One of the greatest "tricks" you can do in a value add strategy is to refinance your correctly rehabbed property & pull out 100% of your original capital.

Thus, you can recycle that same capital into another property immediately.

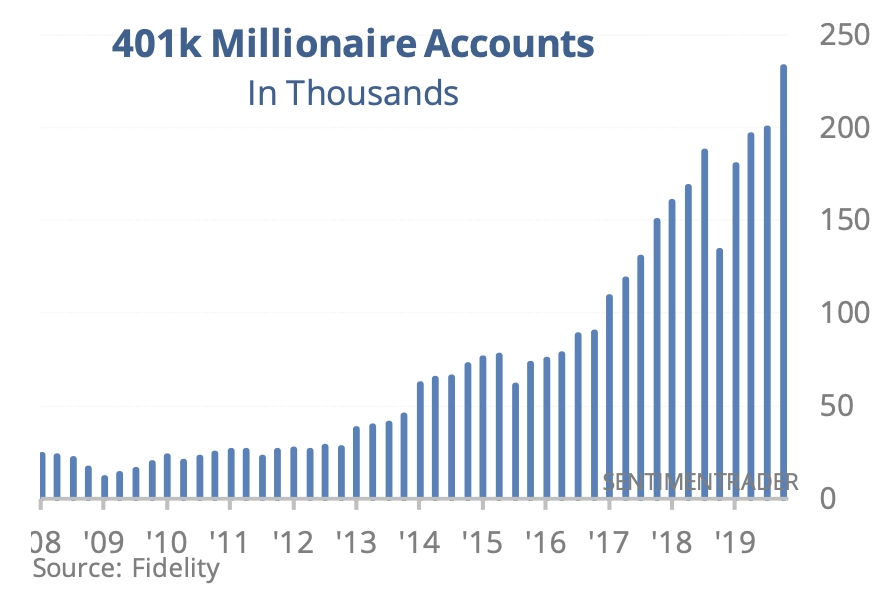

Your original capital doesn't just earn an 8% or 12% return once — it might do it several times.

Depending on how successful you are at finding great deals or which part of the...

The compounding consequences on your capital invested become enormously positive as you achieve rates...

Every one of the properties rehabbed experiences forced appreciation, thus creating you additional rise in equity.

If all of the properties are correctly located, they will...

Your taxes & expenses, your interest to the bank, decreasing your debt (thus increasing your equity) & finally even leaving you additional cash flow in your pocket.

Pulling your 100% (or even more) of your original capital will be in...

As you repeat this cycle several times, you will start to notice an insane increase in your...

You'll actually need to employ an accountant to track just how much money all of your properties are actually making.

Remember, unlike the stock market, real estate has many wealth generators.

• market appreciation (normal price movements)

• forced appreciation (increasing equity via rehab)

• debt paydown (tenant increasing your equity)

• cash flow (tenant putting cash in your pocket)

• tax advantages (depreciation, write-offs & deferrals)

It's called negotiation. And it can be used everywhere when doing real estate, as well as private asset deals in general.

• reducing your entry price (offering special terms)

• reducing your cost of debt (if you're a big guy)

• increasing your interest on debt (if you're lending)

• reducing your cost of materials (if you buy bulk)

• reducing your contractor/builder fees

• reducing your underwriter fees (if you're co-investing)

• increasing your exit price (after the rehab)

• increasing your rent annually (if you're skillful)

• decreasing your agent/broker fees

• others things, etc

In the USA an FHA loan will let you get into real estate for around 3% down payment. In the UK, Buy To Help scheme with a 5% down. In AU, there is a...

When it comes to wealth accumulation you’ll either find a way or you’ll find an excuse.

Are there risks? Yes. Plenty of them.

Will you need to work hard? Yes.

If you are afraid of elbow grease, you'll be stuck in your office cubical for the rest of your life.

What else? A bit of common sense wouldn't hurt.