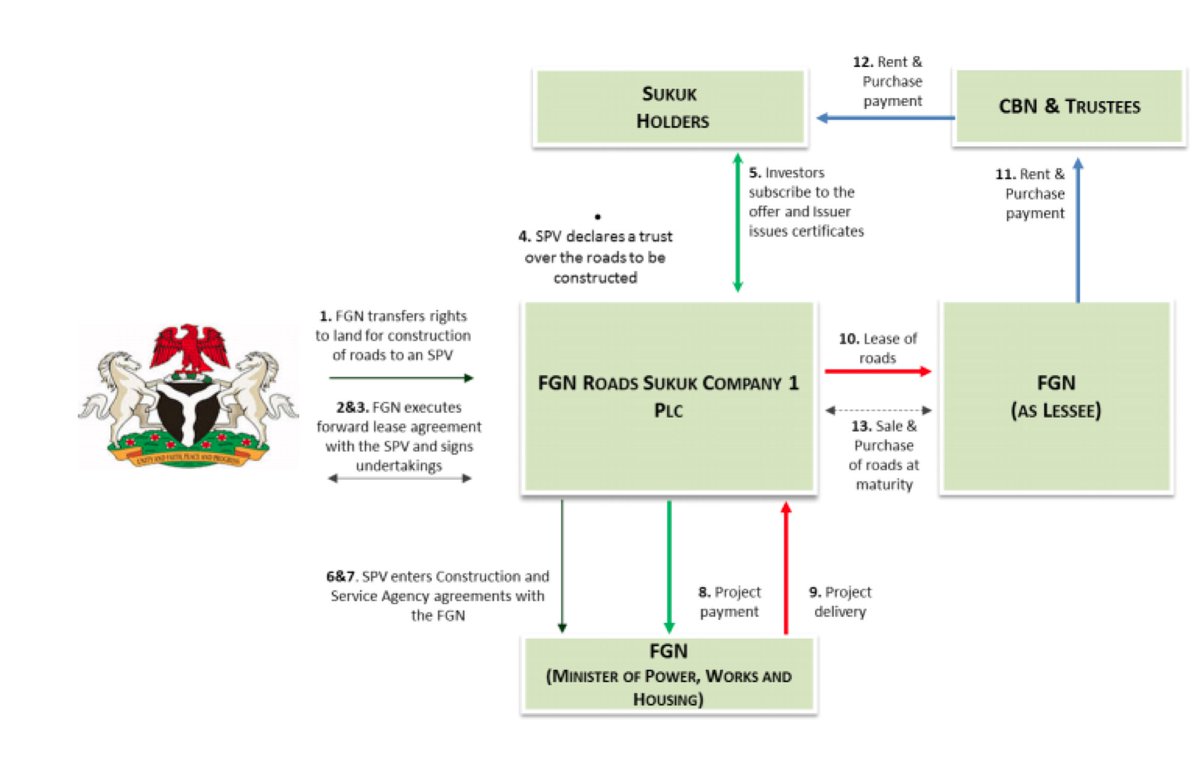

Let me explain - the inherent nature of banking that

May Allah protect us from our own deceptions.

Our ignorance is a choice.

/THREAD