(THREAD)

1.Sanders released a recent list of ways to fund his programs

2. It includes raising taxes to ab 50% marginal rate on middle class, in addition to all wealth, corporate, inequality taxes (adding it up)

3. Even AFTER this, there's a $20 trillion shortfall.

5. What's it mean for middle class? Ex: a family earning $80K would pay 60% marginal rate.

6. Lower premiums, savings for companies would all = big savings for the m.c., Sanders camp says.

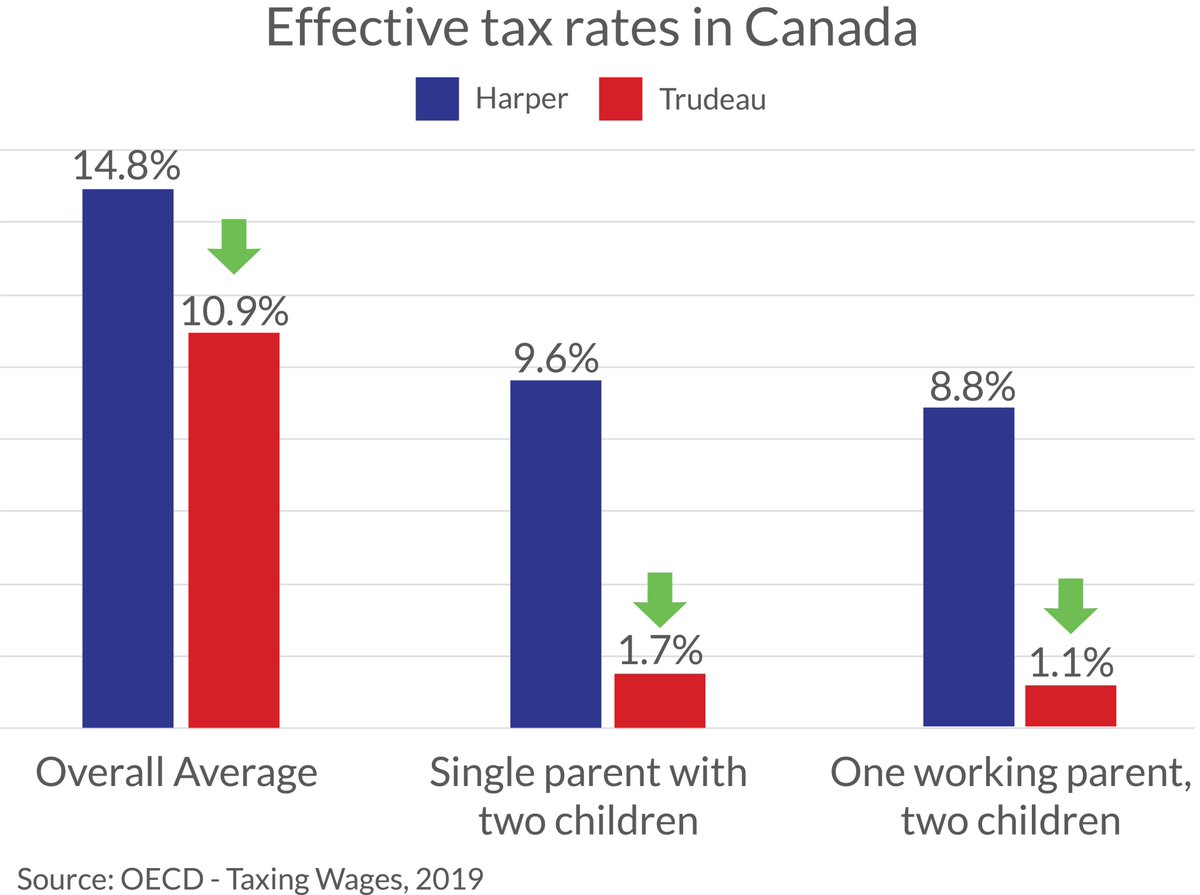

8. BUT the countries he cites as a model have big VAT (sales taxes) & much higher income tax rates.

Here’s Denmark:

9. So .. to have an honest discussion these trade offs need to be part of it.

crfb.org/papers/primary…

Net fiscal impact:

Biden: $800 billion

Sanders: $13 trillion

Warren: $6.1 trillion

22% income tax + 15.3% payroll tax + proposed 4% income surtax + proposed 7.5% payroll tax = 48.8%. W state and local, it’s roughly 50%.

This is for a family with $80,000 in taxable income.